Alright, let’s talk dividend stocks. This week is looking particularly juicy, especially if you’re eyeing Coal India , NTPC , BPCL , and Shriram Finance . But here’s the thing – simply knowing which stocks are going ex-dividend is only half the battle. What truly matters is understanding why these specific companies are offering dividends now, and how you can potentially benefit. And that’s what we are here to unpack.

I initially thought this was just another routine list of ex-dividend dates, but then I realized something crucial: the sheer number of companies going ex-dividend this week signals something bigger about the current market conditions. Let’s dive in.

Decoding the Dividend Rush | Why Now?

So, what’s the deal with so many companies going ex-dividend at the same time? There are a few factors at play, and understanding them can give you a serious edge. The ‘why’ is crucial. It is not enough to just know the dates. You should know the reason.

Firstly, it’s the end of the fiscal year for many Indian companies. And as the fiscal year comes to an end, boards often declare dividends to reward shareholders. Think of it like the company sharing its profits – a tangible thank you for investing. What fascinates me is that we should know why companies are doing better and earning profits.

Secondly, interest rates and the overall economic climate matter big time. When interest rates are relatively stable, companies might find it more attractive to distribute profits rather than reinvesting everything back into the business. Plus, a stable economy gives companies the confidence to share their earnings.

Thirdly, and this is something many people miss: dividend payouts can be a strategic move to attract and retain investors. In a competitive market, a solid dividend yield can be a major draw, particularly for long-term investors looking for consistent income.

Now, let’s get to the specifics – Coal India , NTPC , BPCL , and Shriram Finance . What’s unique about these companies?

- Coal India: The demand for coal has remained robust, leading to strong earnings.

- NTPC: Power generation is a defensive sector, and NTPC has been consistently delivering solid performance.

- BPCL: Despite fluctuations in oil prices, BPCL has managed to maintain profitability, thanks to its diverse operations.

- Shriram Finance: The financial services sector is booming, and Shriram Finance is well-positioned to capitalize on this growth.

These factors contribute to the strong performance, making them capable of giving higher dividend payouts .

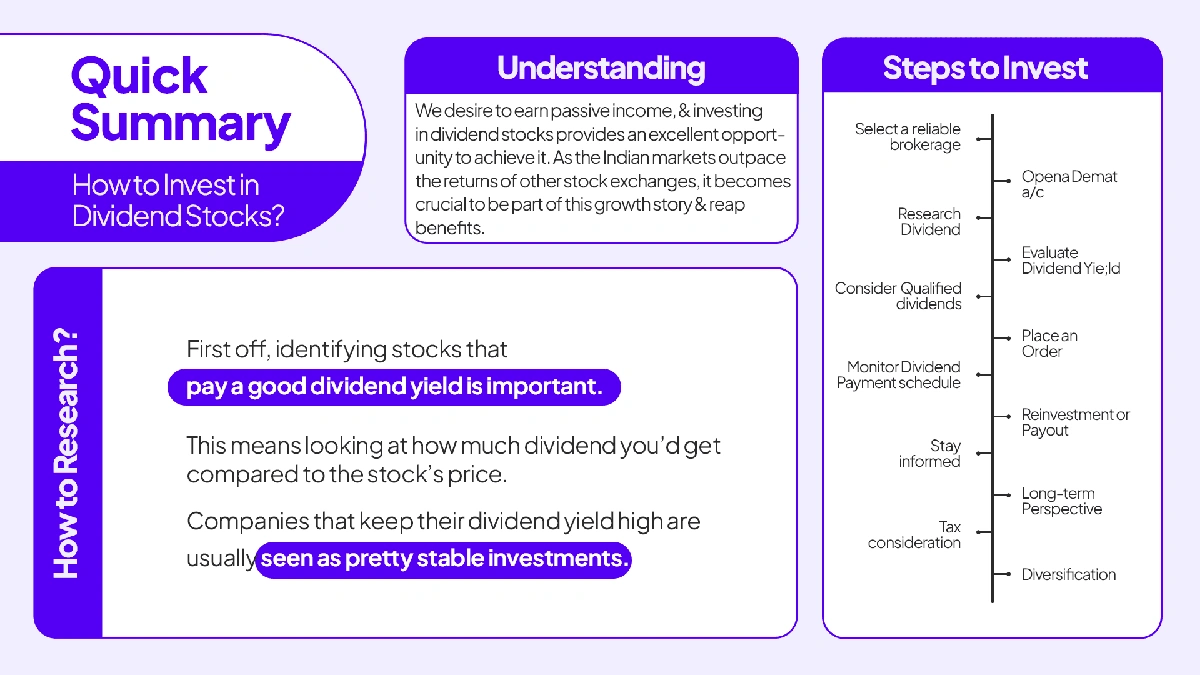

The Investor’s Playbook | How to Make the Most of Ex-Dividend Stocks

Okay, you know which stocks are going ex-dividend, and you have an idea about the underlying reasons. So, how do you play this to your advantage? Let’s be honest, simply buying a stock right before the ex-dividend date isn’t always a guaranteed win. You need a strategy.

Here’s the thing: the stock price typically drops by the amount of the dividend on the ex-dividend date. This is because the stock no longer carries the right to receive the upcoming dividend payment. It’s like buying a concert ticket after the concert has already happened – you don’t get to see the show!

Therefore, a common mistake I see people make is chasing high dividend yields without considering the long-term prospects of the company. A high yield might look attractive, but if the company’s fundamentals are weak, you could end up with a capital loss that more than offsets the dividend income.

So, what’s the smart move? Focus on companies with a history of consistent dividend payments and strong financial health. Look for companies that are not just paying dividends but also growing their earnings and reinvesting in their business.

And here’s a tip I’ve learned over the years: consider the tax implications. Dividends are taxable, and the tax rate can vary depending on your income bracket. Factor this into your calculations to get a clear picture of your net return.

For those interested in exploring further, a deeper dive into dividend yield calculations and financial analysis can provide even greater insight into making informed decisions. One can find more information about the company on platforms likeWikipedia .

Beyond the Quick Buck | Long-Term Value and Portfolio Building

Let me rephrase that for clarity: dividend investing shouldn’t be about chasing quick profits. It’s about building a portfolio of stable, income-generating assets that can provide consistent returns over the long haul. This is about long term wealth creation .

Think of it like planting a tree. You don’t expect to harvest fruit the very next day. But with proper care and patience, that tree will continue to bear fruit year after year. Similarly, a well-chosen portfolio of dividend stocks can provide a steady stream of income for years to come.

But – and this is a big ‘but’ – don’t put all your eggs in one basket. Diversification is key. Spread your investments across different sectors and industries to reduce your risk. A common mistake I see people make is concentrating their holdings in just a few high-yielding stocks. If those stocks perform poorly, your entire portfolio could suffer.

Also, revisit your portfolio regularly. Market conditions change, and so do the prospects of individual companies. Rebalance your portfolio periodically to ensure it continues to align with your investment goals. This may include analyzing the company’s financials .

FAQ | Your Dividend Stock Questions Answered

What if I buy the stock on the ex-dividend date?

You won’t be eligible for the dividend. To receive it, you must own the stock before the ex-dividend date.

How are dividends taxed in India?

Dividends are taxable as per your income tax slab. Check the latest regulations for accurate rates.

What does ‘ex-dividend’ actually mean?

It means the stock is trading without the value of the next dividend payment.

Should I only invest in high-dividend stocks?

No, consider the company’s financials and growth prospects alongside the dividend yield.

Can a company cancel a dividend payment?

Yes, though it’s rare, companies can cancel dividend payments if they face financial difficulties.

Where can I find ex-dividend dates?

Financial websites and brokerages usually list upcoming ex-dividend dates.

So, that’s the lowdown on the ex-dividend stocks this week. Remember, dividend investing is a marathon, not a sprint. Focus on building a diversified portfolio of financially sound companies, and you’ll be well on your way to achieving your long-term financial goals. Always consider how this fits into your larger investment strategy . By the way, did you know that Nvidia is doing amazing ? Check out the link for more information. You can also check LCT Result to know more about finance.

What fascinates me is not just the dividend payouts themselves, but what they signal about the underlying health and future prospects of these companies. It’s a glimpse into their confidence and a testament to their ability to share their success with their shareholders. And that, my friends, is something worth paying attention to.