The thing about gold prices is, they’re never just about gold. It’s a reflection of the world’s anxieties, hopes, and sometimes, its outright panic. So, when you hear that gold prices are holding steady, even with all the economic craziness swirling around us, it’s time to dig a little deeper. What’s really going on? Why aren’t gold prices reacting the way you might expect?

Let’s talk about this buzz around a potential Federal Reserve (Fed) rate cut. Everyone’s anticipating it, and that anticipation is a HUGE part of why gold isn’t going bonkers right now. But here’s the real question: What does this mean for you, sitting in India, thinking about your investments, your family’s future, and maybe even that gold necklace you’ve been eyeing?

The Fed Rate Cut | Why It Matters to Your Gold

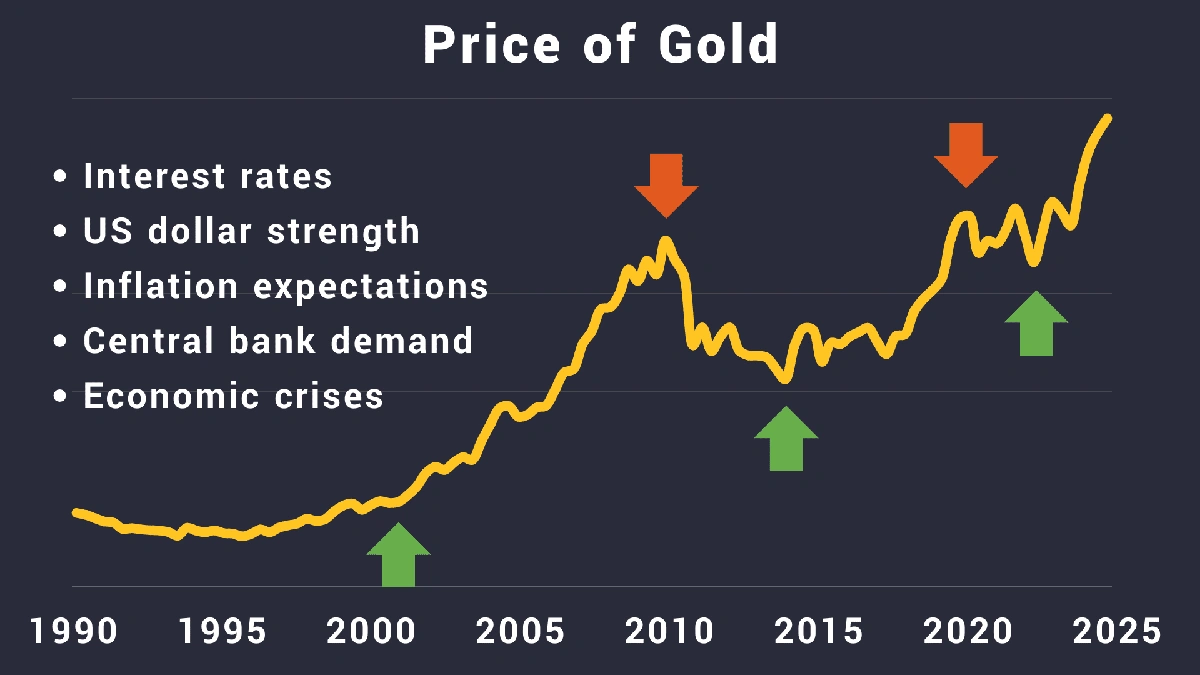

Okay, let’s break it down. A Fed rate cut basically means the U.S. central bank is lowering its key interest rate. Now, I initially thought this would immediately send gold prices skyrocketing, but then I realised there’s a bit more to it than that. A rate cut usually weakens the dollar. And since gold is often priced in dollars, a weaker dollar should make gold more attractive to buyers using other currencies. Makes sense, right?

But, here’s the catch: the expectation of the rate cut is already baked into the cake. Markets are forward-looking. Traders and investors have already priced in the likelihood of the cut. Think of it like knowing a big Bollywood movie is coming out – the hype starts weeks before the actual release. Similarly, all this anticipatory action has already affected gold market dynamics. So that explains why gold prices haven’t zoomed as high as might be expected given the circumstances.

According to experts at Investopedia , gold prices are often inversely correlated with interest rates. This means when rates fall, gold should become more attractive. But this relationship isn’t always straightforward, especially when expectations are high. What fascinates me is how investor sentiment can override these textbook correlations.

Indian Rupee, Inflation, and Your Gold Strategy

Now, let’s bring it home to India. How does all this global financial maneuvering affect you directly? Well, the strength of the Indian Rupee (INR) plays a big role. If the Rupee strengthens against the dollar, the impact of a weaker dollar on gold prices is somewhat mitigated for Indian buyers. In other words, gold might not become significantly cheaper in Rupee terms, even if it becomes cheaper in dollar terms.

And, of course, we can’t forget about inflation. Inflation trends in India are crucial. Gold is often seen as a hedge against inflation. If inflation is high, people tend to flock to gold as a store of value, driving up demand and, consequently, prices. So, while the Fed rate cut might have a certain impact, local inflation dynamics can either amplify or dampen that effect. A common mistake I see people make is focusing solely on global factors while ignoring what’s happening right here in India.

Consider consulting resources like the World Gold Council World Gold Council for in-depth analysis on gold demand trends.

Beyond the Rate Cut | Other Factors at Play

Let me rephrase that for clarity… it’s not just about the Fed rate cut. Geopolitical tensions, global economic growth (or lack thereof), and even movements in other asset classes like stocks and bonds can influence gold prices. For example, if there’s a major political crisis somewhere in the world, investors often rush to safe-haven assets like gold, driving up prices, regardless of what the Fed is doing. Let’s be honest – the world is full of surprises. And those surprises often translate into gold price fluctuations.

And speaking of other asset classes, the performance of the stock market matters too. If stocks are doing well, investors might be more inclined to put their money into equities, reducing demand for gold. But if the stock market takes a tumble, as it often does, gold can suddenly look a lot more appealing. UPI expansion can have a big impact on the Indian market.

Navigating the Gold Market in Uncertain Times

So, what’s the takeaway? Investing in gold isn’t a simple equation. It’s a complex interplay of global and local factors. The anticipation of a Fed rate cut is definitely a significant piece of the puzzle. But it’s just one piece. You need to consider the strength of the Rupee, inflation trends in India, geopolitical risks, and the performance of other asset classes.

Here’s the thing: doing your research and staying informed is really important. Don’t just blindly follow the headlines. Dig deeper, understand the underlying dynamics, and make informed decisions based on your own financial goals and risk tolerance. Rupee hits record low and what it means for global trade. And remember, I’m not a financial advisor – this is just friendly advice from someone who’s been watching the gold market for a while.

The one thing you absolutely must double-check is your investment strategy. Are you looking for a short-term gain or a long-term hedge against inflation? Your investment horizon will significantly impact your decision-making. Sometimes, sitting tight and doing nothing is the best strategy of all.

But what fascinates me is how individual investors can navigate these complex waters. A common mistake I see people make is panicking and making rash decisions based on short-term market fluctuations. Don’t let fear or greed drive your investment strategy.

Let’s talk about this a little more. A well-diversified investment portfolio can help mitigate risks. Don’t put all your eggs in one basket (or all your gold in one vault!). Consider spreading your investments across different asset classes to reduce your overall risk exposure. This is where vodafone idea shares might come in handy as a counter weight to your gold investments.

FAQ | Your Gold Questions Answered

Frequently Asked Questions

Will a Fed rate cut definitely increase gold prices?

Not necessarily. While it often puts downward pressure on the dollar, which can make gold more attractive, the market may have already priced in the expectation. Other factors, like the strength of the Rupee and global risk sentiment, also play a significant role.

How does inflation in India affect gold prices?

High inflation often leads to increased demand for gold as a hedge, potentially driving up prices. Conversely, low inflation may dampen gold’s appeal.

Is it a good time to invest in gold now?

That depends on your individual circumstances and investment goals. Consider your risk tolerance, investment horizon, and overall portfolio diversification strategy before making any decisions.

What are the key factors to watch out for in the gold market?

Keep an eye on Fed policy, the strength of the Rupee, Indian inflation data, geopolitical events, and the performance of the stock market.

Should I buy gold ETFs or physical gold?

Both have their pros and cons. Gold ETFs are more liquid and easier to trade, while physical gold provides a tangible asset. Consider your needs and preferences.

What if I am a first time gold investor?

Start small, do your research, and consider seeking advice from a qualified financial advisor.

Ultimately, understanding factors influencing gold prices will help you make an informed decision about gold investments. Consider this: the real value of gold isn’t just in its price; it’s in its ability to provide stability and security in an ever-changing world. And that, my friend, is something worth considering.