India’s stock market is buzzing! It feels like everyone’s talking about stocks, IPOs, and the next big investment. And guess what? They’re putting their money where their mouth is. The number of Demat account openings has exploded recently, and it’s not just seasoned investors jumping in. We’re seeing a whole new generation of folks – young professionals, students, even your neighborhood shop owner – dipping their toes into the world of the stock market. What’s particularly interesting, though, is that SEBI, the market regulator, is really pushing for financial literacy right now. But why is this happening, and what does it mean for you?

Why the Sudden Demat Account Boom?

Let’s be honest, the stock market can seem intimidating. All those numbers, charts, and jargon – it’s enough to make anyone’s head spin. But a few key things have changed that are making it more accessible than ever. First off, technology has played a HUGE role. Online brokerage platforms have made it incredibly easy to open a Demat account and start trading. We’re talking about opening an account from your phone in your pajamas easy! Plus, there’s a growing awareness of the potential for wealth creation through the stock market, especially among younger generations. They’re seeing their friends and family making money, and they want in on the action. The rise of Fintech companies offering easy access to investment instruments is also a major contributing factor.

But, the bigger picture is the Indian economy itself. The confidence in the Indian economy is growing and more and more people see the markets as offering stable returns compared to traditional investments like gold or property.The Indian economy, as a whole, is seeing increased participation and this participation needs to be sustainable. And this is where SEBI steps in.

SEBI’s Focus on Financial Literacy: More Than Just a Buzzword

Here’s the thing: SEBI isn’t just paying lip service to financial literacy . They recognize that a market flooded with inexperienced investors can be a recipe for disaster. Imagine a scenario where people are blindly investing based on rumors or get-rich-quick schemes. That’s not a healthy market, and it’s definitely not good for the long-term health of the Indian economy. So, SEBI is actively promoting investor education through various channels. Think workshops, online resources, and campaigns aimed at teaching people the basics of investing – how to read financial statements, understand risk, and make informed decisions. What fascinates me is their multi-pronged approach — they’re not just throwing information out there; they’re trying to make it engaging and relevant to different audiences.

According to the latest data, participation is coming from Tier 2 and Tier 3 cities and these areas are the target of SEBI’s drive to increase financial literacy and promote safe and legal trading practices. A common mistake is focusing on quick returns without understanding the risks involved.

The Risks and Rewards of Investing | A Reality Check

Let’s be clear: the stock market isn’t a magic money tree. It’s not a guaranteed path to riches. There are risks involved, and you can lose money. That’s why financial literacy is so crucial. Before you even think about opening a Demat account , you need to understand the basics. What are stocks? What are bonds? What’s the difference between investing and speculating? These are the kinds of questions you need to be able to answer. And even more importantly, you need to understand your own risk tolerance. Are you comfortable with the possibility of losing money? Or are you the kind of person who gets stressed out by even small fluctuations in the market? Be honest with yourself, because your risk tolerance will determine the types of investments that are right for you. It’s absolutely critical to do your homework. Don’t just follow the herd. Do your own research, read up on companies, and understand the market trends. Remember, informed investing is smart investing. What I initially thought was a small blip on the radar turned out to be a tsunami of new investors.

How to Get Started with Demat Accounts (the Right Way)

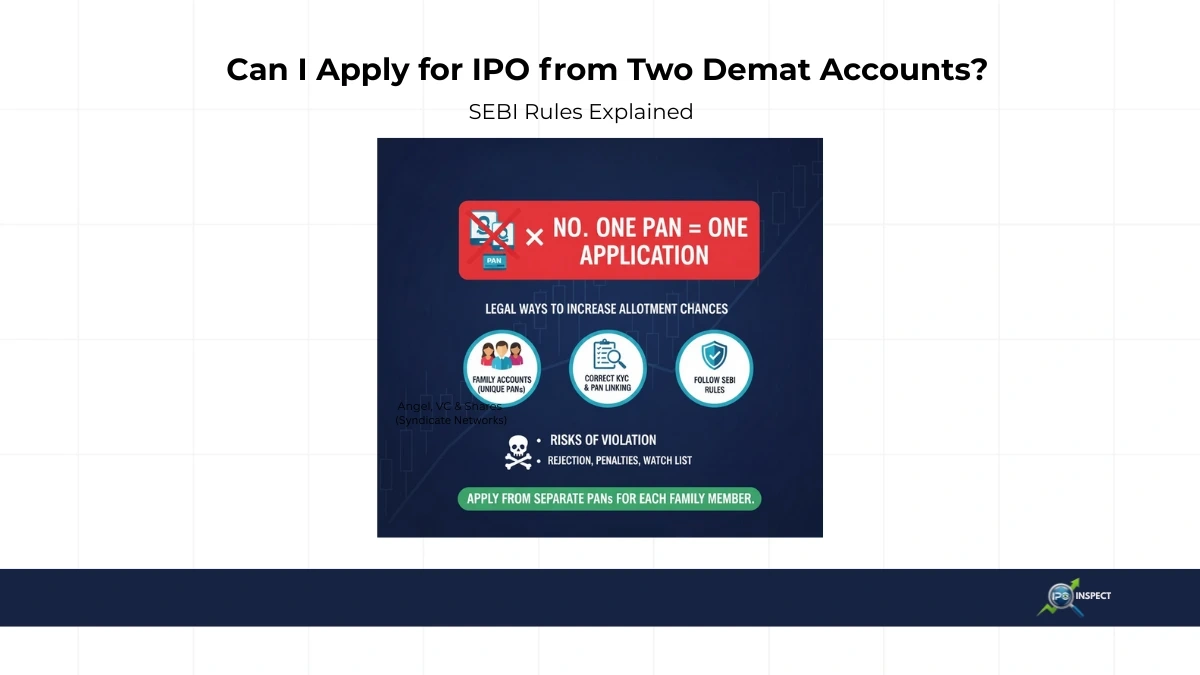

Okay, so you’re interested in opening a Demat account . Great! But where do you start? First, you’ll need to choose a registered Depository Participant (DP). These are basically the intermediaries that hold your shares in electronic form. There are many DPs to choose from, so do your research and compare fees, services, and platforms. Once you’ve chosen a DP, you’ll need to fill out an application form and provide some basic documents like your PAN card and address proof. The application process is usually pretty straightforward and can often be done online. After your application is approved, you’ll receive your Demat account number and you can start trading! A common mistake I see people make is not checking the fine print on the account opening agreement — specifically any hidden charges. One of the documents you will need is an PAN card . Also, remember to use the right KYC forms.

Here’s a quick checklist to make sure you are on the right track:

- Choose a reputable Depository Participant (DP).

- Complete your KYC diligently.

- Understand brokerage fees and other charges.

- Start with small investments.

- Diversify your portfolio over time.

The Future of Investing in India: Financial Literacy is Key

The surge in Demat account openings is a positive sign for the Indian economy. It shows that more and more people are becoming financially aware and are willing to participate in the stock market. But, this growth needs to be sustainable. And that’s where financial literacy comes in. By empowering investors with the knowledge and skills they need to make informed decisions, we can create a more stable and resilient market. What fascinates me is the potential for technology to further democratize investing. We’re already seeing the rise of robo-advisors and AI-powered investment platforms that can help people manage their money more effectively. As these technologies continue to evolve, they have the potential to make investing even more accessible and affordable for everyone.

The Role of RBI in managing the rise of inflation is another aspect to consider when creating a financial plan. Also, be sure to keep an eye on how companies perform in the BSE Sensex .

Demat account Charges and Fees

Let’s talk about the less glamorous side of Demat accounts – the charges and fees. No one likes them, but they are a necessary part of the system. Understanding these charges is crucial for managing your investment costs effectively. Here’s a breakdown of the common fees associated with Demat accounts :

- Account Opening Charges: Some DPs may charge a one-time fee for opening a Demat account.

- Annual Maintenance Charges (AMC): This is a recurring fee charged annually to maintain your Demat account. The amount can vary widely between DPs.

- Transaction Charges: These are levied each time you buy or sell shares. They are usually a percentage of the transaction value or a fixed fee.

- Custodian Fees: These are charged for the safekeeping of your securities.

- Other Charges: These may include charges for dematerialization (converting physical shares into electronic form), rematerialization (converting electronic shares back into physical form), and statement requests.

Before opening a Demat account , carefully compare the fee structures of different DPs. Look for any hidden charges and understand how each fee is calculated. Negotiate if possible, especially if you plan to trade frequently or maintain a large portfolio. Keeping track of your trading volume can help with negotiating a better rate.

FAQ Section

Frequently Asked Questions

What exactly is a Demat account?

Think of it as a bank account for your shares. Instead of holding physical share certificates, your shares are held electronically in this account.

How much money do I need to start investing?

You can start with as little as a few hundred rupees. Some platforms even allow you to buy fractional shares.

What if I choose the wrong DP?

You can always transfer your account to another DP, though there might be some charges involved. So it is best to do your research up front!

Is the stock market gambling?

Not if you’re investing wisely and based on research. Speculating without knowledge is closer to gambling. The key is informed decision-making.

Are Demat accounts safe?

Yes, they are regulated and quite secure. SEBI has put in place multiple layers of protection for investors. DPs are also subject to regular audits and inspections.

What happens if my DP goes bankrupt?

Your shares are held by a depository, not the DP itself. So, even if your DP goes bankrupt, your shares are safe and can be transferred to another DP.