The whispers are getting louder, the anticipation is building – everyone’s talking about the Pine Labs IPO . Valued at a cool $2.7 billion, it’s not just another IPO; it’s a potential goldmine for some and, possibly, a headache for others. Peak XV Partners (formerly Sequoia Capital India) is reportedly eyeing a staggering 40x return, while Invesco could be staring at a potential loss. But here’s the thing: what does this mean for you, the average Indian investor? Let’s dive deep.

The Billion-Dollar Question | Why Now?

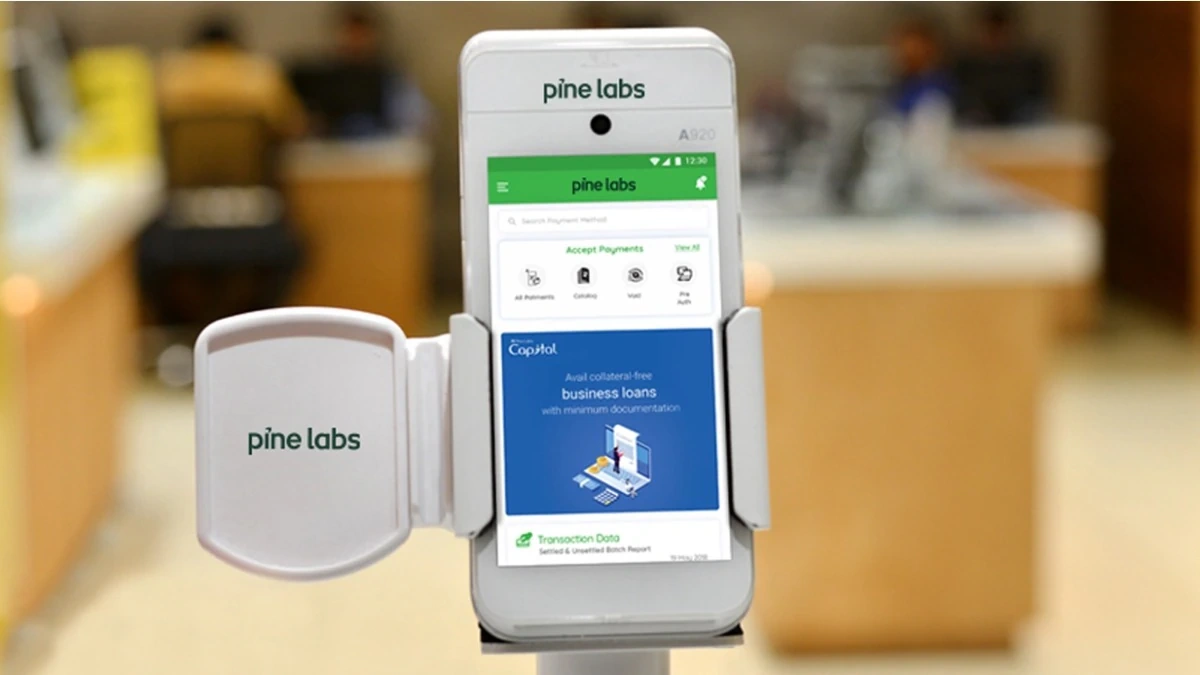

So, why is Pine Labs planning an IPO now? That’s the million – or rather, billion – dollar question, isn’t it? The timing seems…interesting. The global economy is still shaky, inflation is a concern, and the IPO market hasn’t exactly been setting records lately. But sometimes, the best opportunities arise during periods of uncertainty. And let’s be honest, uncertainty is something we Indians are quite familiar with. What fascinates me is the confidence in the Indian market demonstrated by the company going for an IPO despite all odds. Their point-of-sale (POS) solutions are incredibly popular.

One possible reason is that Pine Labs has been strategically positioning itself for growth. They’ve been expanding their product offerings, strengthening their partnerships, and solidifying their presence in the Southeast Asian market. They’ve also been actively acquiring other companies to broaden their technological capabilities. All of this points to a company that’s ready to scale up significantly, and an IPO is a logical step in that direction. But – and this is a big ‘but’ – can they deliver the kind of returns that investors are expecting, especially given the current market conditions?

Peak XV’s Big Bet | 40x Return – Really?

A 40x return? That’s the kind of number that makes even seasoned investors raise an eyebrow. Peak XV, with its deep pockets and keen eye for potential, clearly sees something special in Pine Labs. Maybe it’s the company’s dominance in the Indian merchant commerce space. Maybe it’s their innovative solutions for small and medium-sized businesses. Or maybe it’s just a calculated gamble based on extensive market research and a belief in the long-term growth potential of the Indian economy.

But let’s be realistic: a 40x return is a lofty goal. It requires everything to go right – flawless execution, favorable market conditions, and a bit of luck. As seen on Ford’s India investment , success isn’t always a given. It’s a reminder that even the smartest investors can’t predict the future with certainty.

Invesco’s Predicament | A Cautionary Tale

On the other side of the spectrum, we have Invesco, potentially facing a loss on their Pine Labs investment . This highlights the inherent risks involved in investing, especially in the pre-IPO stage. It’s a reminder that not every investment turns into a success story. Sometimes, despite the best efforts and intentions, things don’t go as planned. What does this tell us? Due diligence is paramount. Understanding the company’s fundamentals, assessing the market risks, and having a clear exit strategy are crucial for any investor, big or small.

And, let’s be honest, it’s also a reminder that even the most sophisticated investors can make mistakes. The market is unpredictable, and sometimes, factors beyond anyone’s control can impact an investment’s performance. So, before you jump on the IPO bandwagon , remember Invesco’s situation. Be careful, be informed, and don’t invest more than you can afford to lose. IPOs can be an interesting way to grow your capital, but are not always a safe bet.

Decoding Pine Labs’ Financial Performance

So, what are the key financial metrics to watch out for? Revenue growth, profitability, and cash flow are the usual suspects. But with Pine Labs, it’s also important to look at their market share in the merchant commerce space, their customer retention rate, and their ability to innovate and adapt to changing market trends. A common mistake I see people make is focusing solely on the top-line growth without paying attention to the bottom line. A company can be growing rapidly, but if it’s not profitable, it’s not sustainable in the long run.

Let me rephrase that for clarity: Look beyond the hype and dig into the numbers. Understand how the company generates revenue, how efficiently it manages its costs, and how well it’s positioned for future growth. Don’t just rely on what you read in the news; do your own research and make your own informed decisions.

The Road Ahead | What to Expect Post-IPO

What happens after the IPO? Will Pine Labs continue its growth trajectory, or will it face headwinds? The answer, as always, is complex. The company will need to navigate a challenging economic environment, compete with other players in the market, and manage the expectations of its new shareholders. But, as seen on ITC’s QFY results , the right approach can yield dividends.

One thing I can tell you is that the Indian digital payments landscape is evolving rapidly. New technologies, changing consumer preferences, and increasing competition are all reshaping the market. Pine Labs will need to stay ahead of the curve if it wants to maintain its leadership position. And that, in turn, will determine whether it can deliver the kind of returns that Peak XV is hoping for.

FAQ About the Pine Labs IPO

What exactly does Pine Labs do?

Pine Labs provides point-of-sale (POS) solutions and merchant commerce platforms.

Is the Pine Labs IPO a good investment?

It depends on your risk tolerance and investment goals. Research thoroughly!

When is the Pine Labs IPO expected to launch?

The exact timeline is still uncertain; keep an eye on financial news.

Where can I find more information about the Pine Labs IPO?

Consult financial news sources and Pine Labs’ official website closer to the launch.

So, the Pine Labs IPO is more than just a financial event; it’s a reflection of the evolving Indian economy and the growing importance of technology in our daily lives. Whether it turns out to be a goldmine or a cautionary tale remains to be seen. But one thing is certain: it’s a story worth watching, and hopefully, now you’re equipped with the right questions to ask.