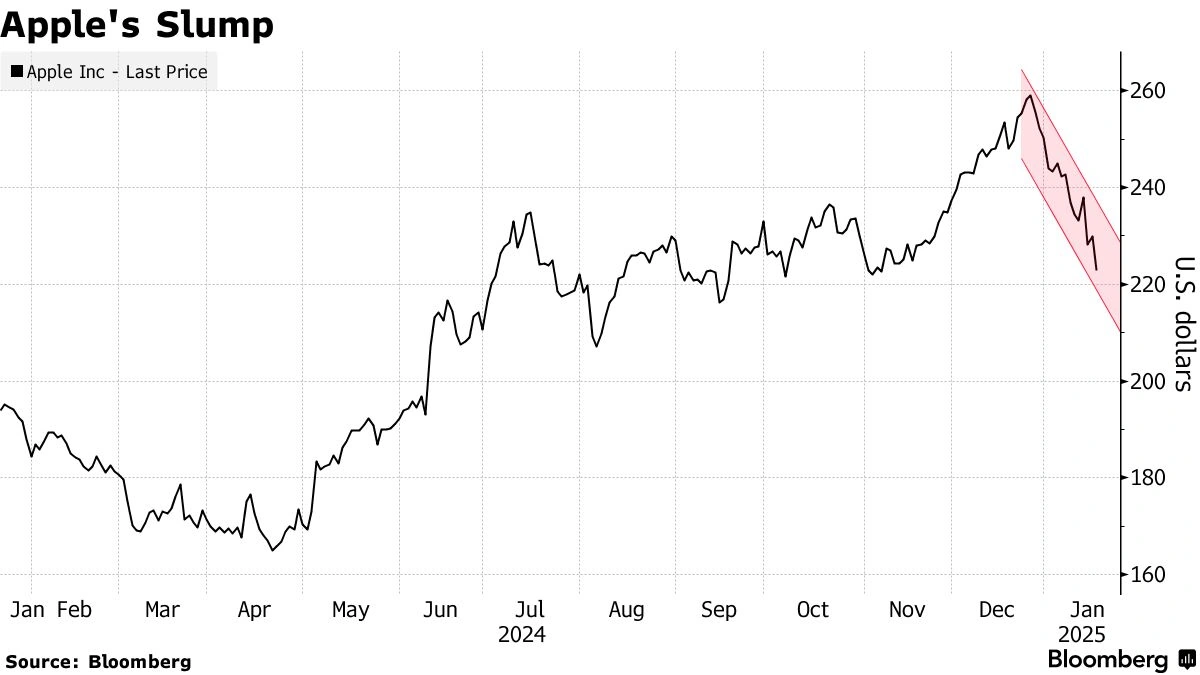

Alright, let’s talk Apple. The tech giant’s stock has been on a tear recently, hitting new all-time highs after a surprisingly optimistic forecast for holiday sales. But here’s the thing: it’s not just about the numbers. It’s about what this surge means for your investments, for the market as a whole, and even for the future of technology. Let’s dive in, shall we? This isn’t just reporting the facts; it’s about understanding the ripples.

Why This Surge Matters (More Than You Think)

So, Apple stock is soaring. Big deal, right? Wrong. This isn’t just another blip on the radar. It’s a signal. See, Apple’s performance is often seen as a bellwether for the entire tech industry and, to some extent, the broader economy. When Apple does well, it suggests that consumer spending is robust, and that innovation is thriving. And during times of economic uncertainty, investors often flock to Apple as a safe bet, which can further drive up the stock price . This time it is no different, the company has proved itself again. What fascinates me is how much confidence the market has in Apple’s ability to consistently deliver, despite global economic headwinds.

But there’s more to it. Apple’s ecosystem is incredibly sticky. Once people buy into the iPhone, they’re more likely to purchase other Apple products and services, creating a loyal customer base. This loyalty translates into predictable revenue streams, which investors love. Apple’s recent push into services, like Apple TV+ and Apple Arcade, is also paying off, adding another layer of revenue and further solidifying its position in the market. The AI market also has a strong impact on apple’s growth.

Decoding the Holiday Sales Prediction

The positive holiday sales prediction is a crucial piece of this puzzle. Let’s be honest, the global economy is a bit shaky right now. Inflation, supply chain issues, and geopolitical tensions are all weighing on consumer sentiment. So, when Apple says it expects a strong holiday season, it’s a big deal. It suggests that even in the face of these challenges, people are still willing to spend money on Apple products. But, and this is a big but, let’s not get carried away. Predictions are just that – predictions. The actual sales figures could differ, and the market can be notoriously fickle. It’s a delicate balance between optimism and realism.

The Impact on Your Investments

Okay, so Apple shares are up. What does this mean for you, the everyday investor? Well, if you own Apple stock, congratulations! You’re likely seeing some nice gains. But even if you don’t own Apple stock, its performance can still impact your portfolio. Many mutual funds and ETFs hold Apple shares, so a rising Apple stock price can boost the overall performance of these funds. However, it’s essential to remember that past performance is not indicative of future results. The stock market can be unpredictable, and even the mighty Apple can’t defy gravity forever. It’s crucial to diversify your investments and not put all your eggs in one basket. This is something I personally believe is key.

One thing I’ve learned over the years is that emotions can be your worst enemy when it comes to investing. Don’t let the fear of missing out (FOMO) drive you to make rash decisions. Investing in Apple , or any stock for that matter, should be a calculated move based on your individual financial goals and risk tolerance. Stay informed, do your research , and consult with a financial advisor if needed.

Challenges and Potential Risks

Now, let’s not paint an overly rosy picture. Apple faces its share of challenges. Competition in the smartphone market is fierce, with companies like Samsung and Xiaomi constantly innovating and vying for market share. Regulatory scrutiny is also increasing, with governments around the world examining Apple’s App Store policies and potential anti-competitive practices. Supply chain disruptions, which have plagued the tech industry for the past couple of years, could also impact Apple’s ability to meet demand during the holiday season.

And let’s not forget the ever-present risk of technological obsolescence. What if a revolutionary new technology emerges that makes smartphones obsolete? It’s a long shot, but it’s a risk that investors need to consider. The tech world moves at lightning speed, and even the most dominant companies can be disrupted. Apple’s revenue and Apple’s growth depends on how fast they adapt.

The Future of Apple | Beyond the iPhone

Looking ahead, Apple’s future success will likely depend on its ability to diversify beyond the iPhone. The company is already making strides in this direction with its services business, its push into augmented reality (AR) and virtual reality (VR), and its rumored foray into the automotive industry. Apple’s strong brand, its massive cash reserves, and its loyal customer base give it a significant advantage in these new markets. But success is far from guaranteed. These new ventures will require significant investment, and Apple will face stiff competition from established players. It’s a high-stakes game, but one that Apple seems well-positioned to play.

The bottom line? Apple’s recent stock surge is a testament to its enduring strength and its ability to innovate and adapt. But it’s also a reminder that the stock market is a complex and unpredictable beast. Invest wisely, stay informed, and don’t let emotions cloud your judgment.

FAQ Section

Frequently Asked Questions

What factors contributed to Apple’s positive holiday sales prediction?

Strong demand for new products, successful marketing campaigns, and a loyal customer base all play a role.

How can I invest in Apple stock?

You can purchase Apple shares through a brokerage account or invest in mutual funds or ETFs that hold Apple stock.

What are the risks of investing in Apple?

Risks include competition, regulatory scrutiny, supply chain disruptions, and technological obsolescence.

What is Apple’s plan for future growth?

Apple plans to expand its services business and invest in new technologies like AR/VR and automotive.

Should I invest in Apple stock now?

Investment decisions should be based on your individual financial goals and risk tolerance.

Where can I get latest apple stock news?

You can get latest apple stock news from trusted financial media outlets like Bloomberg, Reuters, and the Wall Street Journal.