Okay, folks, let’s dive straight into the heart of today’s stock market shenanigans. The Nifty’s taking a tumble, the Sensex is feeling the blues, and everyone’s wondering, “What gives?” I’m not just going to throw numbers at you; I want to give you the ‘why’ behind the ‘what’. So, grab your chai, and let’s break it down. We’ll look at market volatility , financial news , and how it all affects your investment decisions.

Decoding the Dip | What’s Really Happening?

First off, let’s address the elephant in the room: Why the dip? It’s easy to panic when you see those red numbers flashing, but usually, there’s a logical explanation. More often than not, you will find that a dip in the Indian stock market can be attributed to global cues, profit booking, or a combination of both.

Global Cues: What happens in Wall Street, eventually echoes on Dalal Street. Negative news from international markets – be it interest rate hikes by the US Fed, geopolitical tensions, or economic slowdown fears – can trigger a domino effect. Investors get jittery and start selling off their holdings, leading to a market decline. We can track the latest global market updates to stay informed.

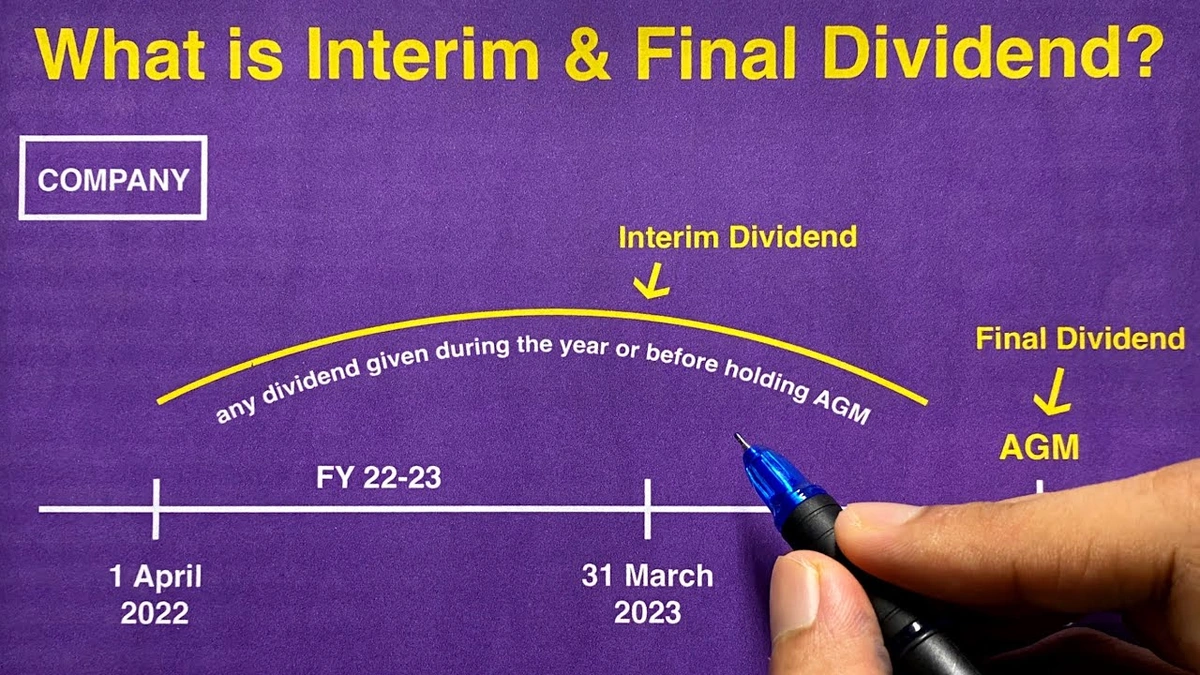

Profit Booking: Sometimes, a dip is just a dip. After a sustained period of gains, investors often choose to cash in their profits. This is called profit booking, and it’s a perfectly normal part of the market cycle. As more people sell, the prices fall, creating the dip you see on your screen. It is important to understand market trends .

Other Factors: Keep an eye on domestic economic data releases, policy announcements, and even something like monsoon forecasts. These seemingly unrelated factors can also influence investor sentiment and trigger market movements. Remember, the market is a complex beast, and it reacts to a multitude of stimuli.

Top Active Stocks | A Closer Look at Waaree, Tata Motors, MCX India, and BSE

Now, let’s zoom in on those top active stocks. Waaree Renewable, Tata Motors, MCX India, and BSE – what’s driving their activity? This is where it gets interesting. Each of these companies operates in a different sector, and their performance reflects sector-specific dynamics.

Waaree Renewable: As the name suggests, Waaree Renewable is in the renewable energy space. With India’s increasing focus on green energy, companies in this sector are generally in the spotlight. Any positive policy announcements or government initiatives related to renewable energy can send their stock soaring. But conversely, delays in projects or regulatory hurdles can dampen investor enthusiasm.

Tata Motors: An auto giant! Tata Motors’ performance is closely linked to auto sales, both domestic and international. Factors like new model launches, sales figures, and overall consumer sentiment play a crucial role. Also, Tata Motors is heavily invested in electric vehicles (EVs), so any news related to the EV market can have a significant impact.

MCX India: MCX is a commodity exchange. Its fortunes are tied to commodity prices and trading volumes. Global events, weather patterns, and economic trends can all influence commodity prices, and consequently, MCX’s performance. Consider the impact of monsoon failure on commodity trading, for example. This would be a significant factor ininvestment strategy.

BSE: The Bombay Stock Exchange itself! BSE’s performance reflects the overall health of the stock market . Higher trading volumes and increased market participation generally translate to better financials for BSE. Regulatory changes and competition from other exchanges can also influence its performance.

Navigating the Volatility | Tips for the Savvy Investor

Okay, so the market’s being a bit of a rollercoaster. What should you do? Here’s the thing: volatility is a normal part of investing. The key is not to panic, but to have a well-thought-out strategy. I find that one common mistake people make is reacting emotionally to market fluctuations. That’s a recipe for disaster. So, I would say think long-term and stay calm.

- Diversify: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes and sectors. This reduces your overall risk.

- Invest Systematically: Consider investing through Systematic Investment Plans (SIPs). SIPs allow you to invest a fixed amount regularly, regardless of market conditions. This helps you average out your purchase price over time.

- Do Your Research: Before investing in any stock, do your homework. Understand the company’s fundamentals, its growth prospects, and the risks involved. Don’t rely solely on tips or rumors.

- Stay Informed: Keep yourself updated on market trends, economic news, and company-specific developments. This will help you make informed decisions.

- Seek Professional Advice: If you’re unsure about anything, consult a financial advisor. They can help you create a personalized investment plan based on your goals and risk tolerance.

The Broader Economic Picture | Connecting the Dots

The stock market doesn’t exist in a vacuum. It’s influenced by the broader economic environment. Factors like inflation, interest rates, GDP growth, and government policies all play a role. Let’s quickly look at the latest news about the Indian economy .

Inflation: Rising inflation can lead to higher interest rates, which can dampen economic growth and negatively impact the stock market . Central banks often hike interest rates to combat inflation, making borrowing more expensive for businesses and consumers.

Interest Rates: As mentioned above, interest rates have a significant impact on the stock market . Higher interest rates can make bonds more attractive relative to stocks, leading to a shift in investment allocation.

GDP Growth: Strong GDP growth generally bodes well for the stock market . It indicates a healthy economy with robust corporate earnings. However, unsustainable growth can lead to inflation and other problems.

Government Policies: Government policies related to taxation, infrastructure spending, and industrial development can all influence the stock market . Investor-friendly policies can boost market sentiment, while policies perceived as unfavorable can have the opposite effect.

Stock Market | Is This a Buying Opportunity?

Here’s the million-dollar question, right? A market dip can be a buying opportunity, but it’s important to be cautious. Don’t just blindly buy stocks because they’re cheap. Assess the underlying reasons for the dip. Are they temporary factors, or are there more fundamental issues at play? One needs to consider risk management strategies.

If you believe the dip is temporary and the long-term prospects of the companies you’re interested in remain strong, then it might be a good time to buy. But always do your research and invest within your risk tolerance.

FAQ Section

Frequently Asked Questions

What if I’m new to the stock market?

Start with the basics. Read books, take online courses, and understand the fundamentals of investing before putting your money in.

How much money do I need to start investing?

You can start with a small amount. Many brokers allow you to invest with as little as ₹500. The key is to start early and be consistent.

What are some common mistakes to avoid?

Emotional investing, not diversifying, and chasing quick profits are common pitfalls. Stick to your strategy and avoid impulsive decisions.

Where can I find reliable stock market news?

Reputable financial news websites, business channels, and company filings are good sources of information.

Is it safe to invest in the stock market?

Investing always involves risk. But with proper research, diversification, and a long-term perspective, you can manage your risk and potentially earn good returns.

How often should I check my portfolio?

It depends on your investment style. Long-term investors don’t need to check their portfolio daily. But it’s important to review it periodically to ensure it aligns with your goals.

In conclusion, remember that the stock market is a dynamic environment. Don’t lose heart during volatile periods. And don’t get too complacent when the market’s booming. Stay informed, stay disciplined, and invest wisely. The Bombay Stock Exchange (BSE) can be a scary place, but also, a place to secure future wealth. Ultimately, this is a game of patience, my friend. Play it wisely.