So, Pine Labs IPO – it’s been a topic of hushed whispers and keen anticipation in the Indian fintech world for quite some time now. And, like any good drama, there’s a twist. The company, a major player in the merchant commerce solutions space, is now aiming for a $3 billion valuation, a step down from earlier targets. What’s the real story here? Why the change of heart? Let’s dive in, not just into the news, but the ‘why’ behind it all.

Why the Valuation Adjustment? It’s More Than Meets the Eye

Here’s the thing: valuation isn’t just a number. It’s a reflection of market sentiment, investor confidence, and, let’s be honest, a bit of guesswork. But in Pine Labs’ case, several factors likely contributed to this recalibration. We’re talking about broader economic headwinds, changing investor appetite, and, perhaps, a more realistic assessment of the company’s growth trajectory in a post-pandemic world. It’s easy to say “market conditions”, but that’s far too simplistic.

The global IPO market has cooled considerably. Rising interest rates, inflation fears, and geopolitical uncertainties have made investors more cautious. High-growth tech companies, once the darlings of the stock market, are now facing increased scrutiny. Look at other tech IPOs – many have seen their valuations slashed or have been postponed indefinitely. This isn’t unique to Pine Labs; it’s a sector-wide reality check. Let’s be honest, sometimes these ‘unicorn’ valuations are based on future potential rather than current profitability.

And then there’s the competition. The Indian fintech landscape is fiercely competitive. Pine Labs faces rivals from established players like Paytm and PhonePe to a swarm of nimble startups. Securing and maintaining market share in such a crowded field requires constant innovation and significant investment. This impacts future projections, which directly translates to valuation expectations.

The Impact on Pine Labs | More Opportunity Than Setback?

Now, you might think a lower valuation is bad news. But let me rephrase that for clarity: it’s not necessarily a death knell. In fact, it could be a strategic move. A more realistic valuation can make the IPO more attractive to investors, increasing the chances of a successful listing. Think of it as setting the stage for long-term, sustainable growth, rather than a short-term pop followed by a fall. Plus, a well-received IPO, even at a lower valuation, provides access to capital that fuels expansion, innovation, and potential acquisitions.

What fascinates me is that this could also be about controlling the narrative. By scaling down expectations, Pine Labs is setting itself up to potentially exceed those expectations post-IPO. A positive surprise – a beat on revenue forecasts, for example – can significantly boost investor confidence and drive up the share price. It’s a smart psychological play. A common mistake I see companies make is overpromising and underdelivering; Pine Labs seems to be avoiding that trap. The Indian market is very good at sniffing out companies with unrealistic expectations.

And, frankly, it speaks volumes about the maturity of the Indian startup ecosystem. We’re moving away from the ‘growth at all costs’ mentality to a more sustainable, profit-focused approach. It’s about building real businesses, not just chasing unicorn status. This revised approach to its initial public offering may benefit the company and investors in the long run.

What Does This Mean for the Indian Fintech Ecosystem?

This scaled-down IPO attempt sends a signal to the entire Indian fintech ecosystem. It underscores the importance of sustainable growth, profitability, and realistic valuations. It’s a reminder that the days of easy money and sky-high valuations are over. Investors are demanding more. They want to see a clear path to profitability, strong unit economics, and a proven business model. Merchant solutions are a hot market in India and Pine Labs is in a good spot to capitalize on this trend.

This could also lead to a more rational allocation of capital. Instead of blindly throwing money at any startup with a flashy pitch deck, investors will be more selective, focusing on companies with solid fundamentals and a long-term vision. This benefits the entire ecosystem by weeding out unsustainable business models and fostering a culture of responsible growth. This change will be great for the Indian economy in the long run as more stable companies become fixtures in the market. And what about Indian stock exchanges in general? Well, stability here is also key.

Looking Ahead | The Future of Pine Labs and Fintech in India

So, where does Pine Labs go from here? Expect the company to double down on its core strengths: providing innovative merchant commerce solutions, expanding its reach in India and Southeast Asia, and exploring new growth opportunities in areas like online payments and financial services. A successful IPO, even at a lower valuation, will provide the capital and credibility needed to achieve these goals. It is very likely that the company will continue to expand it’s payment solutions offerings.

And for the Indian fintech ecosystem as a whole? Expect to see more consolidation, increased regulatory scrutiny, and a greater focus on profitability and sustainability. The sector is maturing, and the players who adapt to this new reality will be the ones who thrive. Frankly, this maturation is overdue. Too much money has been burned on unsustainable business models. A common mistake I see people make is focusing on customer acquisition at all costs, without a clear plan for monetization. Stock market analysis shows these companies tend to be volatile.

What fascinates me is the resilience of the Indian entrepreneurial spirit. Despite the challenges, Indian startups continue to innovate and disrupt. They are solving real problems for millions of Indians, and they are creating tremendous value for the economy. And, they’re doing it in a way that’s uniquely Indian – frugal, innovative, and deeply rooted in local realities. This is the key.

Ultimately, the Pine Labs valuation adjustment is more than just a news story; it’s a sign of the times. It reflects the changing dynamics of the global economy, the evolving priorities of investors, and the maturing of the Indian fintech ecosystem. It’s a reminder that building a successful business takes more than just a great idea and a lot of money. It requires vision, resilience, and a deep understanding of the market. And that, my friends, is a lesson worth learning.

FAQ About Pine Labs IPO

What is Pine Labs and what do they do?

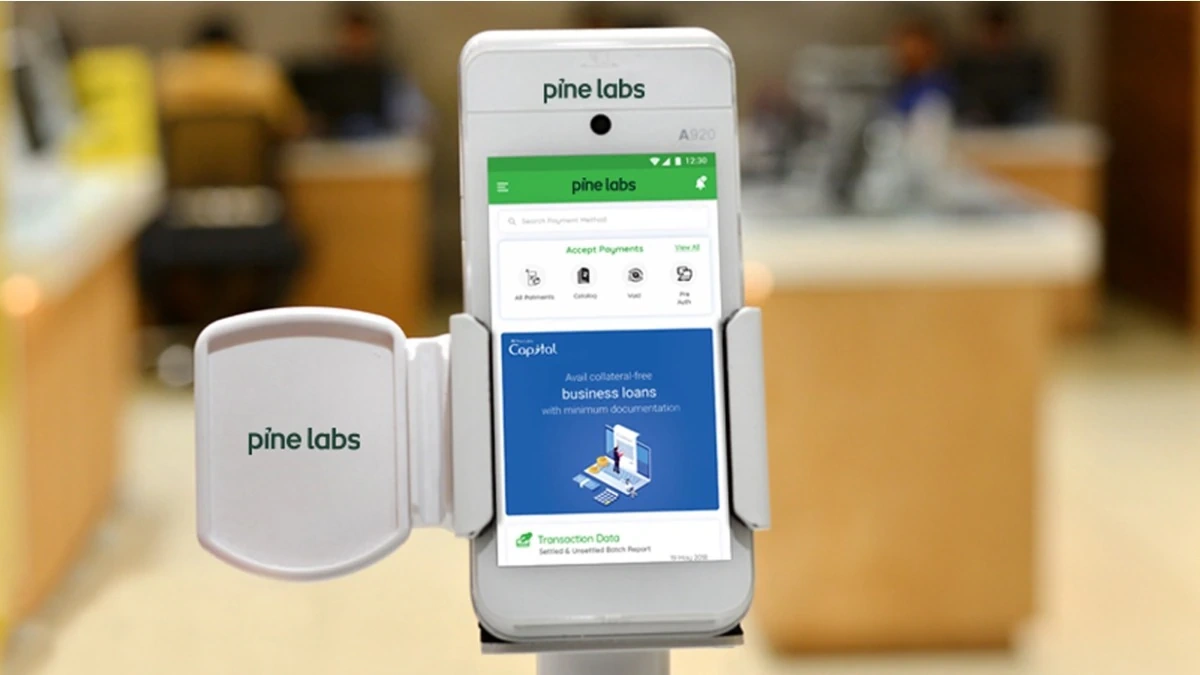

Pine Labs is a leading merchant commerce platform that provides a wide range of payment and commerce solutions to merchants across India and Southeast Asia. They offer point-of-sale (POS) systems, payment processing services, and other tools to help businesses manage their operations and grow their revenue.

Why did Pine Labs scale down its IPO valuation?

Several factors likely contributed to the valuation adjustment, including broader economic headwinds, changing investor appetite, increased competition in the fintech sector, and a more realistic assessment of the company’s growth trajectory. In other words, the market wasn’t what they hoped it would be.

What does this mean for potential investors?

A lower valuation could make the IPO more attractive to investors, increasing the chances of a successful listing. It also sets the stage for long-term, sustainable growth, rather than a short-term pop followed by a fall. Do your due diligence, of course!

Will Pine Labs still go public?

Yes, Pine Labs still intends to go public, but at a revised valuation. The company is likely working to finalize the details of the IPO and secure the necessary regulatory approvals.

How can I invest in the Pine Labs IPO?

Once the IPO is officially launched, you can invest through a registered broker or online investment platform. You will need to have a Demat account and follow the instructions provided by your broker. It’s best to consult with a financial advisor before making any investment decisions.

What are the potential risks of investing in Pine Labs?

As with any investment, there are potential risks to consider. These include market volatility, competition from other fintech companies, regulatory changes, and the overall performance of the Indian economy. Be aware of the risks before committing capital.