Alright, folks, let’s dive headfirst into the tech world and dissect Apple’s Q4 2025 earnings report. Now, I know what you’re thinking: another earnings report? Yawn. But hold on a second. This isn’t just about numbers; it’s about understanding the consumer electronics trends shaping our lives and, more importantly, where Apple is headed. We’re talking about more than just spreadsheets; we’re talking about the future of tech, seen through the lens of Apple’s financial performance .

So, grab your chai, settle in, and let’s break down what Apple’s Q4 2025 earnings really mean.

The iPhone Still Reigns Supreme (But There’s a Twist)

Let’s be honest, the iPhone sales are always the big kahuna. And unsurprisingly, they continue to be a major revenue driver for Apple. But, and this is a big but, the growth isn’t quite as explosive as it used to be. The global smartphone market is maturing, and even Apple isn’t immune. What fascinates me is the shifting demographics. Are they cutting prices? Are they selling more to younger people now? Let’s dig in.

What’s interesting is that emerging markets, like India, are becoming increasingly crucial for Apple’s iPhone growth. The company has been making a concerted effort to tap into the Indian market with more affordable models and localized marketing campaigns. But competition is fierce, with brands like Samsung and Xiaomi already having a strong foothold. This is where understanding market share dynamics becomes vital.

Beyond the iPhone | The Rise of Services and Wearables

Here’s the thing: Apple is no longer just a hardware company. The services segment, which includes Apple Music, iCloud, and Apple TV+, is rapidly becoming a significant source of revenue. This is a conscious move by Apple to diversify its income streams and build a recurring revenue model. Think about it – it’s not just about selling you an iPhone; it’s about keeping you hooked into the Apple ecosystem.

And then there are the wearables – the Apple Watch and AirPods. These products have exploded in popularity, becoming status symbols and essential accessories. The Apple Watch, in particular, has carved out a niche for itself as a health and fitness tracker, appealing to a wider audience beyond just tech enthusiasts. I initially thought wearables were just a fad, but I’ve seen firsthand how they’ve become integral to people’s daily lives. Especially now that they’re starting to track blood sugar levels, and heart rates, which is incredibly useful.

Speaking of wearables, the integration of AI and health monitoring features is a trend to watch. This is an area where Apple has the potential to innovate and differentiate itself from the competition. The question is, how far will they go? Will we see even more sophisticated health features in future Apple Watch models? Only time will tell.

Geopolitical Challenges and Supply Chain Woes

Now, let’s not pretend that everything is sunshine and roses. Apple, like every other multinational corporation, faces its fair share of challenges. Geopolitical tensions, particularly between the US and China, can have a significant impact on Apple’s supply chain and manufacturing operations. The company relies heavily on Chinese factories to assemble its products, so any disruption in that relationship could be costly.

And then there’s the ongoing global chip shortage, which has been wreaking havoc on various industries. Apple hasn’t been immune to this, and it could potentially impact production volumes and lead times. Let me rephrase that for clarity: If Apple can’t get the chips it needs, it can’t make enough iPhones and iPads, which means lower sales and unhappy customers.

Of course, it isn’t all bad news. Apple are working to mitigate risk in different areas, such as diversifying the areas where they manufacture their tech. Diversifying is extremely important to keep your company stable.

The Metaverse and Augmented Reality | Apple’s Next Frontier?

Here’s where things get really interesting. The metaverse and augmented reality (AR) are the buzzwords of the moment, and Apple is rumored to be working on its own AR headset. This could potentially be a game-changer, opening up new possibilities for gaming, entertainment, and productivity. But let’s be honest, the metaverse is still largely uncharted territory, and it’s unclear whether it will truly become mainstream.

What fascinates me is how Apple will approach this space. Will they create a closed ecosystem, like they’ve done with their other products? Or will they embrace a more open and collaborative approach? The answer to that question could determine whether Apple becomes a leader in the metaverse or just another player.

The metaverse and AR are huge potential sectors, with the potential to change how we use computers.

Apple’s Environmental Initiatives | A Genuine Commitment or Greenwashing?

In today’s world, environmental responsibility is no longer optional; it’s a necessity. Apple has made a lot of noise about its commitment to sustainability, pledging to become carbon neutral by 2030. They’ve invested heavily in renewable energy and are working to reduce the environmental impact of their products.

But, and this is a crucial but, are these initiatives genuine, or are they just a form of greenwashing? It’s a question worth asking. Critics argue that Apple could do more to make its products more repairable and longer-lasting, rather than encouraging consumers to upgrade to the latest model every year. It’s a complex issue, and there are no easy answers.

FAQ | Decoding Apple’s Earnings Report

What does “earnings per share” (EPS) actually mean?

EPS shows how much profit a company makes for each share of its stock. Higher EPS usually means the company is more profitable, which can boost investor confidence.

Why do analysts’ estimates matter so much?

Analysts’ estimates set expectations. If Apple beats these expectations, the stock price often goes up. If they miss, it can trigger a sell-off.

What are the key indicators to watch in Apple’s report?

Focus on iPhone sales, services revenue, gross margin (how much profit they make on each product), and guidance for the next quarter.

How does currency exchange impact Apple’s earnings?

A strong dollar can hurt Apple’s earnings because their products become more expensive in other countries, potentially reducing sales.

What are Apple’s plans for India?

Apple is investing heavily in India, opening retail stores and increasing manufacturing. They are trying to capture a larger share of the growing Indian smartphone market.

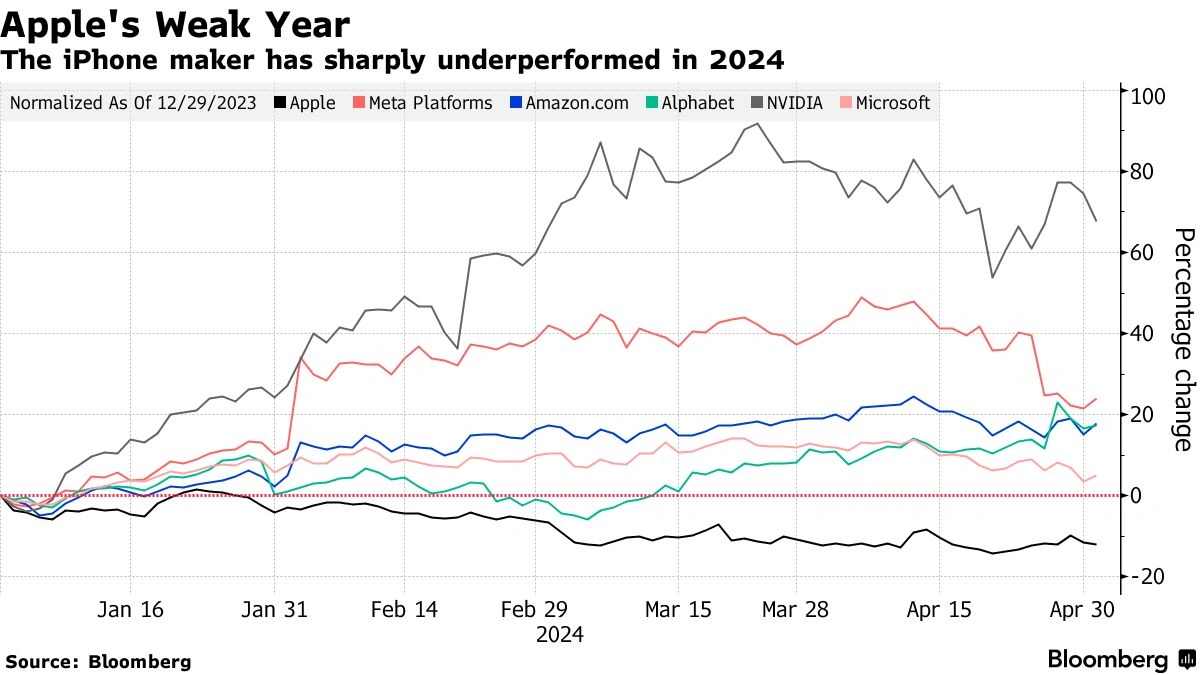

What is Apple’s stock performance in 2025?

As of this report, Apple’s stock had mixed performance. Analysts are positive, but some are concerned about future growth and if Apple will continue to innovate and stay ahead of the curve.

The Bottom Line | Apple’s Future Depends on Innovation

So, what’s the takeaway from all of this? Apple’s Q4 2025 earnings report paints a picture of a company in transition. The iPhone is still king, but Apple is increasingly reliant on services and wearables for growth. The company faces challenges from geopolitical tensions, supply chain constraints, and increasing competition. But it also has opportunities in the metaverse, augmented reality, and environmental sustainability.

Ultimately, Apple’s future success depends on its ability to continue innovating and adapting to a rapidly changing world. Will they be able to maintain their position as a tech leader? Only time will tell. This company has a very interesting history, and the future of Apple relies on great leadership and strong decision making.