The stock market is a fickle beast, isn’t it? One day you’re up, the next you’re down. But what really fascinates me is how these movements reflect the larger economic story playing out around us. Recently, we’ve seen IndiGo , India’s largest passenger airline, experiencing some tailwinds while Tata Motors PV faced a slight turbulence on the BSE. Let’s dive deeper than just the headlines and understand why this happened and what it could mean for you – the everyday Indian investor.

Decoding the Sensex Rebalancing | Why IndiGo Soared

Okay, so the Sensex rebalancing – sounds complicated, right? Essentially, it’s when BSE (Bombay Stock Exchange) periodically adjusts the weightage of its constituent stocks. This isn’t some random event; it’s a calculated move to ensure the index accurately reflects the overall market sentiment and economic performance . The fact that IndiGo shares gained during this rebalancing isn’t just a blip. It signals growing confidence in the aviation sector.

But here’s the thing: why IndiGo specifically? A couple of factors are likely at play. First, domestic air travel has been steadily recovering after the pandemic. People are itching to travel, and IndiGo , with its extensive network and relatively affordable fares, is well-positioned to capitalize on this demand. Second, the airline has been focusing on improving its operational efficiency – cutting costs and streamlining processes. Investors love that!

And this increased demand is not a fluke, as this article UPI integration showcases how technology is making transactions easier leading to higher demands.

Tata Motors PV | A Minor Setback or a Sign of Something More?

Now, let’s talk about Tata Motors Passenger Vehicles (PV) . The drop on the BSE adjustment is noteworthy, but it’s crucial to keep it in perspective. The automotive sector, especially the passenger vehicle segment, is facing its own set of challenges – rising input costs, supply chain disruptions (particularly semiconductors), and fluctuating fuel prices.

What fascinates me about Tata Motors is their ambitious push into electric vehicles (EVs). They’ve got some compelling models in the market, and the EV segment is definitely the future. But, the transition to EVs is not without its hurdles. Infrastructure needs to catch up, and consumer adoption, while growing, still has a long way to go. This may have been a factor in the BSE adjustment – a slight hesitation from investors as Tata Motors navigates this transition.

Don’t count Tata Motors out just yet, though. They’ve shown remarkable resilience and innovation in recent years. Plus, the long-term growth potential of the Indian automotive market remains significant.

The Broader Economic Context | What Does It All Mean?

These individual stock movements are like pieces of a larger puzzle. The Sensex rebalancing, the rise of IndiGo , the adjustment for Tata Motors PV – they all reflect the evolving economic landscape in India. The market is rewarding companies that are adapting to the new normal, embracing efficiency, and capitalizing on emerging trends.

Think about it: the rise in air travel reflects a growing middle class with increased disposable income and a desire to explore. The focus on EVs reflects a growing awareness of environmental concerns and a push towards sustainable solutions. These are powerful undercurrents shaping the Indian economy.

Investing Wisely | Lessons for the Indian Investor

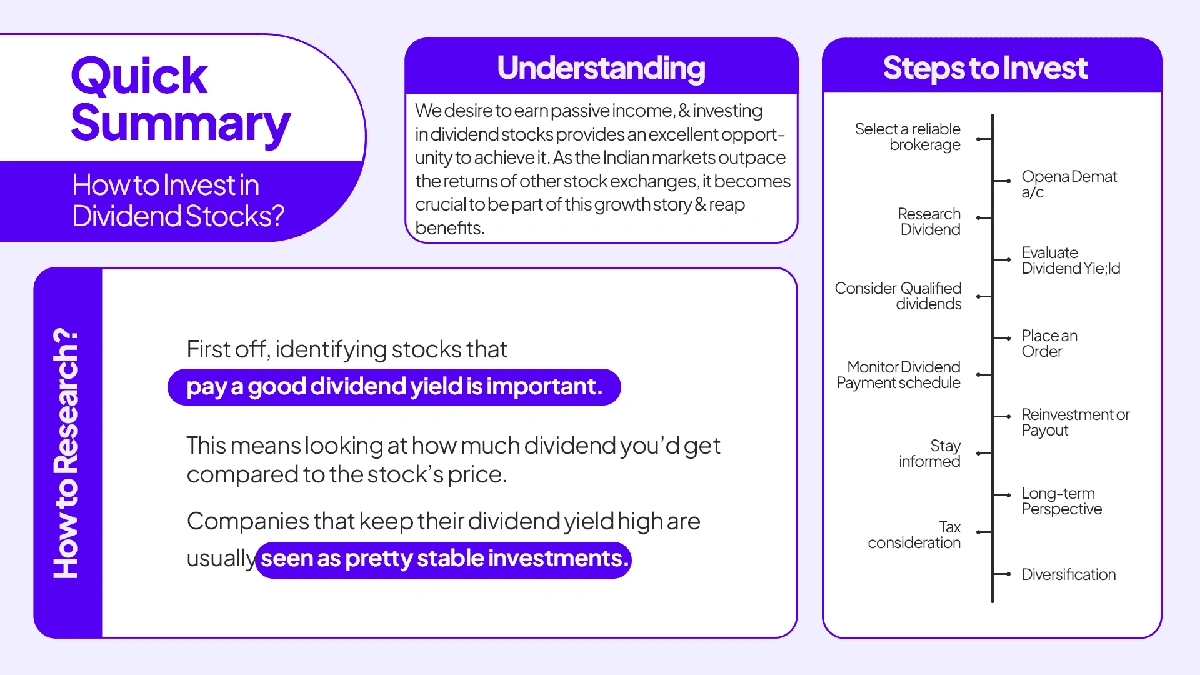

So, what’s the takeaway for the average Indian investor? Here’s the thing: don’t get swayed by short-term fluctuations. Investing is a long-term game. Do your research, understand the underlying fundamentals of the companies you’re investing in, and consider the broader economic context. A common mistake I see people make is… chasing quick gains without understanding the risks.

And diversify! Don’t put all your eggs in one basket. Spread your investments across different sectors and asset classes to mitigate risk. Remember that investopedia.com is a good source of learning about stocks and stock markets.

Plus, stay informed. Keep an eye on market trends, economic indicators, and company news. But don’t get overwhelmed by the noise. Focus on the signals that matter.

Looking Ahead | Opportunities and Challenges

The Indian stock market is full of opportunities, but it’s also fraught with challenges. Geopolitical risks, inflationary pressures, and regulatory changes can all impact market performance. But the long-term growth potential of the Indian economy remains undeniable.

IndiGo ‘s growth trajectory, as this article about international banks also shows, will depend on maintaining its competitive edge, managing its costs effectively, and expanding its network strategically. For Tata Motors, the key will be to successfully navigate the transition to EVs, innovate in the passenger vehicle segment, and address the challenges of rising input costs.

Ultimately, the Indian stock market is a reflection of the Indian economy – dynamic, resilient, and full of potential. By staying informed, investing wisely, and focusing on the long term, you can participate in this growth story and achieve your financial goals.

FAQ

Will IndiGo shares continue to rise?

It’s impossible to predict the future with certainty. However, IndiGo’s strong market position, efficient operations, and the continued growth of the Indian aviation sector suggest a positive outlook.

Is Tata Motors a good long-term investment?

Tata Motors faces some challenges in the short term, but its commitment to EVs and its strong brand equity make it a potentially attractive long-term investment.

What factors influence Sensex rebalancing?

Several factors are considered, including market capitalization, trading volume, and the overall financial performance of the constituent companies.

How often does Sensex rebalancing occur?

The Sensex is typically rebalanced semi-annually.

What if I’m a new investor and don’t know where to start?

Consider consulting a financial advisor who can help you assess your risk tolerance and develop a personalized investment strategy.

What are the key risks to watch out for in the Indian stock market?

Key risks include geopolitical instability, inflationary pressures, and regulatory changes.