Okay, folks, let’s talk about something wild that’s been zipping around the financial circles here in India: RRP semiconductor . Not just a little jump, mind you, but a monumental, head-spinning 66,500% surge! And the whispers? They all point to one man: Rajendra Chodankar, who is now rumored to be a billionaire. Now, I know what you’re thinking – is this real? Is it sustainable? And most importantly, what does it mean for the average investor or anyone remotely interested in the Indian tech scene?

Here’s the thing: these kinds of stories are exciting, they grab headlines, but they also demand a healthy dose of skepticism and a whole lot of digging. Let’s peel back the layers of this semiconductor sensation together.

The Anatomy of a Skyrocket | What Fueled the RRP Semiconductor Surge?

First off, a 66,500% increase is not your everyday occurrence. It’s the kind of number that makes you double-check your calculator and then maybe triple-check it just to be sure. This kind of parabolic rise usually stems from a confluence of factors, and in RRP’s case, the ‘rumors’ are key.

Rumors of what, exactly? Well, that’s where things get interesting. Whispers suggest a major breakthrough in their semiconductor technology or a potentially game-changing partnership with a global tech giant. Or even better, getting huge order from domestic manufacturing companies. Any of these could send a stock into orbit, especially a stock that might have been undervalued to begin with.

But, and this is a huge but, rumors are rumors. They’re not facts, they’re not guarantees, and they should never be the sole basis for any investment decision. It’s also important to understand the often-opaque world of stock valuations and how speculation can drive prices far beyond any rational assessment of a company’s actual worth. What fascinates me is how quickly perception can become reality (at least temporarily) in the stock market.

Rajendra Chodankar | The Man Behind the Millions?

Then there’s Rajendra Chodankar. The name is all over business media. If the rumors are true, he’s become a billionaire practically overnight. This, of course, adds another layer of intrigue. Who is he? What’s his background? And what role did he play in RRP semiconductor’s alleged breakthrough?

These are the questions everyone’s asking, and the answers are crucial for understanding the bigger picture. Is Chodankar a seasoned tech visionary who’s been quietly building something revolutionary? Or is he simply in the right place at the right time, benefiting from market hype? Digging into his history, his previous ventures, and his leadership style will give us a much clearer sense of the long-term potential (or lack thereof) of RRP semiconductors . Let’s be honest; in India, these stories are exciting but also need verification.

For example, if we’re talking about the domestic manufacturing growth, it’s important to check recent government policy changes. A shift toward greater investment in the semiconductor industry could explain some of the enthusiasm.

Navigating the Semiconductor Hype | A Word of Caution for Investors

Okay, let’s get real. Seeing a stock surge like this can trigger major FOMO (Fear Of Missing Out). The thought of getting in early on the next big thing is incredibly tempting. But chasing hype is a dangerous game, especially in the volatile world of the stock market.

Before you even think about investing in RRP semiconductors (or any stock that’s experienced a similar meteoric rise), do your homework. And I mean really do your homework. Scrutinize the company’s financials, understand their technology, assess their competition, and, most importantly, understand the source of this astronomical increase.

Remember, if something seems too good to be true, it probably is. Look beyond the flashy headlines and focus on the fundamentals. As per guidelines, it is best to be skeptical and make sure you do not end up losing money.

A common mistake I see people make is investing based purely on emotion. Don’t let the fear of missing out cloud your judgment. Instead, take a deep breath, do your research, and make a rational decision based on solid information. If you have some money, consider long-term investment options.

Always ensure proper financial literacy when making such decisions. For some people, the best strategy for long-term investment is to consult financial advisors, who may give you more options.

The Broader Impact | What This Means for India’s Tech Ambitions

Beyond the specific case of RRP semiconductors and Mr. Chodankar, this story highlights something crucial about India’s evolving tech landscape: the growing ambition and the increasing potential for homegrown innovation. The government is keen to establish itself as a global semiconductor hub.

Whether or not RRP semiconductors turns out to be a long-term success story, the fact that a company can generate this much buzz and excitement speaks volumes about the growing confidence in India’s technological capabilities. India is really trying to play in the big leagues of global tech, and semiconductors are a key piece of that puzzle. But, let’s remember, it’s still early days and there will be challenges.

The rush also reminds us of the need to consider geopolitical implications. Access to and control of semiconductor technology is vital, and it’s become a security imperative.

The Future of Semiconductors

The semiconductor industry is at the core of technological advancement. They will be at the core of all future technologies. This may also involve navigating complex challenges like supply chain disruptions.

So, is RRP semiconductors the next big thing? Only time will tell. But one thing is certain: this story is a powerful reminder of the dynamism, the potential, and the occasional dose of wild speculation that defines India’s tech revolution. And it should make you think about the future of semiconductors in general.

Stories like these are a reminder that the market is a complex, ever-shifting landscape. Keep your eyes open, stay informed, and never stop questioning. As I see it, those are the keys to navigating this exciting (and sometimes crazy) world of Indian tech. For further reading, you may also want to check these insights.

FAQ

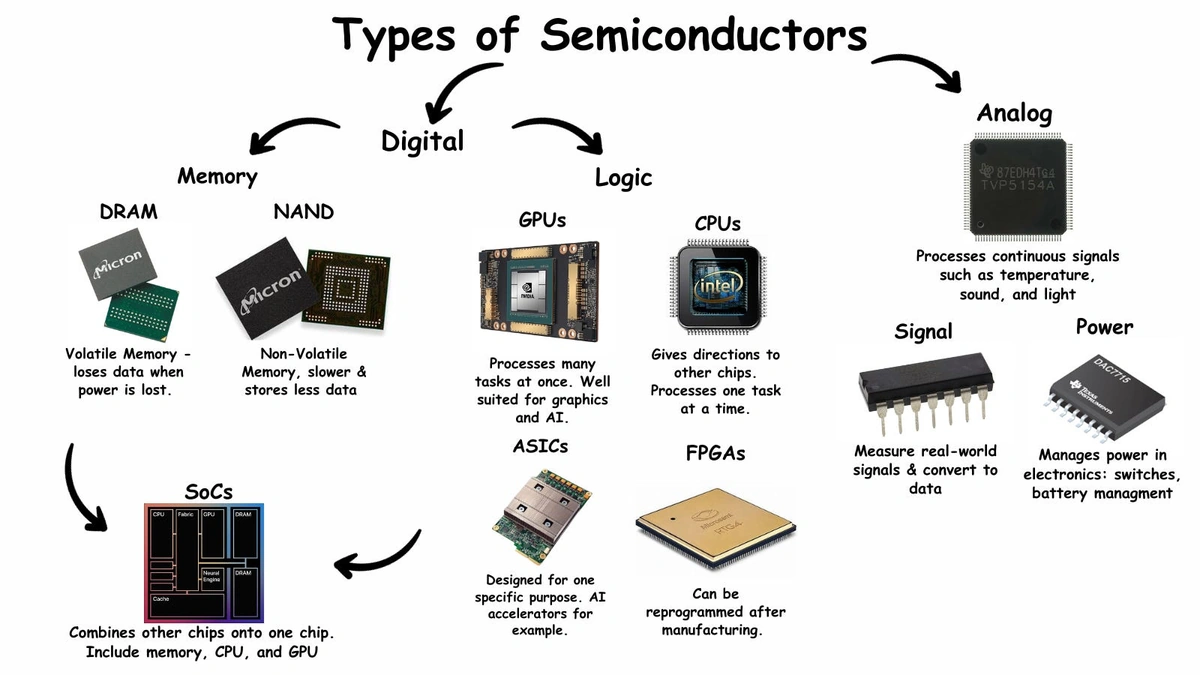

What exactly does a semiconductor do?

Semiconductors are materials that conduct electricity better than insulators but not as well as conductors. They’re the brains behind most electronics, controlling current flow in devices from phones to cars.

Is investing in semiconductors a good idea right now?

The semiconductor industry is growing, but it’s also cyclical. Research individual companies, consider your risk tolerance, and diversify your portfolio.

What are the biggest challenges facing the semiconductor industry?

Right now, supply chain disruptions, geopolitical tensions, and the need for constant innovation are major hurdles.

What if I forgot my application number?

Don’t panic! Most portals have a ‘Forgot Application Number’ option. You’ll usually need to provide your registered email or phone number.

Where can I find reliable information about semiconductor companies?

Look at annual reports, industry analysis from reputable firms, and news from trusted financial outlets.