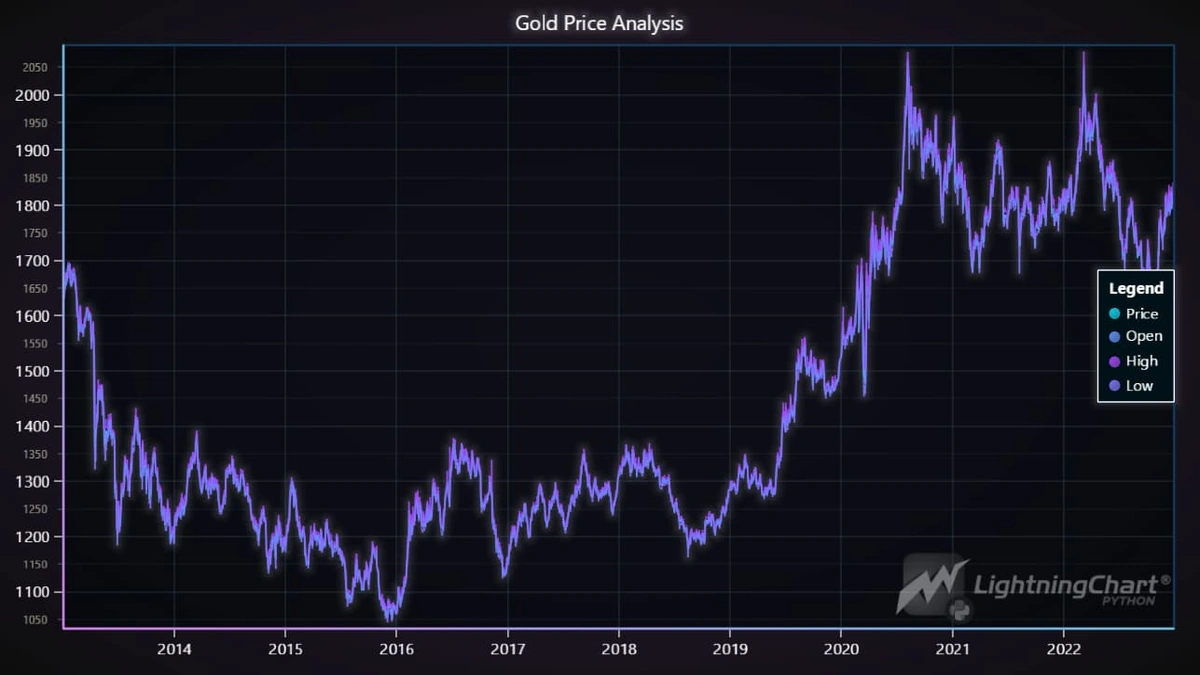

Okay, let’s talk gold. Specifically, the gold price prediction for today and the looming November/December outlook. You might have seen headlines screaming about a “sharp drop.” But let’s be honest, headlines are designed to grab your attention, not necessarily inform you. What’s really going on? And more importantly, what does it mean for you, sitting here in India, thinking about investing or just trying to make sense of the economic roller coaster?

I initially thought this was just another daily fluctuation, but the more I dug into it, the more I realized there’s a confluence of factors at play. And that’s what makes this dip potentially interesting – and potentially a headache if you’re not prepared. Let’s unpack it.

Why the Sudden Drop? Understanding the Market Drivers

So, why the sharp drop in gold prices ? Several factors are likely contributing. Firstly, we’re seeing a strengthening US dollar. Now, I know what you’re thinking: “What does the US dollar have to do with my investment in gold here in India?” Well, gold is often priced in dollars, so when the dollar strengthens, gold becomes more expensive for those using other currencies, potentially dampening demand and pushing prices down. Think of it like this: If your local vegetable vendor suddenly started quoting prices in US dollars, you might think twice before buying, right?

Secondly, keep an eye on rising bond yields. Higher yields can make bonds a more attractive investment compared to gold, which doesn’t offer a yield. Investors might be shifting their funds, triggering a sell-off in gold. And let’s face it, everyone is looking for the best return on their investment, and sometimes safe haven assets like gold take a back seat to higher yielding options.

Also, don’t discount shifts in investor sentiment. News, rumors, and even a particularly influential tweet can send ripples through the market. Remember, the market is partly driven by emotion, not just cold, hard facts.

November/December Outlook | Navigating the Uncertainty

Now, for the million-dollar question: What’s the gold price forecast for November and December? This is where things get tricky. Forecasting is never an exact science, and when you throw in global economic uncertainties, geopolitical tensions, and the ever-present X-factor of unforeseen events, it becomes even more challenging. As the saying goes, “Past performance is not indicative of future results”.

Here’s what I’m watching closely: festive season demand in India. Gold buying tends to increase during Diwali and the wedding season. Will that increased demand be enough to offset the downward pressure from global factors? That’s the key question. Also, keep an eye on central bank policies. Any indication from the Reserve Bank of India (RBI) or the US Federal Reserve about interest rate changes could significantly impact future gold rates .

Speaking of global happenings, the ongoing conflict in Ukraine and tensions elsewhere can drive investors towards safe-haven assets like gold. These are the things that keep market analysts up at night. A good strategy is to consider investing in gold ETFs to minimize physical storage issues.

A common mistake I see people make is panicking and selling when they see a dip. Remember, investing is a long-term game. Don’t let short-term volatility scare you. Consider consulting a financial advisor before making any big decisions.

How to Use This Information to Your Advantage

Okay, so the market is volatile. What can you actually do about it? Here’s the “How” angle.

First, do your homework. Don’t just rely on headlines. Read credible financial news sources, analyze market trends, and understand the underlying factors driving price movements. Sites like Investopedia are a good start.

Second, diversify your portfolio. Don’t put all your eggs in one basket, as they say. Gold can be a valuable part of a diversified portfolio, but it shouldn’t be the only asset you hold. It’s important to understand factors affecting gold prices before investing.

Third, consider using dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of the price. This can help you to smooth out the impact of volatility and potentially buy gold at a lower average price over time.

Fourth, if you are thinking of purchasing physical gold, always check for hallmarks to ensure purity and authenticity. Nobody wants to end up with fool’s gold!

The Role of Geopolitics and Global Uncertainty

One thing I’ve learned over time is that you can’t separate gold prices from the broader geopolitical landscape. Global instability often acts as a tailwind for gold. Think about it: when there’s uncertainty in the world, people flock to what they perceive as safe and stable assets. Gold, with its long history as a store of value, certainly fits that bill. So, any escalation in existing conflicts, or the emergence of new ones, could send gold prices higher.

However, increased global stability, or the perception of it, could have the opposite effect. So, it’s always wise to keep a close eye on these factors when formulating your investment strategy. What fascinates me is how gold reacts to these external stimuli.

Final Thoughts | Stay Informed, Stay Calm

The current gold market trends are showing short-term uncertainty. The gold market can be volatile, and predicting future prices is always a challenge. But by staying informed, understanding the factors at play, and developing a well-thought-out investment strategy, you can navigate the uncertainty and potentially benefit from opportunities that arise. And always remember to consult a qualified financial advisor before making any investment decisions. The key is to act like a seasoned investor, not an emotional gambler.

Here’s a final thought: don’t get caught up in the hype. Focus on the fundamentals, and remember that investing is a marathon, not a sprint. It is advisable to conduct a thorough technical analysis of gold prices before making any decisions. In addition, you can compare it to other asset classes like stock or bonds.

FAQ Section

Will gold prices recover soon?

It’s impossible to say for sure, but keep an eye on the factors mentioned above (dollar strength, interest rates, geopolitical events). A recovery depends on how these factors play out.

Is it a good time to buy gold now?

That depends on your investment goals and risk tolerance. If you’re a long-term investor, this dip might be an opportunity. If you’re looking for a quick profit, be careful.

What are the alternative investment options?

Consider gold ETFs, gold mutual funds, or sovereign gold bonds. These offer different levels of liquidity and risk. Be sure to choose wisely!

How is gold price determined?

Gold prices are determined by global supply and demand, investor sentiment, and currency fluctuations.

Should I sell my gold now?

That depends on your individual circumstances. If you need the money or believe prices will fall further, selling might be an option. But if you’re a long-term investor, consider holding on.

What if I’m new to gold investing?

Start small, do your research, and consult with a financial advisor. Don’t invest more than you can afford to lose.