Okay, let’s talk about Nvidia . Not just the stock price – that’s the headline, after all. What’s really fascinating is the almost unwavering faith traders seem to have in this company. A $5 trillion market cap? That’s not just numbers; it’s a statement. But why is everyone so bullish? And more importantly, what does it mean for you and me – particularly us folks keeping an eye on the Indian markets?

The AI Gold Rush and Nvidia’s Dominance

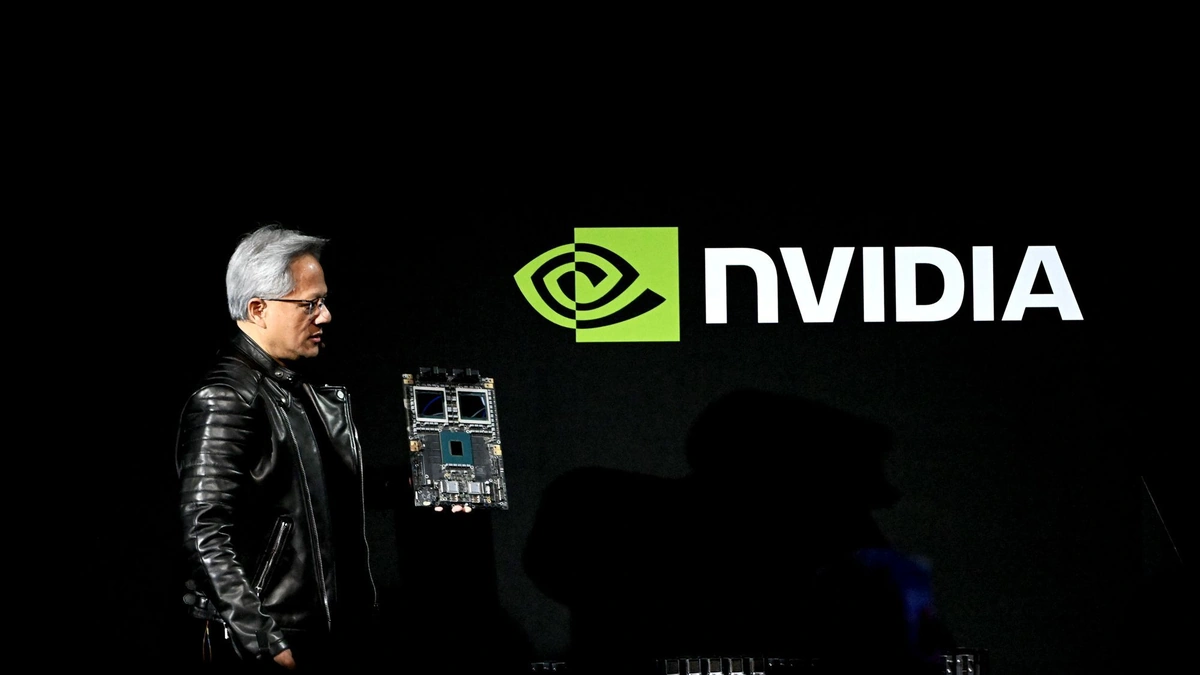

Here’s the thing: Nvidia isn’t just a chipmaker anymore. They’re selling shovels in the AI gold rush. Think of it this way: every company scrambling to build AI needs the best processors, and right now, Nvidia’s GPUs are the top of the heap. Their data center business is booming. It’s not just about gaming anymore (though that’s still a significant chunk of their revenue). It’s about powering the future.

What fascinates me is the scale. We’re talking about a shift that’s happening on a global level, where companies are investing billions in AI infrastructure. And guess who’s supplying the hardware? You guessed it, Nvidia . This isn’t a temporary fad; it’s a fundamental change in how businesses operate.

And it’s not just about the hardware. Nvidia has built a robust ecosystem of software and tools that make it easier for developers to build AI applications. This “stickiness” is crucial. Once companies invest in the Nvidia ecosystem, it becomes harder to switch to competitors.

Understanding the Trader’s Psychology | Fear of Missing Out (FOMO)

Let’s be honest: A lot of the buying pressure is driven by FOMO. Traders see Nvidia’s stock price soaring, and they don’t want to be left behind. It’s a classic case of herd mentality, amplified by social media and the speed of information today. But fear isn’t always the wisest investment strategy. I think it’s essential to understand what is behind the FOMO. One thing that may be playing a role is the company’s revenue growth, which has been impressive. Nvidia’s latest earnings reports have consistently beaten expectations, fueling the positive sentiment.

But here’s what I think: experienced traders are also looking beyond just the hype. They’re analyzing the financials, assessing the competitive landscape, and making informed decisions based on data. The market might be overvaluing Nvidia right now, or they might be properly evaluating it, but the real risk would be if Nvidia can’t continue to innovate and maintain its technological edge. The link to a related article discusses how Nvidia initially reached a trillion-dollar valuation.

What This Means for the Indian Investor

Now, how does all this affect you, the Indian investor? Here’s the thing: investing directly in Nvidia stock can be tricky. It requires opening an international trading account, dealing with currency fluctuations, and navigating foreign regulations. But there are other ways to get exposure.

Many Indian IT companies are increasingly partnering with Nvidia for their AI initiatives. Companies like TCS, Infosys, and Wipro are using Nvidia’s technology to develop AI solutions for their clients. Investing in these Indian IT giants could be a way to indirectly benefit from Nvidia’s growth. Do keep in mind that those Indian companies may use competitors’ technology as well, so you should carefully analyze each firm’s strategy.

Another option is to invest in exchange-traded funds (ETFs) that focus on AI or semiconductors. These ETFs often have Nvidia as a significant holding, providing diversified exposure to the sector. Always read the fine print and understand the ETF’s investment strategy before investing.

Risks and Considerations | The Road Ahead for Nvidia

Let’s be real: no investment is without risk. Nvidia faces increasing competition from other chipmakers like AMD and Intel, who are aggressively investing in AI chips. There’s also the risk of government regulations on AI, which could impact Nvidia’s business. Further, the global supply chain issues that have plagued the semiconductor industry could also affect Nvidia’s ability to meet demand, potentially impacting revenue growth.

And let’s not forget the cyclical nature of the semiconductor industry. Demand for chips can fluctuate wildly, leading to periods of boom and bust. What will happen to the Nvidia stock forecast if we see a bear market?

So, while the future looks bright for Nvidia, it’s essential to be aware of the potential risks and invest wisely. Don’t get caught up in the hype. Do your research, understand the company’s financials, and make informed decisions. According to Wikipedia , Nvidia has had its share of ups and downs over the years. It may be difficult to predict when the tides may turn.

Also, you can check another of our articles at this link .

The Future of AI and Nvidia’s Role

What fascinates me most is the long-term potential of AI. We’re only scratching the surface of what’s possible. From self-driving cars to personalized medicine to climate change solutions, AI has the potential to transform every aspect of our lives. I believe the growth in cloud computing, edge computing, and artificial intelligence is what is fueling the demand for high-performance computing solutions, such as those offered by Nvidia.

And Nvidia is at the forefront of this revolution. They’re not just providing the hardware; they’re also developing the software and tools that will enable AI to reach its full potential. The rise in demand for data center GPUs shows that many industries are adopting AI.

FAQ Section

Frequently Asked Questions

Is it too late to invest in Nvidia?

That’s the million-dollar question, isn’t it? There’s no easy answer. It depends on your risk tolerance and investment goals. Nvidia’s stock price is already high, but the company also has tremendous growth potential. Consider dollar-cost averaging to mitigate risk.

What are the biggest risks to Nvidia’s growth?

Competition from other chipmakers, government regulations on AI, and global supply chain issues are the main risks. Also, as mentioned before, the cyclical nature of the semiconductor industry is also a huge risk to Nvidia stock price .

How can I invest in Nvidia from India?

You can invest directly by opening an international trading account, or indirectly by investing in Indian IT companies that partner with Nvidia or in ETFs that hold Nvidia stock.

Will Nvidia’s stock price keep going up forever?

Let’s be realistic. No stock goes up forever. There will be corrections and downturns along the way. Don’t expect it to be a straight line. It’s important to set realistic expectations for the stock market .

What is Nvidia’s competitive advantage?

Nvidia’s competitive advantage lies in its superior GPU technology, its robust ecosystem of software and tools, and its strong relationships with leading AI companies. This has led to increased adoption of the company’s accelerated computing platform.

What other semiconductor companies are focusing on AI?

AMD and Intel are major competitors, but many smaller companies are also developing AI chips. It’s a rapidly evolving landscape.

So, Nvidia is not just a stock; it’s a bet on the future of AI. Whether that bet pays off is something that only time will tell. But one thing is certain: the AI revolution is just getting started, and Nvidia is right in the thick of it. It will be interesting to see if the AI revolution will keep up this demand.