Okay, folks, let’s talk about something that’s got the investment world buzzing – the first negative mutual fund flow we’ve seen this fiscal year, according to the latest AMFI data. Now, you might be thinking, “So what? Numbers go up, numbers go down.” But here’s the thing: this isn’t just a random blip. It’s a signal, a potential shift in the financial landscape, and something every smart investor in India should be paying attention to. The main keyword is the mutual fund flow .

I initially thought this was just another data point, but the more I dug in, the more I realized the deeper implications. We need to understand why this is happening. It’s not just about redemptions exceeding investments. It’s about investor sentiment, market confidence, and maybe even a hint of economic headwinds. That’s what’s so fascinating here.

Decoding the Data | What’s Really Going On?

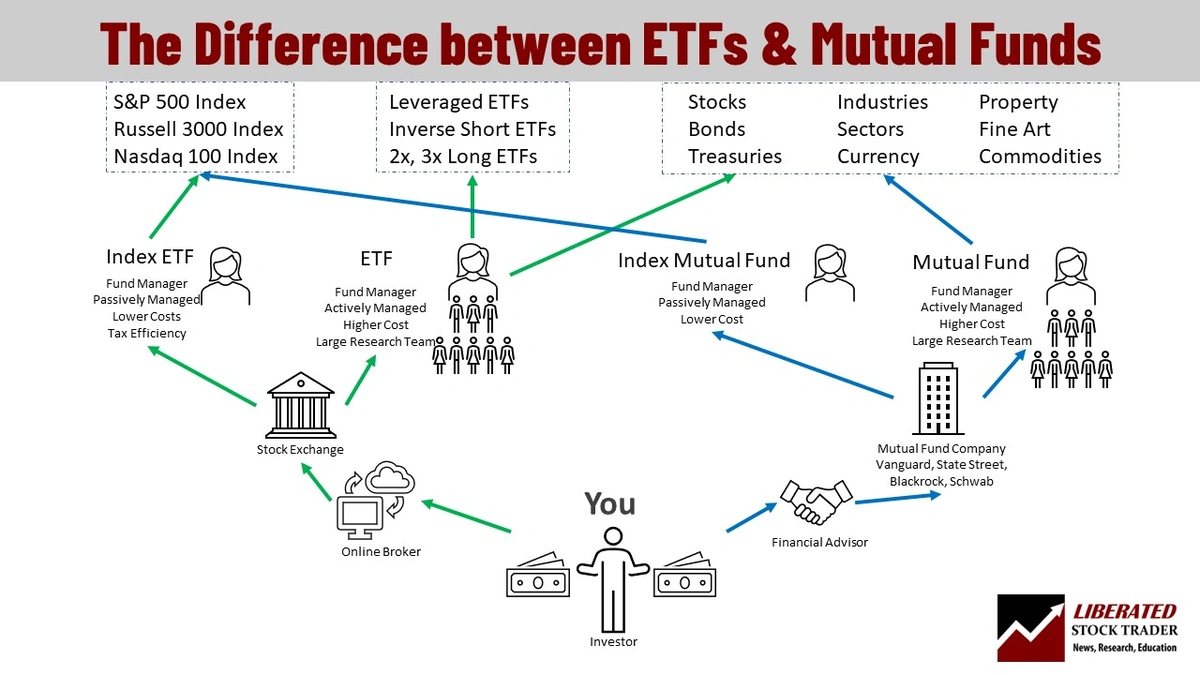

So, what does negative mutual fund flow actually mean? Simply put, it means that more money is flowing out of mutual funds than is flowing in. Investors are redeeming their units at a higher rate than new investments are being made. This can happen for a variety of reasons, and usually it’s a combination of factors.

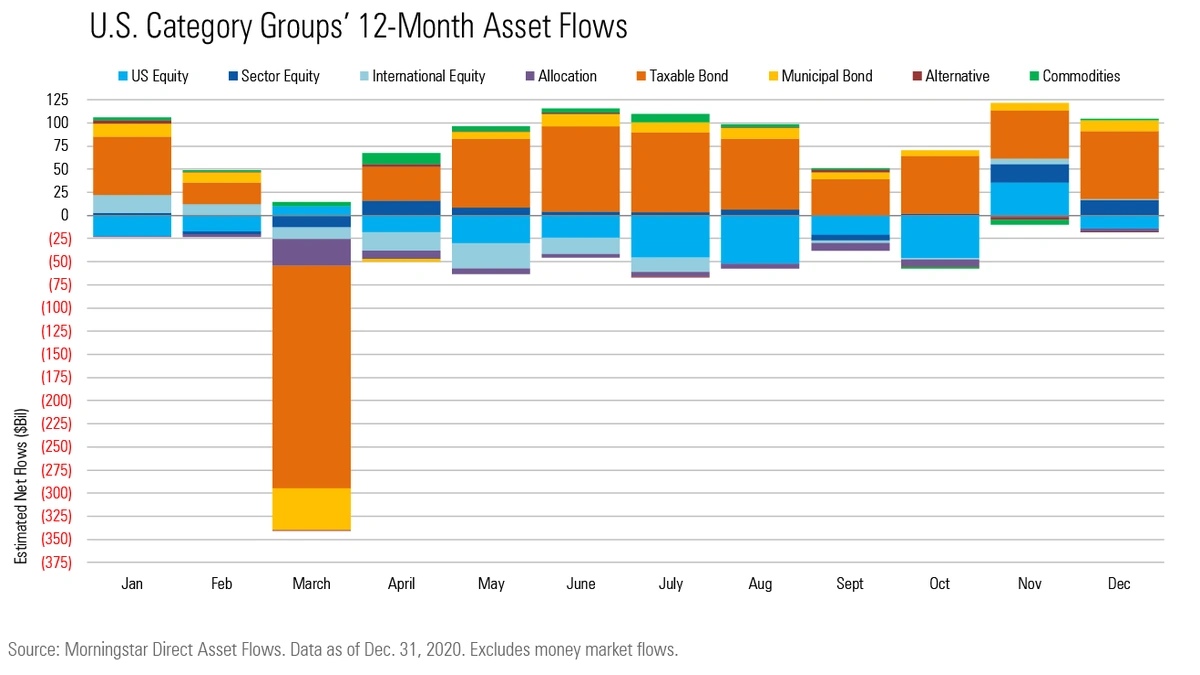

One of the biggest drivers is often market volatility . When the stock market is turbulent, investors tend to get nervous and pull their money out, seeking safer havens. We’ve certainly seen our share of volatility lately, with global economic uncertainties, rising interest rates, and geopolitical tensions all playing a role. The impact of equity markets is significant here. But it’s not just about fear. Sometimes, it’s about opportunity.

Another factor could be that investors are simply reallocating their assets. Maybe they’re shifting from equity funds to debt funds in anticipation of interest rate hikes. Or perhaps they’re exploring alternative investment options like real estate or gold. According to the latest data, certain categories of mutual funds have been hit harder than others. Understanding these nuances is key to making informed investment decisions. For context, you can check out credible sources like AMFI’s official website for detailed reports.

The Ripple Effect | How This Impacts You

Okay, so money’s flowing out. Big deal, right? Not so fast. Negative mutual fund flow can have a ripple effect throughout the entire financial system. When mutual funds have to sell off their holdings to meet redemption requests, it can put downward pressure on stock prices. This is especially true if the redemptions are concentrated in certain sectors or companies. The impact on stock markets is notable.

And it’s not just about the stock market. Negative flows can also affect bond yields, interest rates, and even the overall availability of credit. In other words, what happens in the mutual fund industry can have a very real impact on the broader economy. It affects the value of your investments, the cost of borrowing money, and even job growth. This is the reason investment strategies need to be nimble.

But, let’s be honest, sometimes the market overreacts. Fear can be contagious, and investors often make decisions based on emotion rather than logic. This can create buying opportunities for those who are willing to take a longer-term view. As the saying goes, “Be fearful when others are greedy, and greedy when others are fearful.” Keep an eye on the debt market for opportunities.

What Should Investors Do? Practical Steps Forward

So, what should you do in light of this negative mutual fund flow ? First and foremost, don’t panic. Resist the urge to make impulsive decisions based on short-term market fluctuations. Instead, take a deep breath, assess your portfolio, and consider the following:

Revisit your asset allocation . Make sure your portfolio is still aligned with your risk tolerance and financial goals. If you’re nearing retirement, you may want to consider reducing your exposure to equities and increasing your allocation to more conservative assets like bonds or fixed deposits. However, if you have a longer time horizon, you may be able to ride out the volatility and potentially benefit from future market gains. A common mistake I see people make is not rebalancing their portfolios regularly.

Consider systematic investment plans (SIPs) . One of the best ways to navigate market volatility is to invest regularly through SIPs. This allows you to buy more units when prices are low and fewer units when prices are high, effectively averaging out your cost over time. It’s a disciplined approach that can help you avoid the temptation to time the market. For more information on SIPs, you could read investment blogs. Here’s more information.

Seek professional advice. If you’re unsure about how to proceed, consult with a qualified financial advisor. They can help you assess your individual situation and develop a personalized investment strategy. Remember, everyone’s circumstances are different, and what works for one person may not work for another.

And let’s be clear, negative mutual fund flow doesn’t necessarily mean it’s time to abandon mutual funds altogether. Mutual funds still offer a lot of advantages, including diversification, professional management, and liquidity. But it does mean it’s time to be more selective about the funds you invest in and to pay closer attention to market trends. Consider using financial planning tools to assess your strategy.

Long-Term Perspective | Riding the Waves

Here’s the thing: investing is a marathon, not a sprint. There will be ups and downs along the way. Negative mutual fund flow is just one of those bumps in the road. The key is to stay focused on your long-term goals and to avoid getting caught up in the day-to-day noise. A long-term approach to financial goals is crucial.

Remember, the stock market has historically delivered strong returns over the long term, despite periods of volatility. And while past performance is no guarantee of future results, it does provide some comfort knowing that the market has always recovered from downturns. Focus on your investment portfolio ‘s long-term potential.

So, don’t let this negative mutual fund flow scare you away from investing. Instead, use it as an opportunity to learn more about the market, refine your investment strategy, and position yourself for long-term success. The market is always changing, and it’s up to us to adapt and evolve along with it. And hey, remember to celebrate those wins along the way. The journey is just as important as the destination.

FAQ | Answering Your Burning Questions

Frequently Asked Questions

What exactly is AMFI?

AMFI stands for the Association of Mutual Funds in India. It’s the industry body that represents all registered mutual funds in India. They publish data and guidelines related to the mutual fund industry.

Is this negative flow a sign of a major crash coming?

Not necessarily. While negative flow can indicate investor caution, it doesn’t automatically mean a crash is imminent. It’s just one factor to consider.

Should I sell all my mutual fund holdings now?

That depends on your individual circumstances. It’s best to consult with a financial advisor before making any drastic decisions.

What types of mutual funds are most affected by this?

Equity funds, especially those focused on specific sectors, tend to be more volatile and thus more susceptible to outflows during market downturns. Small cap funds are often high-risk.

How often does AMFI release this data?

AMFI typically releases data on mutual fund flows on a monthly basis.

Where can I find more information about this negative flow?

Check out the AMFI website or consult with a financial news source for the latest updates and analysis.

What fascinates me is how these market shifts reveal deeper human psychology. It’s not just about the numbers; it’s about our hopes, fears, and the choices we make in the face of uncertainty. And that, my friends, is a story worth watching.