Okay, let’s talk about something that might seem a world away, but actually has a real impact on your wallet and the Indian economy: the US Federal Reserve (often called the Fed) and its interest rate decisions. When the Fed sneezes, the world catches a cold or, in some cases, experiences a welcome breeze. We’re diving deep into what a US Fed rate cut really means for India. Not just the headlines, but the nitty-gritty, the ‘why’ behind the ‘what’.

I initially thought this was straightforward – lower rates, good for everyone, right? But then I realized there are layers to this onion, each with its own set of potential tears (or smiles) for the Indian economy and markets. So, grab your chai, and let’s unpack this.

Decoding the US Fed Rate Cut | It’s More Than Just Numbers

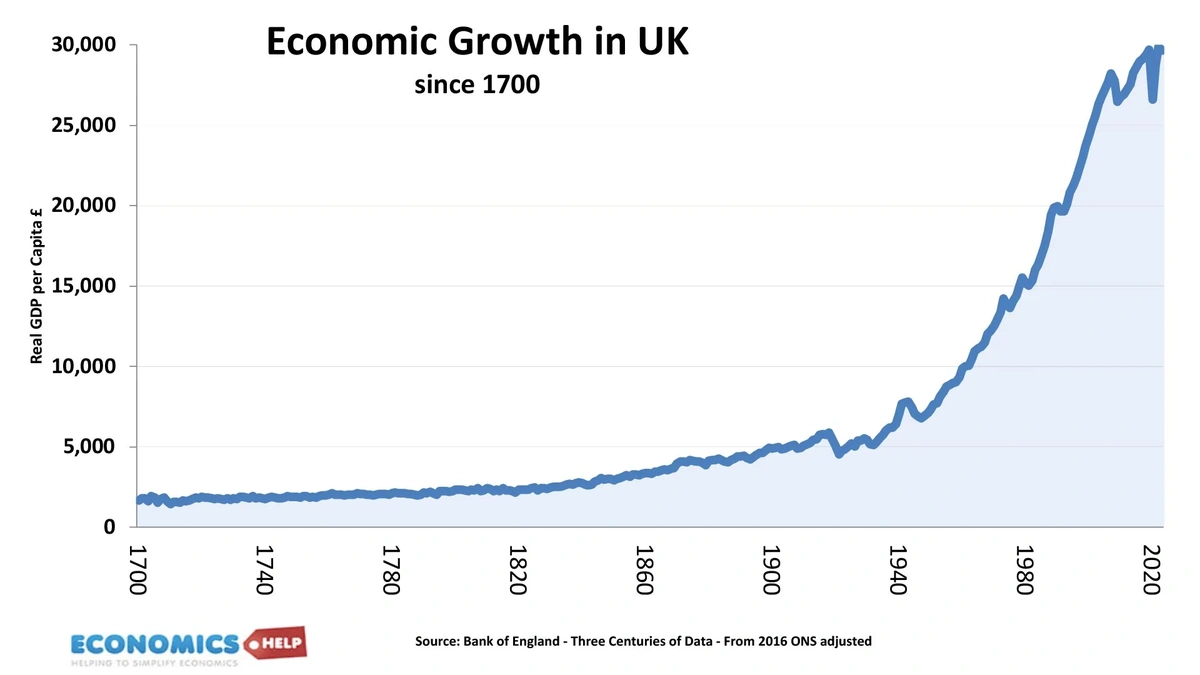

The US Fed, in a nutshell, is like the Reserve Bank of India (RBI), but for the United States. Its main job is to keep the US economy stable, and one of its primary tools is manipulating interest rates. When the Fed cuts rates, it basically makes it cheaper for banks to borrow money. These banks then pass on these lower rates to businesses and consumers. This encourages borrowing, spending, and hopefully, economic growth. But, and this is a big ‘but,’ what happens when this financial tidal wave hits the shores of India?

Here’s the thing: in a globalized world, money flows where it gets the best return. If the US Fed cuts rates, US investors might look to emerging markets like India for higher yields. This can lead to increased foreign investment in Indian stocks and bonds. A common mistake I see people make is thinking this always leads to good times. It can, but it also creates complexities. For example, what happens when the US economy rebounds and investors rush back? We’ll get to that.

How a US Fed Rate Cut Ripples Through Indian Markets

So, how exactly does this money inflow affect us? Well, firstly, it can boost the Indian stock market. Increased foreign investment means more demand for Indian stocks, which can drive up prices. Think of it as a vote of confidence in the Indian economy. Secondly, it can strengthen the Indian Rupee against the US dollar. More dollars flowing into India means higher demand for Rupees, and you know how supply and demand works. This is significant, but let me rephrase that for clarity: a stronger Rupee can make imports cheaper (yay!) but can also hurt Indian exporters (uh-oh!).

But there is a downside to everything. If the rate cuts are too aggressive, the US dollar might depreciate, making imports expensive. This is when the RBI intervention becomes crucial to keep things stable.

The impact on Indian debt markets is also noteworthy. Increased foreign investment can lower borrowing costs for Indian companies, making it easier for them to expand and invest. This is especially relevant for infrastructure projects, which often require significant funding. According to the latest data, Bloomberg shows significant capital inflows into emerging markets following the last Fed rate cut. The actual impact depends on a multitude of factors, including India’s economic growth rate, inflation, and overall global economic climate.

The RBI’s Balancing Act | Navigating the Fed’s Decisions

Here’s where it gets interesting. The RBI doesn’t just sit back and watch. It actively manages the impact of these external forces. One of its primary tools is managing the money supply and intervening in the foreign exchange market. If the Rupee appreciates too much, the RBI might buy dollars to moderate the rise, preventing Indian exports from becoming uncompetitive. Similarly, if there’s a sudden outflow of capital, the RBI might step in to stabilize the currency. The RBI, in a way, is the unsung hero, working to keep the Indian economy on an even keel.

And, of course, the RBI also has its own interest rate decisions to make. It needs to balance the need to attract foreign investment with the need to control inflation and promote domestic growth. It’s a complex juggling act, and let’s be honest, it doesn’t always get it right. But what fascinates me is how interconnected these decisions are the Fed’s actions influencing the RBI’s, and vice versa.

Potential Risks and How to Prepare

Now, let’s talk about the potential pitfalls. One of the biggest risks is sudden capital flight. If the US economy rebounds strongly, or if global risk sentiment shifts, investors might pull their money out of India and head back to the US. This can lead to a sharp depreciation of the Rupee, a decline in the stock market, and increased borrowing costs for Indian companies. It’s like a financial earthquake, and nobody wants to be caught unprepared.

Another risk is inflation. If the increased money supply from foreign investment leads to excessive demand, it can drive up prices. The RBI needs to be vigilant in monitoring inflation and taking appropriate measures to keep it in check. As per the guidelines mentioned in various economic articles, it is imperative to remain informed of fluctuating financial markets.

So, what can you do to prepare? As an individual investor, it’s crucial to diversify your portfolio. Don’t put all your eggs in one basket. Consider investing in a mix of assets, including stocks, bonds, and real estate. And, most importantly, stay informed. Keep an eye on what the Fed and the RBI are doing, and understand the potential impact on your investments. A common mistake I see people making is blindly following market trends without understanding the underlying fundamentals. Be smart. Be informed. Be prepared.

The Long-Term View | Sustainable Growth, Not Just Quick Gains

Ultimately, the goal isn’t just to chase quick gains from foreign investment. It’s to build a sustainable and resilient Indian economy that can withstand global shocks. This requires a focus on structural reforms, improving infrastructure, and enhancing the competitiveness of Indian businesses. The impact of rate cuts on the Indian economy also depend on factors like political stability. And this includes the growth and fiscal policies in place.

The US Fed’s decision has a wide-ranging effect on the global economy . It is essential to have a good understanding of these before making an investment. And this is especially true for India.

But, I think, here’s the ultimate takeaway: a US Fed rate cut is not a magic bullet. It’s just one piece of a very complex puzzle. Its impact on the Indian economy and markets depends on a multitude of factors, including the RBI’s actions, the global economic climate, and the resilience of the Indian economy itself. So, don’t get carried away by the headlines. Dig deeper, understand the nuances, and make informed decisions. And remember, in the world of finance, as in life, there are no easy answers.

Check outthis articleto learn about how AI may impact the economy.

FAQ Section

What if the US Fed raises rates instead of cutting them?

If the US Fed raises rates, it can lead to capital outflows from India, weakening the Rupee and potentially hurting the stock market.

How does the Indian government influence the impact of US rate changes?

The Indian government’s policies on trade, investment, and fiscal spending can all influence how the Indian economy responds to changes in US interest rates .

What are the main factors that determine the Rupee’s exchange rate?

The Rupee’s exchange rate is influenced by factors such as the balance of payments, inflation, interest rates, and market sentiment.

Can the RBI completely insulate India from the effects of US Fed policy?

No, the RBI cannot completely insulate India, but it can manage the impact through various policy tools.

How can I stay updated on the latest developments in this area?

Follow reputable financial news sources, like The Economic Times and the Business Standard, and stay informed about the Fed and RBI policy statements.

Clickhereto know more about earnings from Tata Capital.