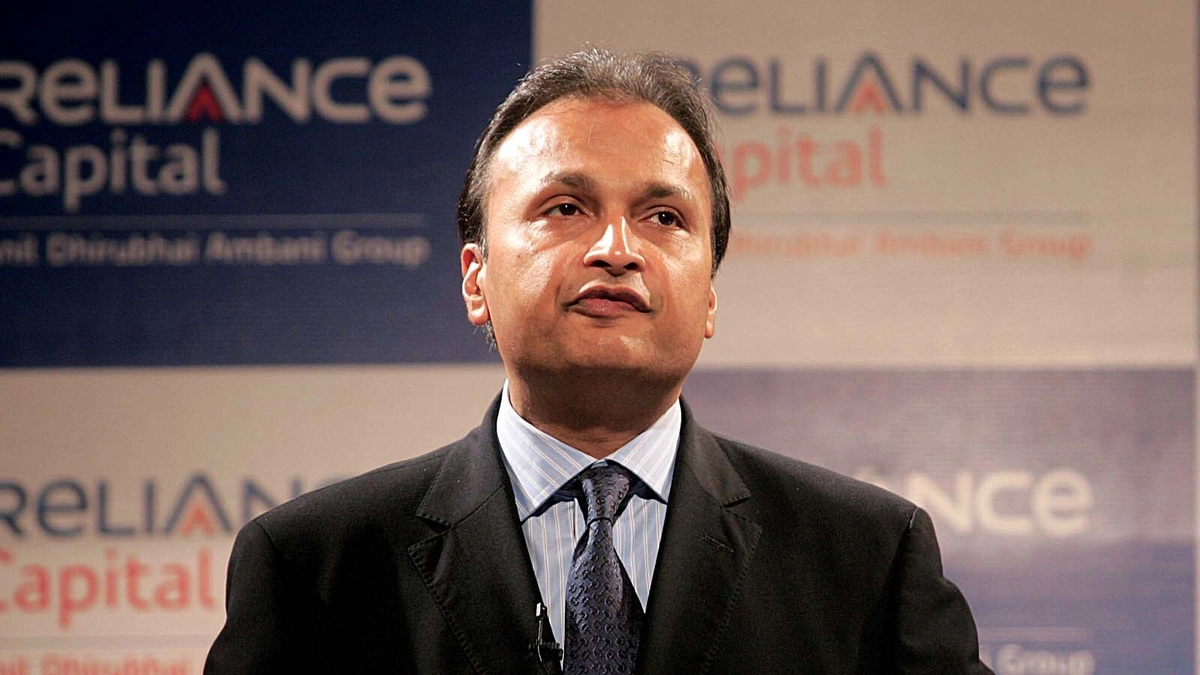

So, the news is buzzing: the Enforcement Directorate (ED) has seized assets worth over ₹3,000 crore belonging to Anil Ambani . That’s a hefty sum, no matter how you slice it. But before we get lost in the numbers, let’s dig a little deeper. This isn’t just about one person; it’s a peek into the complex world of financial regulations, money laundering , and the consequences that follow. What fascinates me is understanding why this matters to you and me, beyond the headlines.

The “Why” | Understanding the Implications of the Asset Seizure

Why should the average person in India care about the ED seizing Anil Ambani’s assets? Here’s the thing: it’s not just about schadenfreude, or enjoying someone else’s misfortune. It’s about the integrity of our financial system. When economic offenders allegedly engage in money laundering, it erodes trust in the system. It affects investments, job creation, and ultimately, the economic well-being of the country. Think of it as a leaky pipe in a building; if not fixed, it can damage the entire structure. The ED’s actions, in this case, are aimed at plugging that leak, at least that’s what they claim. It’s a step towards accountability. The Prevention of Money Laundering Act (PMLA) is the legal framework that empowers the ED to take such actions. According to the ED, the assets were seized under this very act. The investigation, currently, is related to allegedly violating the Foreign Exchange Management Act (FEMA).

The implications are far-reaching. It sends a message that no one is above the law – theoretically, at least. It also highlights the increasing scrutiny on high-value transactions and the government’s commitment (or at least its stated commitment) to combatting financial crimes. But, and this is a big ‘but,’ it also raises questions about the effectiveness of existing regulations and the need for stronger oversight. More scrutiny will only improve accountability and transparency . Let’s be honest, such cases often drag on for years, and the actual recovery of the seized assets can be a long and complicated process. So, while the seizure is a significant step, it’s only the beginning of a potentially protracted legal battle.

Decoding the Money Laundering Probe | What Does it Really Mean?

Money laundering – it sounds like something out of a Hollywood movie, right? But in reality, it’s a serious issue. Essentially, it’s the process of concealing the origins of illegally obtained money, making it appear legitimate. It involves a series of transactions designed to obscure the original source of the funds. In the context of this probe, the ED is investigating how Anil Ambani allegedly used offshore entities to move funds and conceal assets. And, of course, offshore companies are always a red flag, and are regulated by FEMA guidelines .

Here’s where it gets interesting. The ED isn’t just looking at direct transactions; they’re tracing the entire chain of events, following the money trail to uncover the true beneficiaries and the ultimate purpose of these transactions. This often involves complex investigations across multiple jurisdictions, dealing with different legal systems and banking regulations. It’s like untangling a giant knot, and the ED needs to pull on every single strand. The investigative agencies like the ED are trying to showcase how the money was ‘layered’. The layering is the process of moving the funds around different bank accounts, and investment vehicles.

Anil Ambani’s Financial Troubles | A Recap

This isn’t exactly breaking news; Anil Ambani’s financial troubles have been well-documented for years. Once a titan of Indian industry, his Reliance Group has faced significant challenges, including mounting debt and declining profitability. The troubles can be traced back to aggressive expansion and ambitious projects that didn’t quite pan out. The telecom sector, in particular, proved to be a major setback. Reliance Communications, once a leading player, was weighed down by debt and ultimately went bankrupt. As per reports, the debt recovery tribunals are also actively pursuing claims against Ambani and his group companies.

These financial woes have had a ripple effect, impacting investors, lenders, and employees. The seizure of assets by the ED adds another layer of complexity to an already challenging situation. It also raises questions about corporate governance and the responsibility of business leaders to manage their companies prudently. But, let’s be fair, business is inherently risky. Sometimes, things don’t go as planned, and even the most astute leaders can face unforeseen challenges. The key is how they respond to those challenges and whether they act responsibly and ethically. Another interesting fact, as per sources, is that many of these assets are allegedly held under benami properties or proxy holdings.

The Road Ahead | What’s Next for the Investigation?

So, what happens now? The ED will likely continue its investigation, gathering evidence and building its case. Anil Ambani will have the opportunity to defend himself and challenge the ED’s actions in court. The legal process could take months, if not years, to play out. During this time, the seized assets will likely remain under the control of the ED. The investigation might also trigger further scrutiny of other individuals and entities connected to Anil Ambani’s business dealings. And who knows what else might come to light as the investigation progresses? The ED’s role is to prevent financial irregularities .

One thing is certain: this case will continue to attract significant attention and will serve as a reminder of the importance of financial integrity and accountability. It also underscores the challenges of navigating the complex world of corporate finance and the potential consequences of failing to do so responsibly. The Indian legal system is known for its slow pace, therefore, one should expect that this investigation will take a significant amount of time before any final verdict is delivered. But given the high profile nature of the case, the courts may expedite the process.

Key Lessons From This Case

This case serves as a stark reminder that even prominent figures are subject to legal and financial scrutiny. It underscores the importance of ethical business practices and transparent financial dealings. Corporate governance is not just a buzzword; it’s essential for maintaining trust and confidence in the business world. For investors, it’s a reminder to do their due diligence and understand the risks involved before investing in any company. And for the public, it’s a reminder that the pursuit of justice, however slow, is a cornerstone of a fair and equitable society. Strong corporate governance is a key factor in maintaining economic health .

FAQ Section

Frequently Asked Questions (FAQ)

What exactly does “asset seizure” mean?

It means the ED has taken temporary control of Anil Ambani’s assets. He can’t sell or transfer them without the ED’s permission.

What is the Prevention of Money Laundering Act (PMLA)?

It’s a law that allows the ED to investigate and seize assets involved in money laundering.

What happens to the seized assets?

They remain under the ED’s control until the court decides their fate. They could be returned, confiscated, or used to compensate victims.

Is Anil Ambani guilty?

Not yet. The investigation is ongoing, and he has the right to defend himself in court.

Where can I get official updates on this case?

Check the official website of the Enforcement Directorate (ED) and reputable news sources.

What are the challenges in the investigation?

Challenges include tracing complex financial transactions across multiple jurisdictions, dealing with different legal systems, and gathering sufficient evidence to prove money laundering.