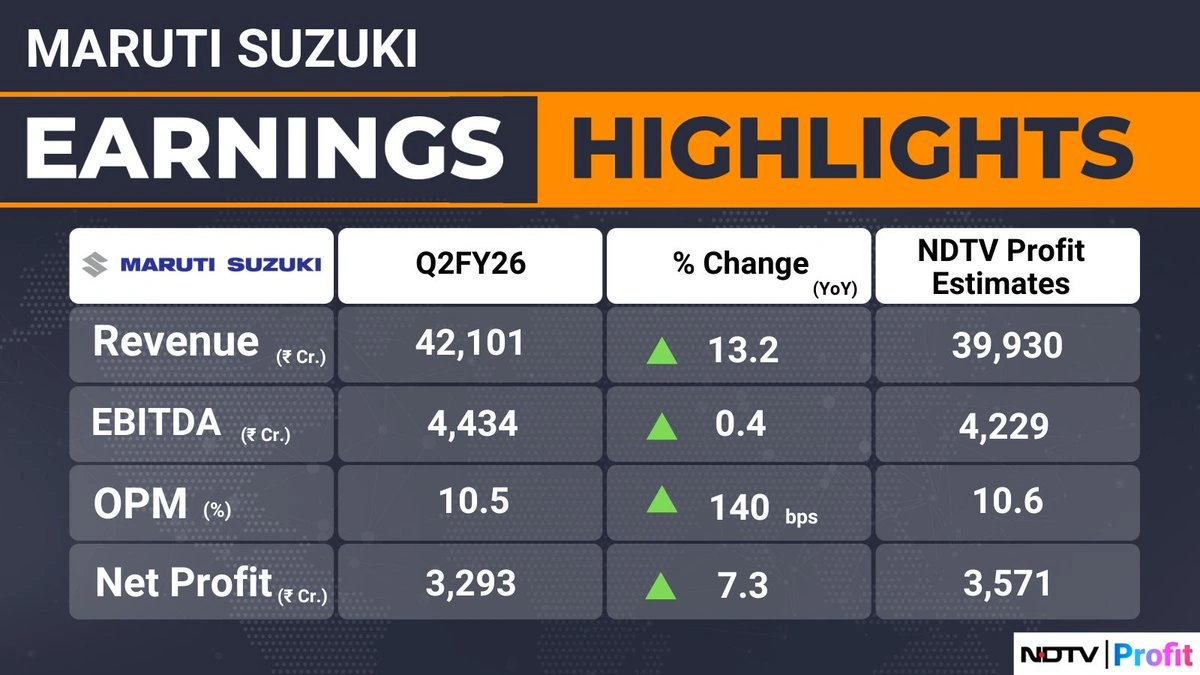

Here’s the thing about numbers: they often tell a story far more nuanced than the headlines suggest. Maruti Suzuki’s recent Q2 results are a prime example. An 8% jump in Maruti Suzuki profit to ₹3,349 crore sounds great, right? And it is! But peeling back the layers reveals a fascinating narrative of resilience, strategic maneuvering, and a bit of luck riding on the global wave. Let’s be honest, the Indian auto market has seen better days, so how did Maruti manage this?

The Export Lifeline | More Than Just Numbers

The headline mentions record exports, and that’s where the real story begins. While domestic sales faced headwinds, Maruti Suzuki cleverly capitalized on international demand. But, here’s the question I was asking myself: why now? Why this surge in exports?

It’s a confluence of factors, really. Global supply chains are still recovering, creating opportunities for manufacturers who can deliver. And Maruti, with its established brand and efficient production, was perfectly positioned to fill that void. This is a good time to check gold holdings . The increase in exports has helped them to counter the domestic dip. Let me rephrase that for clarity: if they had relied solely on the Indian market, these results would have looked very different. Think of it as a safety net, expertly woven.

Decoding the Domestic Dip | What’s Really Happening?

So, what about that domestic dip? It’s crucial to understand why it happened. Several factors are at play. Rising inflation is hitting consumers’ wallets, making them think twice before buying a new car. The increased vehicle prices are a big factor. The constantly fluctuating exchange rates impact input costs. And let’s not forget the lingering effects of the pandemic on consumer sentiment. People are prioritizing essential spending, and a new car, for many, falls into the ‘luxury’ category. Maruti Suzuki, however, cleverly navigated these challenges by introducing new models and focusing on fuel-efficient vehicles, appealing to budget-conscious buyers. It seems that they are focused on future IPO plans .

But, I initially thought this was straightforward, but then I realized that the ‘domestic dip’ is not the same across all segments. Entry-level cars are facing the biggest challenges, while demand for SUVs and premium hatchbacks remains relatively strong. This highlights a shift in consumer preferences and purchasing power.

Strategic Levers | How Maruti Pulled It Off

Now, let’s talk strategy. Maruti Suzuki didn’t just sit back and watch the market unfold. They actively managed the situation. One key move was focusing on cost optimization. By streamlining operations, negotiating better deals with suppliers, and improving efficiency, they were able to protect their profit margins even amidst rising input costs. According to a recent report by the Society of Indian Automobile Manufacturers (SIAM), cost reduction measures are crucial for survival in the current market scenario. Another crucial aspect of Maruti’s success lies in its diverse product portfolio. They offer a wide range of cars, catering to different customer segments and price points. This diversification helps them to mitigate risks and capitalize on emerging opportunities. It’s like having multiple irons in the fire – if one falters, the others can still keep you warm.

And, what fascinates me is their commitment to innovation. They are investing heavily in research and development, focusing on electric vehicles and alternative fuel technologies. This forward-thinking approach will be crucial for long-term growth and sustainability. The demand forecast looks positive for the future.

The Road Ahead | Challenges and Opportunities

Looking ahead, Maruti Suzuki faces both challenges and opportunities. The Indian auto market is expected to recover in the coming years, driven by rising disposable incomes and increasing urbanization. However, competition is also intensifying, with new players entering the market and existing players launching aggressive expansion plans. The increased competition intensity will definitely impact the profitability. According to data from Statista, the Indian passenger vehicle market is projected to reach 5 million units by 2025, creating significant opportunities for growth. But to capitalize on these opportunities, Maruti Suzuki needs to stay ahead of the curve. They need to continue innovating, investing in new technologies, and adapting to changing consumer preferences. They also need to strengthen their brand and build stronger relationships with customers.

Here’s my take: While sources suggest a period of uncertainty, the underlying fundamentals of the Indian auto market remain strong. And Maruti Suzuki, with its strong brand, efficient operations, and diverse product portfolio, is well-positioned to navigate the challenges and capitalize on the opportunities. Let’s not forget the impact on shareholders . Their decisions impact millions of investors.

FAQ Section

Frequently Asked Questions

What factors contributed to Maruti Suzuki’s Q2 profit increase?

Record exports played a significant role, offsetting a domestic sales dip. Cost optimization and strategic pricing also helped.

How is the domestic market impacting Maruti Suzuki’s performance?

The domestic market is facing challenges due to inflation and changing consumer preferences, but Maruti is adapting by offering diverse products.

What is Maruti Suzuki doing to address the challenges in the auto market?

They are focusing on cost optimization, product diversification, and investing in electric vehicles and alternative fuel technologies.

What are the future prospects for Maruti Suzuki in the Indian auto market?

The Indian auto market is expected to recover, presenting opportunities for growth, but competition is intensifying.

How do currency fluctuations affect Maruti Suzuki’s profitability?

Fluctuations in currency fluctuations can impact input costs and profitability, requiring careful management of forex risk .

What is Maruti Suzuki’s strategy for electric vehicles?

Maruti Suzuki is investing heavily in research and development of electric vehicles and plans to launch multiple EV models in the coming years.

So, the next time you see a headline about Maruti Suzuki’s profits, remember that there’s a much deeper story to be told. It’s a story of resilience, adaptation, and strategic brilliance – a story that offers valuable lessons for businesses in India and beyond.