The news hit the financial circuits like a mild electric shock: Shapoorji Pallonji Mistry, before his passing, pushed for Tata Sons listing , arguing it was a ‘moral and social imperative.’ It’s easy to see this as just another headline about corporate governance. But here’s the thing: it’s a window into the complex, often opaque, world of India’s largest conglomerate, and it raises a question that affects millions of shareholders and the future of Indian markets. What I find most interesting is not that he said it, but why now, and what does it mean for the average investor? Let’s dive in.

Why a Tata Sons IPO is a Big Deal

Let’s be honest, Tata Sons isn’t your corner store. It’s the holding company of the Tata Group, a sprawling empire with interests ranging from steel and software to tea and telecom. It’s basically the kingpin of Indian Industry. Think about the sheer scale: owning stakes in companies like Tata Consultancy Services (TCS), Tata Motors, and Tata Steel. All these behemoths contribute to the overall valuation of Tata Sons. A listing would unlock immense value, potentially making it one of the largest IPOs in Indian history. Imagine the feeding frenzy among institutional investors and the retail frenzy. That’s a lot of pressure and excitement, right? But why the sudden urgency for an IPO? That’s where the ‘moral and social imperative’ comes in, which Mistry highlighted.

And that’s where understanding the context becomes crucial. Shapoorji Pallonji Group, the Mistry family’s investment firm, has been a significant shareholder in Tata Sons for decades. But their relationship had soured considerably. A listing would give them an exit route, allowing them to monetize their stake. But it also achieves something more profound: increased transparency and accountability for Tata Sons. Here’s why that matters to you and me. A listed company is subject to much stricter regulatory oversight. More transparency and better governance are expected. This includes reporting requirements, shareholder rights, and independent board oversight. This can have a trickle-down effect, improving corporate governance standards across the entire Tata Group. Also, one of the key reasons is shareholder value.

The ‘Moral and Social Imperative’ Explained

The phrase ‘moral and social imperative’ might sound like corporate jargon. But Mistry was likely alluding to the responsibility Tata Sons has to its stakeholders, including employees, customers, and the broader community. As per reports, Shapoorji Mistry believed that unlocking the true value of Tata Sons through listing would benefit all these stakeholders by enhancing transparency and ensuring fair market value for its shares. A common misconception I have seen is that this is about personal gain. This is about ensuring that the wealth created by Tata Sons is distributed fairly and transparently. And that, my friends, is a big deal in a country like India, where wealth inequality is a significant concern. Let me rephrase that for clarity: It wasn’t just about money. It was also about setting a precedent for responsible corporate behavior.

But there is also the other elephant in the room. The valuation of Tata Sons is a complex beast, influenced by various factors, including the performance of its listed subsidiaries, its unlisted investments, and its brand value. Estimates vary wildly, ranging from ₹8 lakh crore to over ₹11 lakh crore. So, a successful IPO hinges on accurately valuing the company and pricing the shares attractively for investors. What fascinates me is how the IPO would affect the stakes held by Tata Trusts, the philanthropic arm of the Tata Group, which owns a majority stake in Tata Sons. The increased value could significantly boost the Trusts’ ability to fund social and charitable initiatives. What about the possible scenarios and the Tata Sons share price?

Here are some internal links: Karnataka 2nd PUC Result 2025 and New Hero Splendor Plus .

Potential Hurdles and Challenges

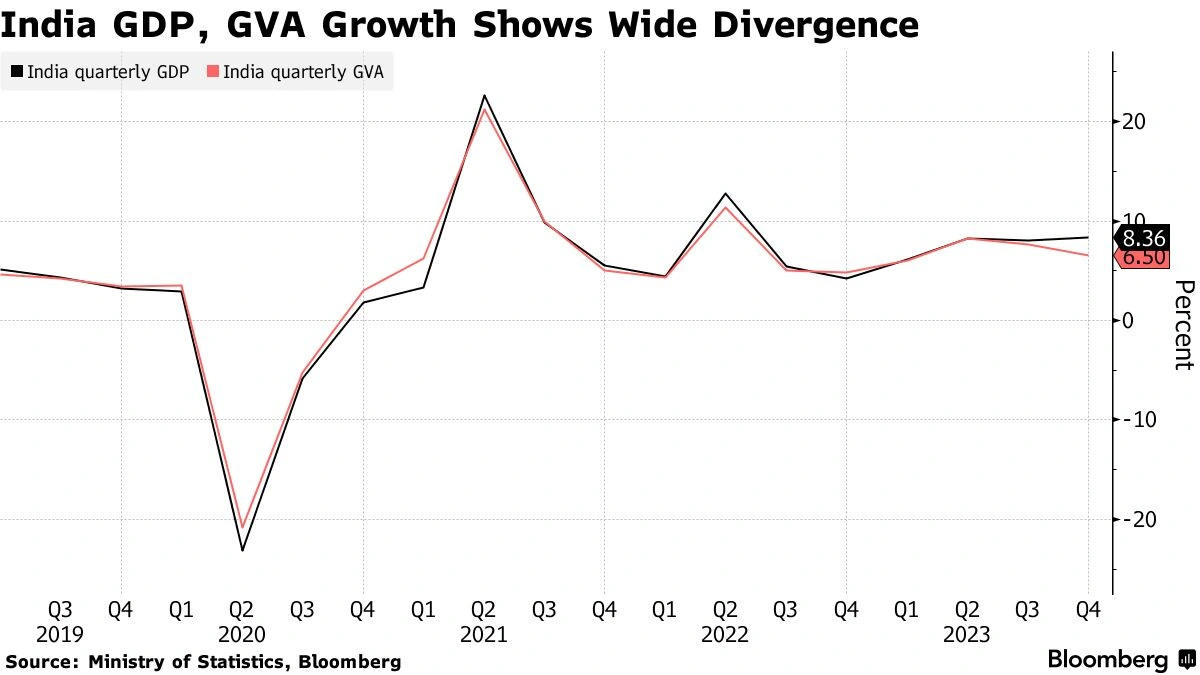

Let’s not pretend it’s all sunshine and roses. A Tata Sons IPO faces several potential hurdles. One of the biggest is the cross-holding structure within the Tata Group. Tata Sons holds stakes in various Tata companies, which in turn hold stakes in other Tata companies. Unraveling this complex web of ownership can be a daunting task. Then there’s the regulatory environment. The Securities and Exchange Board of India (SEBI) has strict rules and regulations governing IPOs, and Tata Sons would need to comply with all of them. Also, the group’s debt needs to be factored in. But what if there are legal challenges, maybe a petition against it? What could be the potential impact on the Indian stock market, or even the Indian economy ?

According to theSEBI guidelines, all listed companies need to adhere to strict corporate governance. But then there’s the big question: How does one accurately value something as vast and multifaceted as Tata Sons? It’s not as simple as looking at the book value of its assets. You have to consider the brand value, the potential for future growth, and the intangible factors that make Tata Sons unique. Also, you have to consider any current or future legal battles.

What This Means for the Average Investor

For the average investor in India, a Tata Sons IPO would be a once-in-a-lifetime opportunity to own a piece of one of the country’s most respected and iconic companies. But it’s not without its risks. IPOs can be volatile, and the share price can fluctuate wildly in the initial days of trading. So, it’s crucial to do your homework before investing. Understand the company, its financials, and the risks involved. Don’t get caught up in the hype and make an informed decision based on your own risk tolerance and investment goals. Consider, too, the smaller Tata group companies .

And, remember, diversification is key. Don’t put all your eggs in one basket. A common mistake I see people make is to invest based on emotions rather than logic. The Tata name carries immense weight in India, and it’s easy to get swept up in the excitement. But always remember that investing is a marathon, not a sprint. You should be focusing on the long term. Also, don’t invest just because your friends are. Let me rephrase that for clarity: investing should be a well-researched decision.

The Future of Tata Sons and Indian Markets

Whether or not Tata Sons ultimately lists its shares remains to be seen. But Mistry’s call for a listing has undoubtedly sparked a crucial debate about corporate governance, transparency, and shareholder value in India. It has the potential to reshape the landscape of Indian markets, setting a new standard for corporate behavior and inspiring other large conglomerates to follow suit. This could also pave the way for other family businesses to go public.

What fascinates me the most is the ripple effect this could have on other Indian companies. Will it inspire them to embrace greater transparency and accountability? Will it lead to a more level playing field for investors? Only time will tell. The listing of Tata Sons would represent not just a financial event, but a pivotal moment in Indian corporate history. But here’s the final, most important insight: it’s a reminder that even the largest and most powerful companies are ultimately accountable to their stakeholders and the broader community.

FAQ

What is Tata Sons?

Tata Sons is the principal investment holding company of the Tata group and holds the bulk of shareholding in Tata group companies.

Why is there a discussion about Tata Sons listing shares?

The late Shapoorji Pallonji Mistry urged Tata Sons to list its shares, citing a ‘moral and social imperative’, to unlock value and increase transparency.

What are the potential benefits of Tata Sons listing?

Listing could lead to greater transparency, improved corporate governance, and fair market value for its shares, benefiting all stakeholders.

What are some challenges to Tata Sons listing?

Challenges include the complex cross-holding structure within the Tata Group, regulatory compliance, and accurately valuing the company.

How would a Tata Sons IPO affect the average investor?

It would offer an opportunity to invest in one of India’s most respected companies, but it’s crucial to do thorough research and understand the risks involved.

Where can I find more information about Tata Sons and its potential listing?

Stay tuned to reputable financial news sources and official announcements from Tata Sons for the latest updates and detailed information.