Okay, let’s talk about the stock market. Not just the numbers, but what those numbers mean for you and me. November 21st saw some interesting movement in the NSE and BSE, didn’t it? Nifty hitting 26,000, Sensex soaring to 85,500 – all against a backdrop of, shall we say, energetic market volatility . And then there’s Maruti and M&M stealing the show as top gainers. But what’s really going on? Let’s find out.

Decoding the Market Jitters

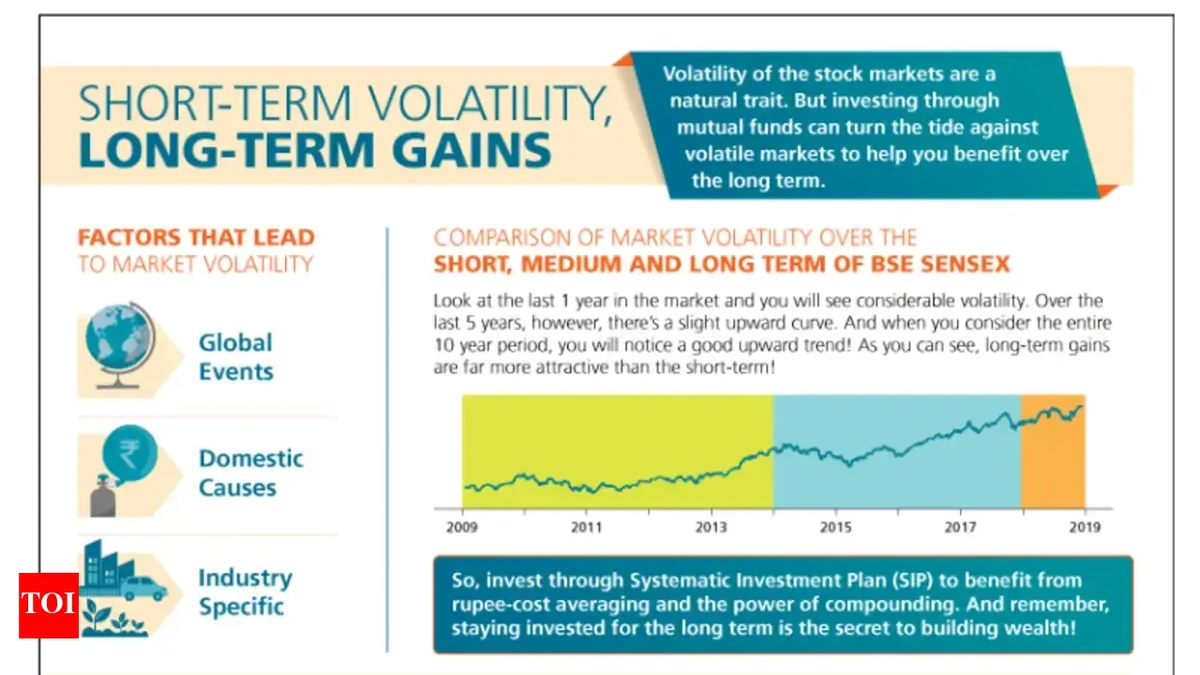

First off, market volatility isn’t some abstract concept dreamt up by economists. It’s the real-world feeling of your investments bouncing around like a rubber ball. And honestly, it’s enough to make anyone a little queasy. What triggers it, though? Well, a whole cocktail of factors: global economic uncertainty, rising inflation (something hitting us all in the wallet, right?), and good old investor sentiment. When people get nervous, they sell. And when they sell, things get…well, volatile. You see, it’s a bit of a self-fulfilling prophecy.

But here’s the thing: volatility isn’t always a bad thing. Think of it like this, it can also present opportunities. It creates entry points for savvy investors who know how to spot a good deal amidst the chaos. Remember, market corrections are a normal part of the economic cycle. They’re a pressure release valve. Consider this a timely alert.

Why Maruti & M&M? The Auto Sector’s Surge

So, why were Maruti Suzuki and Mahindra & Mahindra (M&M) the shining stars that day? Several reasons, actually. The auto sector, after a period of lukewarm performance, has been showing signs of a comeback. We are seeing increased demand fueled by the festive season, easing supply chain constraints (remember those chip shortages?), and new model launches that are getting people excited. Plus, both Maruti and M&M have been making smart moves in the EV space, which is definitely where the future is headed. But , if you want to read more about Maruti Suzuki, check this Maruti Suzuki Profit .

The festive season boost shouldn’t be underestimated. Diwali, especially, is a time when Indians traditionally make big purchases. Cars are right up there on that list. And let’s not forget the psychological factor: after a tough couple of years, people are ready to spend a little and treat themselves.

Nifty 26,000 and Sensex 85,500 | Milestones or Just Numbers?

Okay, let’s be real. Big numbers like Nifty 26,000 and Sensex 85,500 sound impressive, don’t they? They’re great headlines. But what do they actually mean? Well, they’re indicators of overall market health. They reflect the collective performance of a basket of top companies. When these indices rise, it generally means that investors are feeling optimistic about the economy and corporate earnings. But – and this is a big but – they don’t tell the whole story.

The truth is that you shouldn’t get too hung up on specific numbers. They’re useful benchmarks, sure, but they can be misleading. The important thing is to look at the underlying trends. Are corporate earnings growing? Is the economy expanding? What’s the outlook for inflation and interest rates? These are the questions that really matter. Always check the Economic indicators .

Navigating Market Volatility | Tips for the Indian Investor

So, what’s an Indian investor to do in the face of all this stock market fluctuation ? Panic selling is almost always a bad idea. The key is to stay calm, stay informed, and have a plan. Here are a few pointers that I always suggest. The first, always diversify your portfolio. Don’t put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate, gold, etc.) to reduce your overall risk. Second, invest for the long term. Don’t try to time the market. Focus on buying quality companies and holding them for the long haul.

Third, consider SIPs (Systematic Investment Plans). SIPs allow you to invest a fixed amount regularly, regardless of market conditions. This helps to average out your cost of investment and reduce the impact of volatility. Fourth, do your research. Don’t just follow the herd. Understand the companies you’re investing in and their long-term prospects. Read company reports, follow industry news, and consult with a financial advisor if needed. And finally, don’t be afraid to sit on the sidelines. If you’re feeling uncomfortable with the current market conditions , there’s nothing wrong with holding cash and waiting for a better opportunity. Don’t feel pressured to invest just because everyone else is. You could even look into Air India Funding , and diversify that way.

The Road Ahead | What to Expect

What does the future hold? Honestly, no one knows for sure. But here’s what I’m watching: global economic growth, inflation trends, interest rate movements, and geopolitical developments. These factors will all play a role in shaping the market landscape in the coming months. I think that understanding market trends is crucial. Also, be prepared for continued volatility. The market rarely moves in a straight line. There will be ups and downs. The key is to stay focused on your long-term goals and not get distracted by short-term noise.

And finally, remember that investing is a marathon, not a sprint. It’s about building wealth gradually over time. So, stay patient, stay disciplined, and don’t let market volatility scare you off course. Happy investing!

FAQ

What if I’m new to investing and feel completely lost?

Start small! Don’t feel like you need to dive in headfirst. Open a Demat account, invest a small amount in a well-diversified index fund, and gradually learn as you go.

How often should I check my portfolio?

Resist the urge to check it every five minutes! Once a month is generally sufficient, unless there’s a major market event.

What are some good resources for learning about investing?

There are tons of great books, websites, and online courses out there. Start with the basics and gradually expand your knowledge.

Is it a good time to invest in IPOs right now?

IPOs can be tempting, but they’re often risky. Do your research and understand the company’s business model before investing.

What’s the difference between the NSE and the BSE?

They’re both stock exchanges, but the NSE is generally considered to be more modern and technologically advanced.