Okay, so BPCL dropped a bit of a bomb – a good one, though! They’re dishing out a ₹7.5 interim dividend . But let’s be honest, the headline alone doesn’t tell you much. What does this mean for the average investor in India? Is it time to load up on BPCL shares? Or is this just a flash in the pan? Let’s dive in – because the ‘why’ behind this move is way more interesting than the ‘what’.

Why This Dividend Matters | More Than Just Pocket Change

Here’s the thing: dividend announcements , especially interim ones, are often viewed as a company’s way of signaling confidence. But in the case of BPCL (Bharat Petroleum Corporation Limited), it’s a bit more nuanced. This isn’t just about rewarding shareholders (though, of course, it does). It’s about strategic financial management, and understanding that requires digging a bit deeper. Let me rephrase that for clarity – while a dividend payout is always welcome, its real significance lies in what it reveals about the company’s financial health and future outlook. Many companies are considering providing stock dividends . Now, a common mistake I see people make is viewing dividends in isolation. The ₹7.5 figure is important, sure, but it’s the context that makes it meaningful. To fully grasp the magnitude of this announcement, we must understand the nuances of the ex-dividend date .

Think of it like this: a healthy company with strong cash flow can comfortably afford to distribute dividends. It’s a sign they’re not just hoarding cash but actively using it to benefit shareholders. Now, with the current economic conditions and BPCL’s recent performance, this dividend payout indicates a level of stability and profitability that should reassure investors.

The Government Angle | Decoding the Strategy

But, and it’s a big but, BPCL is a public sector undertaking (PSU). Which means the government is a major shareholder. So, any major financial move like this needs to be seen through the lens of government strategy. What fascinates me is the potential for the government to utilize dividends from PSUs like BPCL to meet its budgetary needs. It’s a way to generate revenue without directly raising taxes. And in a year where fiscal prudence is key, this becomes even more important. The dividend income to government provides a crucial source of revenue, and it will be interesting to see the dividend yield to be expected.

Consider this: the government has been pushing PSUs to improve their efficiency and profitability. A strong dividend payout from BPCL could be seen as a validation of those efforts. It’s a way for the government to showcase the success of its policies and encourage further investment in these companies. You can understand the record date to determine if you qualify for the dividend. Here is a link that might interest you.

Navigating the Market | Should You Buy, Sell, or Hold?

Okay, so the big question: what should you do with this information? Should you rush out and buy BPCL shares? Not so fast. While the dividend is definitely a positive sign, it’s just one piece of the puzzle. A common mistake I see people make is basing investment decisions solely on dividend announcements. It’s crucial to consider the broader market context, BPCL’s future growth prospects, and your own risk tolerance. The financial performance indicators will also be able to allow you to determine whether BPCL is worth investing in.

Let’s be honest – the stock market is never a sure thing. There are always risks involved. But with BPCL, the dividend announcement provides a degree of confidence. It suggests that the company is on a solid financial footing and committed to rewarding its shareholders. But, it’s important to know about the impact of dividend before making an investment decision.

Future Growth and Sustainability | What’s Next for BPCL?

So, what’s next for BPCL? Is this dividend payout sustainable in the long run? That’s the million-dollar question. BPCL has been investing heavily in renewable energy and diversifying its business. This is crucial for long-term sustainability. As per guidelines mentioned in various financial publications, the ability to adapt to changing market conditions is essential for a company to maintain consistent dividend payments .

I initially thought this was straightforward, but then I realized that BPCL’s future depends on its ability to innovate and stay ahead of the curve. The company needs to continue investing in new technologies, improving its operational efficiency, and expanding its market reach. Only then can it ensure that it can continue to deliver strong returns to its shareholders. And, of course, successfully navigate the complexities of the market. Here is a link to another interesting read.

FAQ | Your Burning Questions About BPCL’s Dividend, Answered

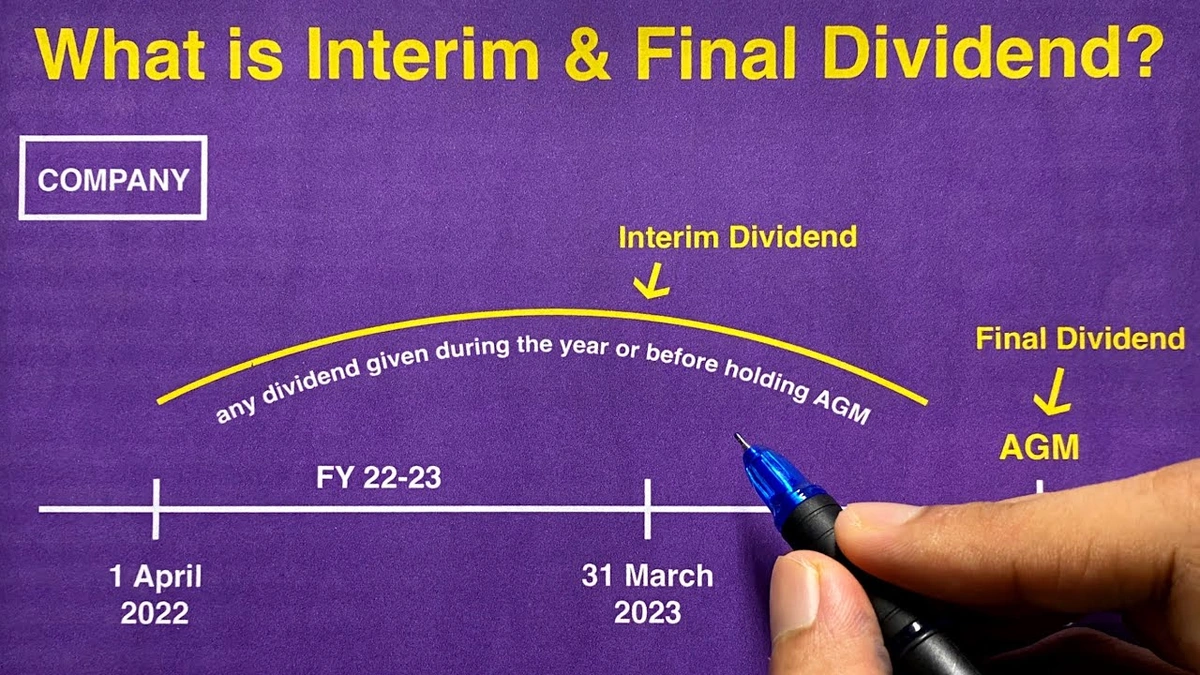

What exactly is an interim dividend?

An interim dividend is a dividend payment made by a company before its annual general meeting (AGM). It’s basically a way for companies to distribute profits to shareholders more frequently than just once a year.

When is the record date for this BPCL dividend?

The record date is the date on which you must be a registered shareholder of BPCL to be eligible to receive the dividend. Check with BPCL’s investor relations for the specific date.

How will this dividend impact the stock price?

Typically, the stock price will drop by roughly the amount of the dividend on the ex-dividend date. However, market sentiment and other factors can also influence the price.

What if I bought the stock just before the record date?

If you buy the stock right before the record date, you will be eligible for the dividend. However, remember that the stock price will likely adjust downwards on the ex-dividend date.

Is this a good time to invest in BPCL?

That depends on your individual investment goals and risk tolerance. Consider the dividend announcement, BPCL’s financial performance, and the overall market outlook before making a decision.

In conclusion, BPCL’s interim dividend is a positive signal, but it’s crucial to look beyond the headline. It reflects the company’s current financial strength and future ambitions. But, like any investment, it comes with inherent risks. Before making any decision, make sure to research comprehensively and understand the big picture.