The buzz around artificial intelligence is deafening, isn’t it? You can’t open a financial news site – or even scroll through your social media feed – without seeing something about it. Boom, bubble, or something in between? That’s the question on every investor’s mind. But let’s be honest, the real question beneath all the hype is: How do we make sense of this as individuals here in India, and how can we ensure our investments are safeguarded.

What fascinates me is how quickly AI has gone from a futuristic concept to a very real investment opportunity… or is it? Let’s cut through the noise and analyze why investors are so fixated on artificial intelligence , and more importantly, whether this is a genuine long-term trend or just another fleeting tech bubble waiting to burst.

The “Why” Angle | Decoding the Investor Obsession with AI Stocks

So, why the frenzy? It’s not just about the cool factor, although, let’s be real, self-driving cars and robots are pretty cool. The deeper reason is the immense potential for disruption and increased efficiency across nearly every industry. Think about it: from healthcare to finance, manufacturing to agriculture, AI can automate tasks, analyze data, and make predictions with speed and accuracy that humans simply can’t match. This translates to potentially massive cost savings and revenue growth for companies that successfully implement it. Consider Sensex and Nifty dip for a moment, and how AI can be used to predict these dips.

But here’s the thing: not all AI is created equal. The current excitement is largely focused on specific areas like machine learning, natural language processing, and computer vision. Companies that are leaders in these fields, or that are effectively integrating these technologies into their products and services, are the ones attracting the most attention – and investment dollars.

Is It a Bubble? Echoes of Dot-Com and Crypto

Ah, the million-dollar question! The word “bubble” is enough to make any seasoned investor break out in a cold sweat. We’ve seen this movie before, haven’t we? The late 90s dot-com boom, the more recent cryptocurrency craze – both fueled by hype, speculation, and a fear of missing out (FOMO). And while the underlying technology behind AI is undeniably powerful, there are legitimate concerns about valuations getting ahead of themselves.

Let’s be honest, some companies are simply slapping the ” AI ” label on their products to boost their stock price, even if their actual use of artificial intelligence is minimal. This is where due diligence becomes absolutely crucial. Investors need to look beyond the hype and carefully evaluate a company’s business model, competitive advantages, and long-term growth prospects.

Navigating the AI Landscape: An Investor’s Guide

So, how do you separate the wheat from the chaff in this rapidly evolving landscape? Here’s a few steps for an investor like you. It’s a practical approach, a guide to navigate the complex maze. A common mistake I see people make is not properly diversifying their portfolio, especially in emerging technologies .

- Do Your Homework: Don’t just rely on headlines and social media buzz. Dive deep into a company’s financials, technology, and management team. Read their annual reports, listen to their earnings calls, and try to understand their competitive position in the market.

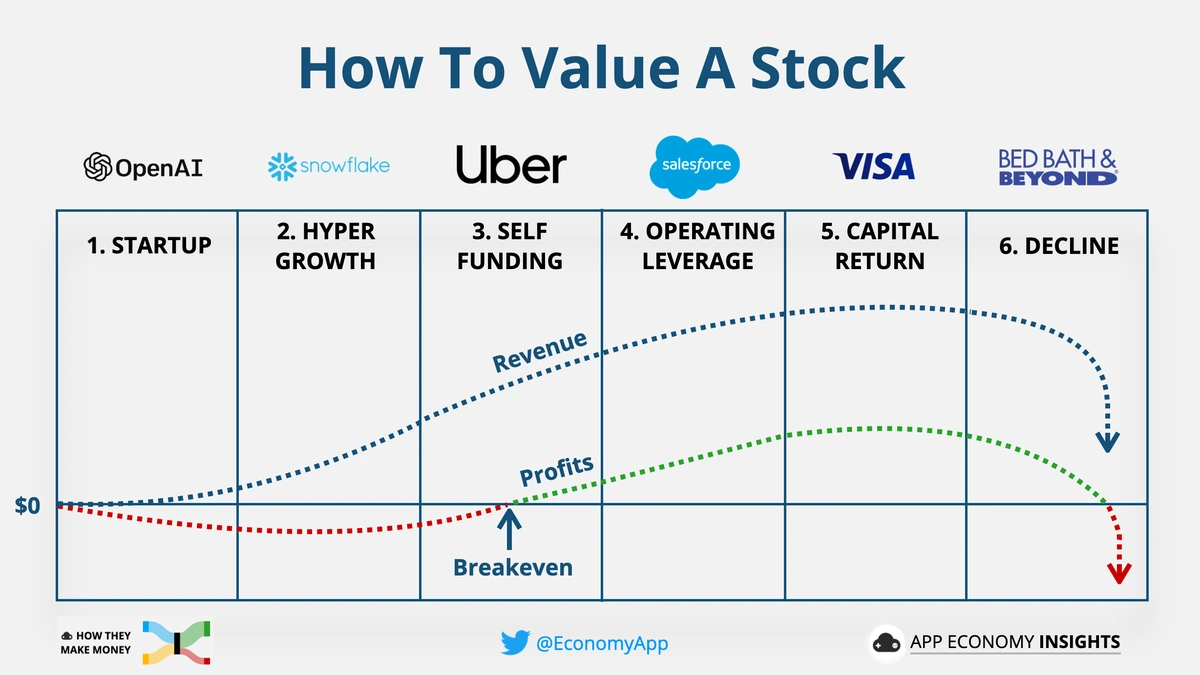

- Focus on Fundamentals: Look for companies with strong revenue growth, healthy profit margins, and a clear path to profitability. Avoid companies that are burning through cash and relying solely on future promises.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different AI-related companies, sectors, and geographies to mitigate risk.

- Consider ETFs and Mutual Funds: If you’re not comfortable picking individual stocks, consider investing in exchange-traded funds (ETFs) or mutual funds that focus on the AI sector. This can provide instant diversification and access to a portfolio of leading AI companies.

The Indian Angle | Opportunities and Challenges

Now, let’s bring it back home. India has the potential to be a major player in the AI revolution. We have a large pool of talented engineers, a thriving startup ecosystem, and a government that is actively promoting AI adoption. However, there are also challenges to overcome, including limited access to data, infrastructure constraints, and a shortage of skilled AI professionals. According to a study, AI’s ethical considerations are also a crucial factor that needs to be addressed, especially regarding data privacy. This study highlights the need for robust frameworks to ensure responsible AI development and deployment.

What fascinates me is the application of AI in addressing the challenges India faces, especially in rural areas. The integration of Nifty record high could lead to enhanced resource management, improved agricultural productivity, and better healthcare access.

Beyond the Hype | The Long-Term Vision for Artificial Intelligence

Ultimately, the future of AI is not about whether it’s a boom or a bubble, but about its long-term potential to transform our world. What fascinates me is not the immediate gains, but the transformative power of AI , especially its impact on various sectors in India. While there will undoubtedly be ups and downs along the way, the underlying trend is clear: AI is here to stay, and it will continue to reshape our lives in profound ways. For example, as mentioned on Wikipedia , the potential applications of AI in healthcare and education are immense, offering personalized learning experiences and improved diagnostic accuracy.

Let’s be honest, the AI revolution is just getting started. What matters now is not whether we’re in a boom or a bubble, but whether we’re prepared to adapt to the changes that AI will bring. We need to invest in education, training, and infrastructure to ensure that India can fully participate in – and benefit from – the AI revolution. What will drive the success is our ability to turn AI insights into real-world impact, creating value for businesses and individuals alike.

FAQ Section

Is AI really going to change everything?

Yes, but it’s a gradual process. Don’t expect robots to take over the world tomorrow, but do expect AI to become increasingly integrated into our daily lives over the next decade.

What are the biggest risks of investing in AI?

High valuations, intense competition, and rapid technological changes are key risks. Also, companies could fail to execute on their plans, or face regulatory hurdles.

How can I learn more about AI?

There are tons of online courses, books, and articles available. Start with the basics and gradually work your way up to more advanced topics. Consider resources from reputable organizations like IBM .

What skills will be most valuable in the age of AI?

Critical thinking, problem-solving, creativity, and communication skills are the human skills that AI can’t easily replicate. These will be highly sought after in the future job market.

Should I be worried about AI taking my job?

It’s a valid concern, but AI is more likely to augment human capabilities than completely replace them. Focus on developing skills that complement AI , such as creativity and emotional intelligence.

Where can I find more insights on AI insights?

Explore industry blogs, research reports, and academic papers. Look for reputable sources with a proven track record of accuracy and objectivity.