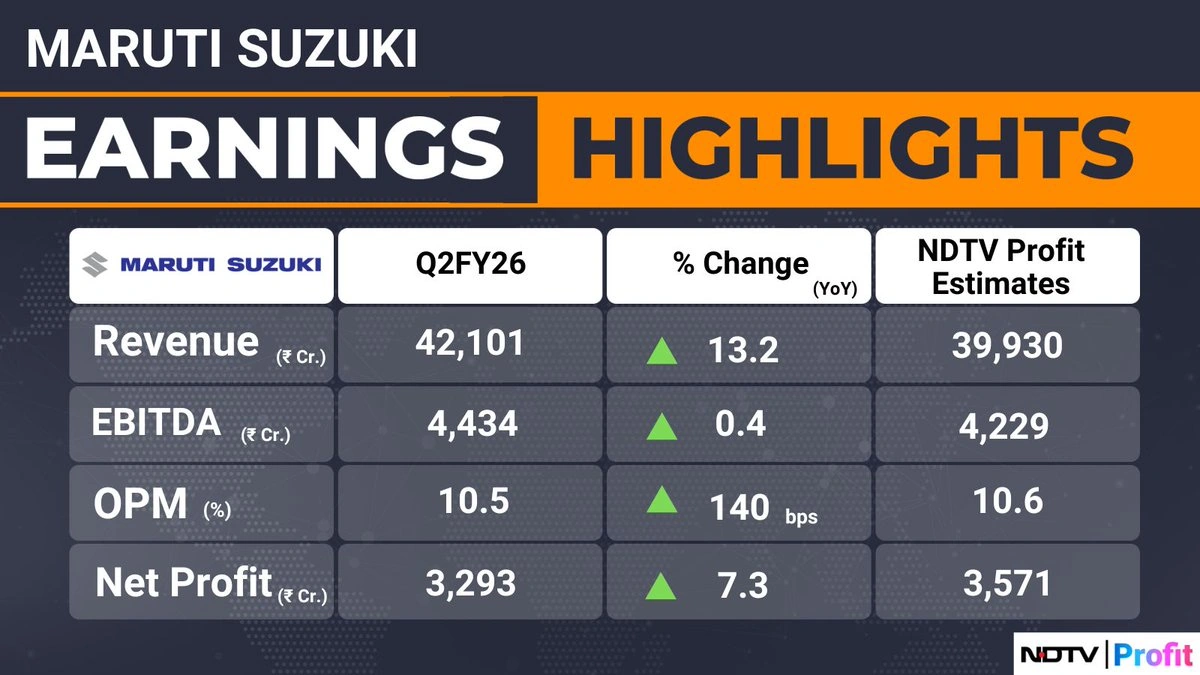

So, Maruti Suzuki, the king of Indian roads, just dropped its Q2FY26 numbers. Maruti Suzuki profit jumped 7.9% year-on-year, landing at ₹3,349 Cr. Sounds like a party, right? Well, the stock market wasn’t exactly throwing confetti; shares actually dipped. What gives? That’s the question everyone’s asking. It initially seems straightforward, but a closer look reveals a more nuanced picture. Let’s dive in and try to understand why this seemingly positive news was met with a bit of a shrug (and a slight dip) from investors.

Decoding the Numbers | More Than Meets the Eye

Here’s the thing: a profit increase is usually good news. But in the world of finance, context is everything. Is 7.9% growth enough? That depends on expectations. Were analysts predicting a bigger jump? Were there specific concerns about rising input costs eating into margins? These are the questions that analysts, and savvy investors, pore over. A significant factor influencing market sentiment is the overall auto industry performance . If the entire sector is booming, a 7.9% increase might be seen as just keeping pace, not necessarily outperforming the competition.

Let me rephrase that for clarity. Think of it like this: if everyone else is scoring 90%, getting 7.9% more than last year (your 60%) might not feel like a stellar achievement. The devil, as always, is in the details. We need to look at quarterly performance trends and dissect the contributing factors to understand the complete story. And that includes market share analysis to determine if Maruti Suzuki is maintaining its dominance.

The Input Cost Conundrum and Future Outlook

But, one of the biggest challenges facing automakers right now is rising input costs. Steel, aluminum, precious metals – the prices of everything that goes into making a car have been climbing. This directly impacts profitability. Maruti Suzuki, like its competitors, has likely been battling these rising costs. So, while revenue might be up, the real profit margin – the amount of money they actually keep after paying for everything – might be squeezed.

So, what’s the outlook? What happens from here? That’s where the future gets interesting. Maruti Suzuki’s management’s commentary on the future growth prospects and mitigation strategies for rising costs will be crucial. Are they planning to raise prices? Are they finding ways to become more efficient? Are they investing in electric vehicles (EVs) and other new technologies to stay ahead of the curve? Their answers to these questions will heavily influence investor confidence and, consequently, the stock price. Remember, the market is forward-looking. It cares less about what happened and more about what’s going to happen.

The EV Game and Shifting Market Dynamics

And speaking of the future, let’s be honest, the automotive landscape is changing faster than ever. Electric vehicles are no longer a distant dream; they’re a rapidly growing reality. Maruti Suzuki has been relatively slow to embrace EVs compared to some of its competitors. While they’ve announced plans and showcased prototypes, they don’t yet have a mass-market EV offering in India. This perceived lag in the electric vehicle market could be weighing on investor sentiment. Investors are wondering if Maruti Suzuki will be able to maintain its dominance in the EV era.

What fascinates me is how quickly consumer preferences are evolving. Indians are becoming increasingly aware of environmental issues and are more willing to consider EVs, even if they come with a slightly higher price tag. This shift presents both a challenge and an opportunity for Maruti Suzuki. They need to adapt quickly to this changing landscape to remain competitive. Here is a link about Amazon layoffs . What will be the overall impact?

Digging Deeper | Beyond the Press Release

To really understand what’s going on, we need to go beyond the headline numbers and the press release. We need to analyze the company’s financial statements, listen to analyst calls, and read reports from independent research firms. We need to understand the underlying trends, the competitive dynamics, and the potential risks and opportunities facing Maruti Suzuki.

A common mistake I see people make is taking these announcements at face value. They read the headline, see a positive number, and assume everything is fine. But the stock market is a complex beast, and it rarely reacts in a predictable way. Several reports also focus on export sales performance and its contribution to the overall revenue. Understanding the breakdown of domestic vs. international sales provides a clearer picture of the company’s market reach and diversification efforts. This Moneycontrol article focuses on the impact of currency exchange rates on the company’s profitability and competitiveness in the global market.

Looking Ahead | What Should Investors Do?

Ultimately, whether or not to invest in Maruti Suzuki is a personal decision that depends on your individual risk tolerance, investment goals, and time horizon. However, it’s crucial to do your homework and understand the factors that are driving the company’s performance and the market’s reaction to it.

The one thing you absolutely must consider is not just the current numbers, but the future potential. Is Maruti Suzuki well-positioned to compete in the evolving automotive market? Are they making the right investments in EVs and other new technologies? Are they managing their costs effectively? If you believe the answer to these questions is yes, then a temporary dip in the stock price might represent a buying opportunity. But if you have concerns about the company’s long-term prospects, it might be wise to stay on the sidelines. Let’s consider the impact of recent global economic events on the automotive industry.

FAQ

Frequently Asked Questions About Maruti Suzuki’s Financial Performance

What does YoY mean?

YoY stands for Year-over-Year. It’s a way to compare a company’s performance in one period (like a quarter) to the same period in the previous year.

Why did Maruti Suzuki’s shares decline despite a profit increase?

Several factors could contribute, including unmet expectations, concerns about rising input costs, or perceived slow progress in the electric vehicle market.

What are input costs?

Input costs are the expenses a company incurs to produce its goods or services, such as raw materials, labor, and energy.

How important is the electric vehicle (EV) market for Maruti Suzuki?

The EV market is increasingly important. Maruti Suzuki’s success in this segment will be crucial for its long-term growth and competitiveness.

Where can I find more detailed information about Maruti Suzuki’s financial performance?

You can find information on the company’s website, in financial news articles, and in reports from independent research firms.

What are some key metrics to watch for in future reports?

Key metrics include revenue growth, profit margins, market share, and progress in the electric vehicle market.

So, while Maruti Suzuki’s Q2FY26 numbers might seem straightforward on the surface, they reveal a complex and evolving story. It’s a story of growth, but also of challenges and uncertainties. And that’s exactly what makes the stock market so fascinating (and sometimes, so frustrating!).