So, the buzz is building – an RBI rate cut is potentially on the horizon next week. Following a surprisingly robust GDP report, the chatter among economists and financial analysts has reached a fever pitch. But, let’s be honest, what does all this actually mean for you and me, the average folks trying to navigate the Indian economy? It’s not just about numbers; it’s about how those numbers affect our lives.

The Big Question | Why Now?

The strong GDP data is definitely a key factor. But, it’s crucial to understand the nuances. The Reserve Bank of India (RBI) doesn’t just react to one data point. They look at a whole host of indicators – inflation, global economic trends, the monsoon’s progress (yes, even that matters!), and overall market sentiment. I initially thought that the strong GDP numbers would make a rate cut unlikely, but then I realized the RBI also has to consider the need to stimulate further growth and keep the economy humming along. And that brings us to the ‘why’ behind a potential repo rate cut . It’s a balancing act – managing inflation while encouraging investment and spending. The impact of a monetary policy committee decision is massive. Also, keep an eye on how government policies are working in tandem.

Decoding the Debate | Experts Weigh In

What fascinates me is the sheer divergence of opinions among experts. You’ve got some arguing that a rate cut is a no-brainer, a necessary shot in the arm for the economy. They point to the need for cheaper credit to fuel business expansion and consumer spending. On the other hand, you’ve got the cautious voices warning about the potential inflationary pressures that could arise from a rate cut. They argue that it could devalue the Indian Rupee . And let’s not forget the global context. International Monetary Fund (IMF) and the World Bank’s views on global economic stability have been guiding principles. Ultimately, the RBI is independent, and makes its own call. This debate isn’t just academic; it has real-world implications for interest rates on your home loan, your savings accounts, and the overall cost of borrowing.

The ‘How’ | How Does a Rate Cut Affect You?

Here’s the thing: an interest rate cut isn’t some abstract concept. It directly impacts your wallet. Lower interest rates typically translate to cheaper loans – for everything from homes and cars to personal expenses. This can be a boon for borrowers, making it easier to manage debt and potentially freeing up cash for other investments or spending. But, it’s not all sunshine and roses. Lower interest rates also mean lower returns on your savings accounts and fixed deposits. So, while you might save money on your loans, you might earn less on your savings. A common mistake I see people make is not considering the long-term implications of these changes. It’s crucial to reassess your financial strategy. Financial planning becomes even more critical.

Navigating the Uncertainty | What You Can Do

Let’s be honest, predicting the RBI’s moves with 100% accuracy is impossible. Even the experts get it wrong sometimes! But, that doesn’t mean you’re helpless. The best thing you can do is stay informed, understand the different perspectives, and make informed decisions based on your own financial situation. Consider talking to a financial advisor to get personalized guidance. And don’t panic! Whether the RBI cuts rates or not, the Indian economy is resilient. We’ve seen the Indian economy withstand major shocks over the years. The key is to be prepared and adaptable.

RBI’s Stance and Market Expectations

The RBI’s communication is key. They often provide subtle hints about their future intentions through their policy statements and press conferences. Pay close attention to these signals. Are they sounding more dovish (inclined towards lower rates) or hawkish (concerned about inflation)? What language are they using to describe the economic outlook? These nuances can provide valuable clues about the direction of monetary policy. Also, keep an eye on the yield curve . It reflects investor expectations, and also helps to predict any looming risks.

FAQ Section

Frequently Asked Questions

What exactly is the repo rate?

The repo rate is the interest rate at which the RBI lends money to commercial banks.

How often does the RBI review interest rates?

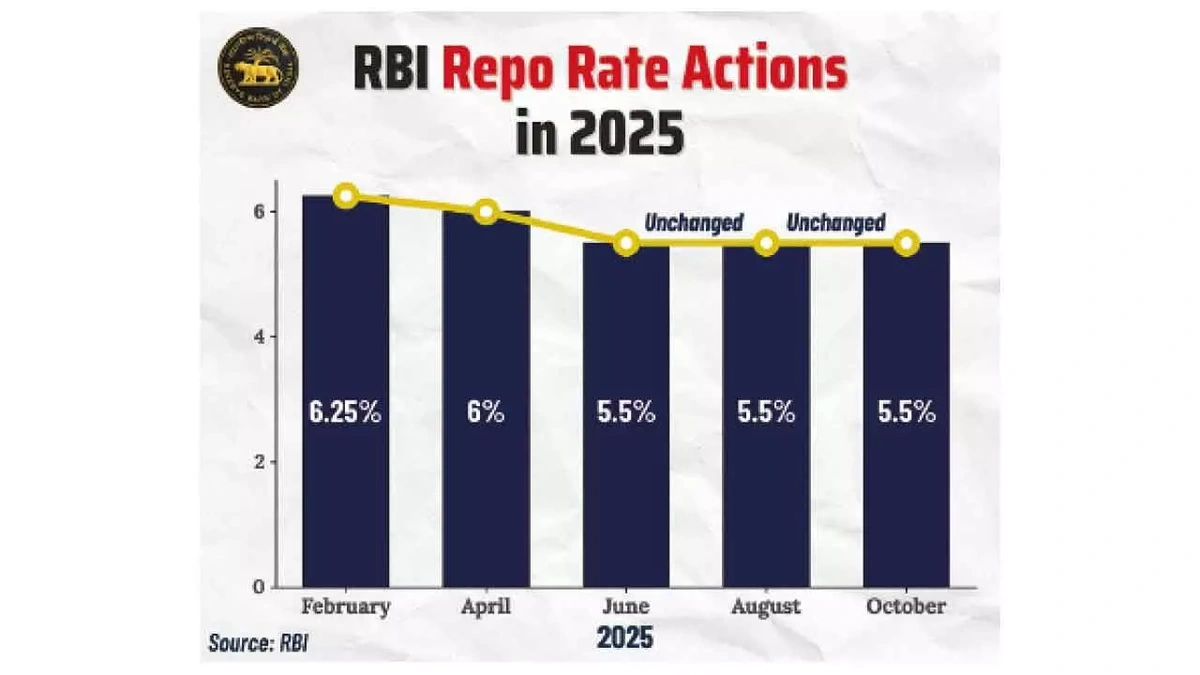

The RBI’s Monetary Policy Committee (MPC) typically meets every two months to review interest rates.

What if I have existing loans? Will my EMI change immediately?

It depends on the type of loan. If it’s linked to a benchmark rate, the EMI will likely change. Speak to your bank for more details.

Where can I find the official RBI announcements?

The official announcements are always posted on the RBI’s website (rbi.org.in).

Could the RBI surprise us with no change?

Absolutely. While a rate cut is widely anticipated, the RBI could always maintain the status quo.

Ultimately, the decision on an rbi monetary policy hinges on a complex interplay of factors. And remember, the Indian economy is far more than just numbers on a spreadsheet. It’s about the aspirations, dreams, and hard work of millions of people. A stable economy ensures the hard work is rewarded, and that the dreams can be achieved.