Okay, so SBI , that behemoth of Indian banking, just revised its GDP growth forecast upwards – to a solid 7.6%. Now, that’s not just a number; it’s a headline that whispers stories of bustling factories, rising incomes, and maybe, just maybe, a slightly easier time for all of us. But here’s the thing: simply reporting that SBI changed a number misses the real story. The question is: why does this revision matter, especially to someone trying to navigate life in India right now? Let’s unpack this, shall we?

Why SBI’s GDP Growth Revision Is a Big Deal (Beyond the Number)

Let’s be honest – GDP growth predictions can feel a bit abstract. They’re numbers thrown around by economists in fancy suits. But the truth is, this revised forecast is a vote of confidence in the Indian economy. It signals that SBI, with its fingers on the pulse of pretty much everything happening financially in the country, sees continued momentum. This isn’t just optimism; it’s based on the actual, tangible performance of the economy in the second quarter (Q2). And Q2 was apparently, pretty darn robust. Think of it as a doctor giving the economy a check-up and saying, “Looking good! Keep up the good work!” A healthy economy translates to more jobs, increased investments, and potentially, better infrastructure. All things we can use, right?

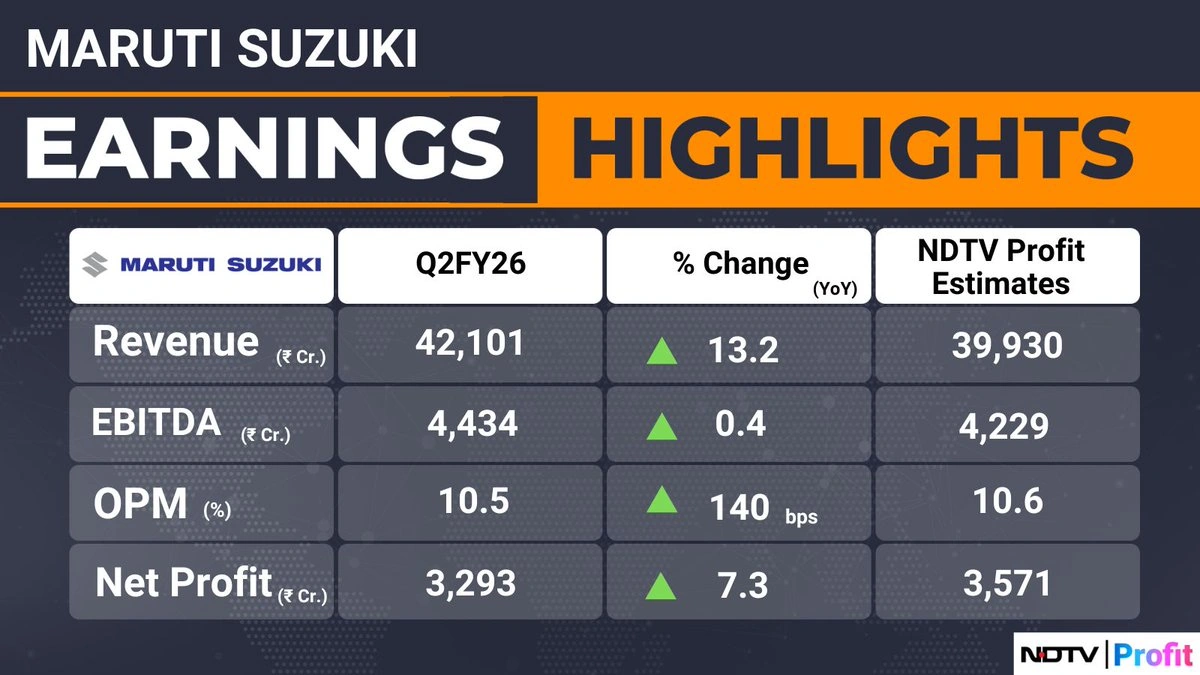

But here’s the thing that initially struck me: it’s not just that they revised it, but why now? What changed between the last forecast and this one? The answer lies in the details of the Q2 performance. Stronger-than-expected growth in sectors like manufacturing and services likely played a crucial role. Also, government spending on infrastructure is another key aspect that pushed economic activity . The festive season also contributed its share, with increased consumer spending across the country.

Decoding the Q2 Performance | What Drove the Optimism?

So, what exactly made Q2 so impressive? Several factors contributed. The manufacturing sector saw a revival, driven by increased demand both domestically and internationally. The services sector, particularly IT and related services, continued its strong performance. Furthermore, the agricultural sector, despite some challenges, held its own. And you can’t forget the impact of increased government spending on infrastructure projects. Roads, railways, ports – all these investments create jobs and boost economic activity across various sectors. All these factors combined to paint a picture of an economy that’s not just growing, but growing at a healthy pace. This boost in economic activity reflects in the economic outlook of various financial institutions.

Now, here’s something I found fascinating: the interconnectedness of these sectors. A strong manufacturing sector needs a robust services sector to support it. Increased government spending creates demand for goods and services across the board. It’s like a complex machine, with each part playing a crucial role in the overall performance. And when all the parts are working in sync, you get a growth forecast revision like the one we’re seeing from SBI.

The Ripple Effect | How This Impacts You and Me

Okay, enough with the economic jargon. How does this actually affect your life? Well, a growing economy generally means more job opportunities. Companies are more likely to hire when they’re confident about the future. It also means potential salary increases. As companies become more profitable, they’re more likely to share the wealth with their employees. And that, my friend, means more money in your pocket. Moreover, increased government revenues allow for greater spending on social programs. Education, healthcare, infrastructure – all these areas can benefit from a growing economy. Better infrastructure , in particular, can significantly improve the quality of life for everyone.

But, and this is a big ‘but’, it’s not all sunshine and rainbows. Inflation remains a concern. A rapidly growing economy can lead to increased demand, which in turn can drive up prices. The RBI (Reserve Bank of India) will need to carefully manage monetary policy to keep inflation in check. Another challenge is ensuring that the benefits of growth are distributed equitably. It’s crucial that the government focuses on policies that support small businesses, create opportunities for marginalized communities, and bridge the income gap. Because a rising tide should lift all boats, not just the yachts.

Navigating the Future | What to Watch Out For

So, what should you be keeping an eye on in the coming months? First, watch the RBI’s actions. Their decisions on interest rates will have a significant impact on the economy. Higher interest rates can curb inflation but also slow down growth. Second, monitor global economic trends. A slowdown in the global economy could impact India’s exports. Third, pay attention to government policies. Any major policy changes could have significant implications for various sectors. Basically, stay informed and be prepared to adapt to changing circumstances. Also read about RBI norms here.

And here’s the thing that I think a lot of people miss: these revisions aren’t set in stone. The economy is a complex beast, and things can change quickly. A sudden global crisis, a major policy shift, or even a bad monsoon could throw everything off track. That’s why it’s important to take these forecasts with a grain of salt. They’re useful indicators, but they’re not guarantees. The Indian economy is dynamic and thus can be difficult to predict.

The Road Ahead | Challenges and Opportunities

Looking ahead, India faces both challenges and opportunities. On the challenge side, there’s the ongoing global uncertainty, the threat of rising inflation, and the need to create more jobs. But there are also significant opportunities. India has a young and growing population, a large and increasingly affluent middle class, and a government that’s committed to economic reforms. If India can navigate the challenges and capitalize on the opportunities, it has the potential to become one of the world’s leading economies. And that, my friends, is something worth getting excited about.

What fascinates me is the sheer resilience of the Indian economy. Despite all the challenges, it continues to grow and adapt. It’s a testament to the hard work and ingenuity of the Indian people. And that’s something to be proud of. So, the next time you hear about a GDP growth forecast, remember that it’s not just a number. It’s a reflection of the collective efforts of millions of people, all working towards a better future.

FAQ About GDP Growth and Its Impact

What exactly does GDP measure?

GDP (Gross Domestic Product) measures the total value of goods and services produced within a country’s borders during a specific period, usually a quarter or a year.

Why is GDP growth important?

GDP growth is an indicator of a country’s economic health. Higher growth usually translates to more jobs, increased incomes, and better living standards.

How does inflation affect GDP growth?

High inflation can erode purchasing power and reduce consumer spending, which can negatively impact GDP growth. The RBI attempts to manage inflation to keep the GDP growth intact.

What are some factors that can affect India’s GDP growth?

Global economic trends, government policies, monsoon patterns, and investment levels can all affect India’s GDP growth.

What if the GDP growth is stagnant?

This might indicate recession or a period of slow economic activity.

So, there you have it – a deeper dive into SBI’s GDP growth prediction and why it matters. It’s not just about the numbers; it’s about the stories they tell and the potential they unlock. And in a country as dynamic and diverse as India, those stories are always worth listening to.