Okay, so SEBI – that’s the Securities and Exchange Board of India, the folks who keep the Indian markets in check – is suggesting lower mutual fund fees . But here’s the thing: Why should you, sitting in your chai-sipping armchair, even care? Let’s be honest, finance news can feel like it’s written in Klingon sometimes. This article is here to break that down and explain why this move could mean more money in your pocket. Think of it as a friendly nudge from your wallet’s future self.

Decoding the Fee Structure | What Are You Really Paying?

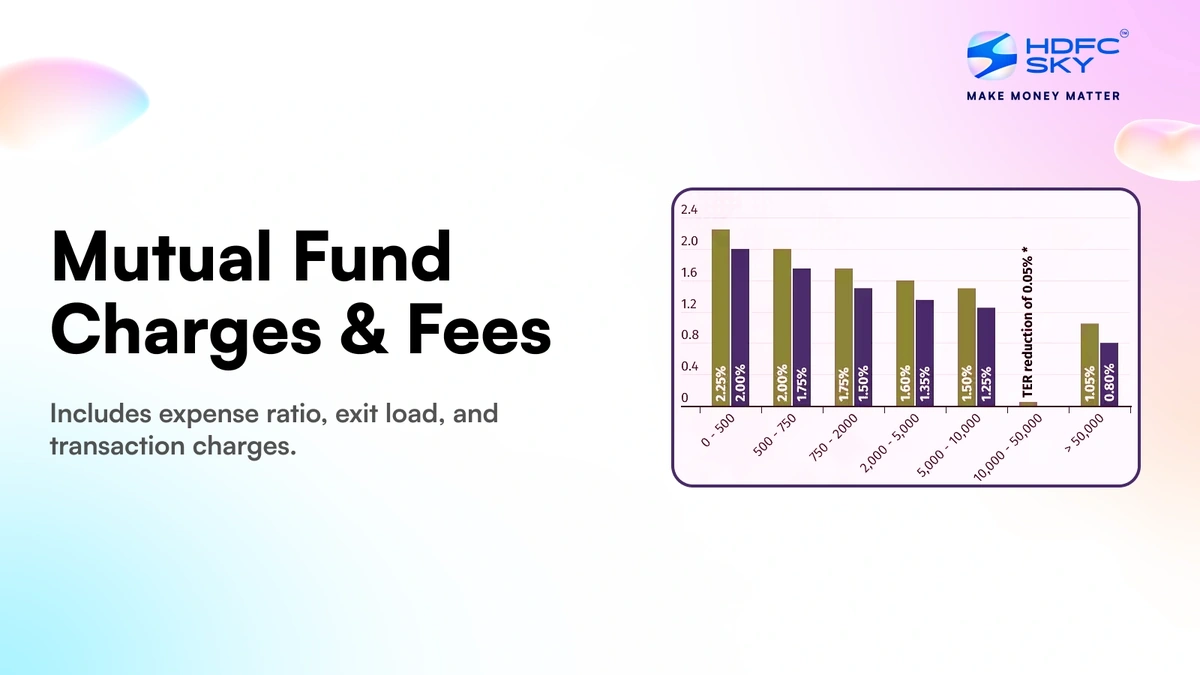

Most of us, when we invest in a mutual fund , focus on the returns. Makes sense, right? We want to see our money grow. But what often gets overlooked is the jungle of fees that these funds charge. And I mean, a jungle. We’re talking expense ratios, exit loads, transaction charges, and more. It can be head-spinning.

The expense ratio is the big one. It’s essentially the annual cost of running the fund, expressed as a percentage of your investment. This covers everything from the fund manager’s salary to administrative costs. A common mistake I see people make is ignoring this tiny percentage. But let me tell you, those percentages add up – especially over the long term.

Let’s say you’re investing ₹1 lakh. A 1% expense ratio means ₹1,000 goes towards fees every single year. Now, imagine that over 20 years, and factor in the compounding effect. Suddenly, that ‘small’ fee has eaten into a significant chunk of your potential returns. See why I’m making a big deal out of this? Understanding expense ratios is non-negotiable for smart investing.

SEBI’s suggestion to lower these fees is all about making investing more affordable – and more transparent – for the average Indian investor. The goal is to encourage more people to participate in the market, knowing that they aren’t being bled dry by hidden or excessive charges.

The “Why” Behind the Suggestion | Investor Protection & Market Growth

So, why is SEBI doing this now? Well, there are a few key reasons. First and foremost, it’s about investor protection. SEBI’s primary mandate is to safeguard the interests of investors. Excessive fees can erode returns and discourage people from investing, which isn’t good for anyone.

But, there’s also a bigger picture at play. India’s financial markets are still relatively underpenetrated compared to other developed economies. A lot of people still shy away from investing, often because they find it too complicated or too expensive. By lowering fees and increasing transparency, SEBI hopes to make the market more accessible and attractive to a wider range of investors.

The one thing you absolutely must double-check when choosing a mutual fund is not only its historical performance, but also understand it’s direct and indirect costs. Historical performance doesn’t guarantee future results, and high returns can sometimes mask high fees. SEBI is trying to level the playing field here, ensuring that investors aren’t unfairly disadvantaged.

How Lower Fees Impact Your Returns | A Real-World Scenario

Let’s get practical. How does a reduction in mutual fund fees actually impact your returns? Imagine two identical mutual funds, Fund A and Fund B. Both invest in the same stocks and generate the same returns – say, 12% per year. The only difference? Fund A charges an expense ratio of 1.5%, while Fund B charges 0.75%.

Now, let’s say you invest ₹50,000 in each fund for 10 years. After 10 years, your investment in Fund A would be worth approximately ₹1,37,646. Not bad, right? But your investment in Fund B would be worth approximately ₹1,52,637. That’s a difference of almost ₹15,000 – all thanks to a seemingly small difference in expense ratios!

See what I mean? Those fees really do add up over time. A lower expense ratio means more of your money stays invested, compounding and growing over the long term. This is particularly important for long-term goals like retirement planning or funding your children’s education. If you are looking for tax saving investments then explore silver global asset allocation .

According to the latest circular on the official SEBI website (www.sebi.gov.in – though, let’s be honest, who actually reads those things?), they’re also pushing for greater transparency in how these fees are disclosed. This means that fund houses will have to be more upfront and clear about all the charges involved, making it easier for investors to compare different options.

Navigating the Future | What Should Investors Do Now?

So, what should you do with this information? First, don’t panic and start selling all your mutual fund investments. That’s never a good idea. Instead, take some time to review your existing portfolio. Look closely at the expense ratios of your funds. Are you paying more than you should be?

Compare your funds to similar options in the market. There are plenty of online tools and resources that can help you compare expense ratios, historical performance, and other key metrics. Don’t be afraid to switch to a lower-cost fund if it makes sense. Just be mindful of any exit loads or tax implications.

A common mistake I see people making is prioritizing only the historical returns while choosing a mutual fund. Yes, returns are important, but so are fees. A fund with slightly lower returns but significantly lower fees might actually be a better long-term investment. Remember to think about the after-fee returns, not just the headline numbers. For stock market climb , you can also read this resource .

The Bottom Line | A Win for the Indian Investor

SEBI’s move to encourage lower mutual fund fees is ultimately a win for the Indian investor. It’s a step towards creating a more transparent, accessible, and affordable market. It’s a reminder that even small changes can have a big impact on your long-term financial goals. And, hey, who doesn’t like the idea of keeping more of their hard-earned money?

What fascinates me is how this seemingly dry regulatory change can have such a tangible impact on people’s lives. It’s a testament to the power of small, incremental improvements. So, go forth, review your portfolio, and make sure you’re not leaving money on the table.

FAQ Section

Frequently Asked Questions

What exactly is an expense ratio?

It’s the annual cost of operating a mutual fund , expressed as a percentage of your investment. It covers management fees, administrative costs, and other expenses.

How do I find the expense ratio of my mutual fund?

You can find it in the fund’s fact sheet or prospectus, which is usually available on the fund’s website or through your broker.

Will lowering fees guarantee higher returns?

No, lower fees don’t guarantee higher returns, but they can improve your net returns by reducing the amount of money that goes towards expenses.

Is there a downside to switching to a lower-fee fund?

There might be exit loads (fees for selling your investment) or tax implications if you sell your existing fund. Always consider these factors before making a switch.

Are all mutual fund fees negotiable?

Generally, no. Expense ratios are usually fixed. However, some brokers may offer discounts or rebates on certain fees, especially for large investments.

Where can I learn more about mutual fund fees?

The SEBI website ( www.sebi.gov.in ) is a great resource for information about regulations and guidelines related to mutual funds.