So, the big news is out: mutual fund assets in India have crossed the Rs 80 trillion mark. That’s a HUGE number. But, here’s the thing that’s got me thinking, and clearly Sebi (Securities and Exchange Board of India) concerned: are we really understanding where our money is going? Are we financially literate enough to make informed decisions, or are we just blindly following the crowd?

Sebi chief’s recent statement highlighting the low financial literacy rates in India, even as the mutual funds industry booms, is a serious wake-up call. It’s not just about having money; it’s about knowing what to do with it. And that’s where financial literacy comes in. Let’s dive deeper, shall we?

Why Financial Literacy Matters More Than Ever

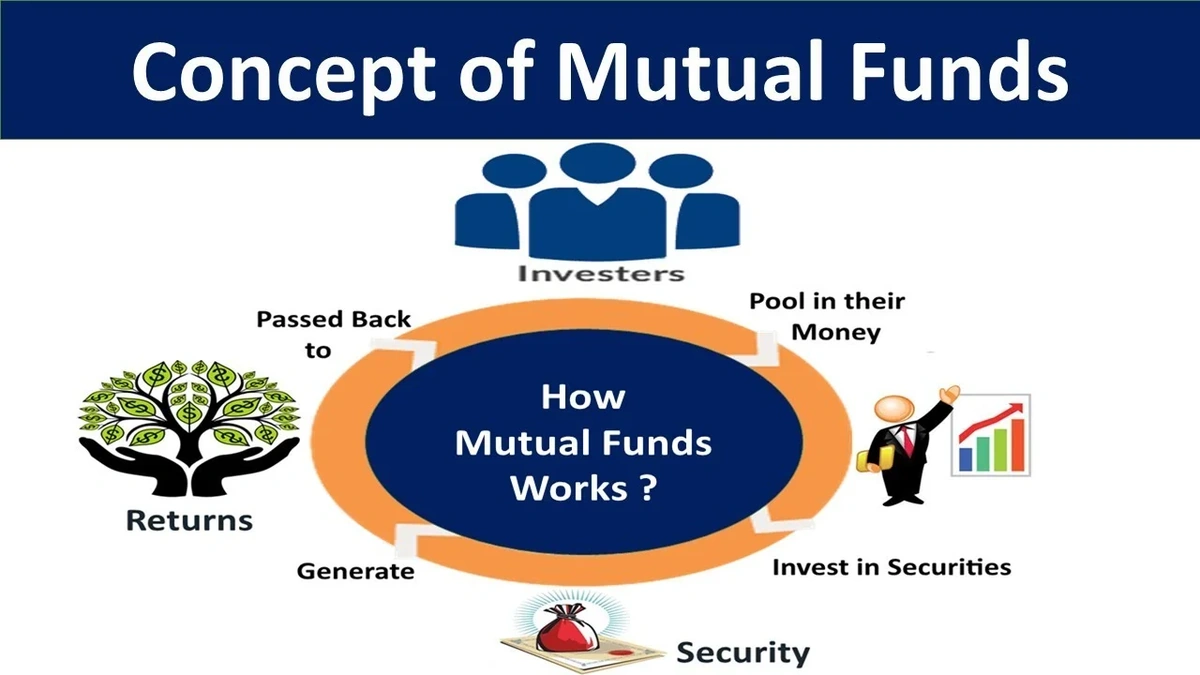

Think of it this way: investing in mutual funds without financial literacy is like driving a car without knowing the rules of the road. You might get lucky for a while, but eventually, you’re going to crash. Okay, maybe not crash, but definitely make some costly mistakes.

Financial literacy isn’t just about understanding complex jargon. It’s about grasping the basics – things like risk assessment, diversification, understanding expense ratios, and knowing the difference between a debt fund and an equity fund. A common mistake I see people make is chasing high returns without understanding the associated risks. Remember that line, “Past performance is not indicative of future results”? It’s there for a reason. I initially thought this was straightforward, but then I realized that it is worth taking into account the implications for retail investors who want to make smart investments.

What fascinates me is how rapidly the financial landscape in India is changing. We have fintech companies popping up left and right, offering all sorts of investment options. While innovation is great, it also means there’s more room for confusion and potentially, mis-selling. The more complex the market, the more crucial it is to have a solid foundation of financial knowledge.

The Indian Context | A Unique Challenge

Here’s the thing: India isn’t like other developed markets. We have a massive population, diverse income levels, and varying levels of access to education and technology. According to data from the Reserve Bank of India (RBI)RBI, financial inclusion is still a work in progress, especially in rural areas. This means that a significant portion of the population is still outside the formal financial system, let alone equipped to make informed investment decisions. The latest findings reveal that digital literacy has a direct impact on financial literacy, and many people still struggle with basic online navigation, therefore, they are unable to invest in financial products.

Let me rephrase that for clarity: simply providing access to investment options isn’t enough. We need to ensure that people have the tools and knowledge to use them effectively. Think about the Pradhan Mantri Jan Dhan Yojana (PMJDY), which aimed to bring more people into the banking system. While it was a great initiative, simply opening bank accounts doesn’t automatically translate into financial literacy.

What Can Be Done? A Multi-Pronged Approach

So, what’s the solution? It’s not a one-size-fits-all answer, but rather a multi-pronged approach involving regulators, financial institutions, educators, and even us, the individuals. Sebi has been actively promoting financial literacy through various initiatives, but more needs to be done. Here’s what I think is crucial:

- Early Education: Financial literacy should be integrated into the school curriculum, not as an afterthought, but as a core subject.

- Accessible Resources: We need more resources that are easy to understand and available in multiple languages. Think animated videos, interactive games, and plain-language guides.

- Targeted Programs: Programs specifically designed for women, rural populations, and other underserved groups are essential.

- Transparency and Disclosure: Financial institutions need to be more transparent about fees, risks, and potential returns. No more hiding behind complex jargon!

The Role of Technology and Fintech

Technology can be a powerful tool for promoting financial literacy. Fintech companies can leverage data and analytics to personalize financial advice and make it more accessible. But, and it’s a big but, we need to be careful about the potential risks. The rise of robo-advisors and automated investment platforms is exciting, but it also means that people may be relying too heavily on algorithms without understanding the underlying principles.

According to the latest circular on the official SEBI website,SEBI website, these platforms must ensure they are providing unbiased advice and adequately disclosing the risks involved. It’s a tightrope walk – balancing innovation with investor protection.

Empowering Yourself | Taking Control of Your Financial Future

Ultimately, financial literacy is a personal responsibility. No one is going to hand you the answers on a silver platter. You need to take the initiative to learn, ask questions, and seek out reliable information. A common mistake I see people make is being intimidated by financial jargon. Don’t be! Start with the basics, and gradually build your knowledge. It’s best to keep checking the official portal for updates.

Here are a few tips:

- Read, read, read: There are tons of great books, blogs, and websites dedicated to personal finance.

- Attend workshops and seminars: Many organizations offer free or low-cost financial literacy workshops.

- Talk to a financial advisor: A good advisor can help you create a personalized financial plan.

- Start small: You don’t need to become an expert overnight. Start with small investments and gradually increase your exposure as you become more comfortable. Stock market investments involve the risk of losing money, and so it’s important to invest only what you can afford to lose.

The rise in mutual fund investments is a positive sign for the Indian economy, but it’s also a reminder that we need to prioritize financial literacy. It’s not just about growing assets; it’s about empowering individuals to make informed decisions and secure their financial future. And remember, knowledge is power, especially when it comes to money.

By the way, check out upcoming IPOs analysis . Also, you should read this air travel disruptions guide.

FAQ

What exactly does “financial literacy” mean?

It’s understanding basic financial concepts: budgeting, saving, investing, debt management, and risk assessment. It means knowing how to make informed financial decisions.

Why is financial literacy so important in India right now?

With increasing access to financial products and a rapidly evolving market, people need to understand how to manage their money effectively to avoid making costly mistakes. Systematic investment plans can work for long term financial goals.

Where can I find reliable information about financial literacy in India?

Organizations like SEBI, RBI, and the National Centre for Financial Education (NCFE) offer resources. Also, look for reputable financial blogs and advisors.

Is it too late to start learning about financial literacy if I’m already an adult?

Absolutely not! It’s never too late to start. Begin with the basics and gradually build your knowledge. Many online courses and resources are available for adults.

Are there any free resources for improving my financial literacy?

Yes! Many organizations offer free workshops, online courses, and downloadable guides. Check the websites of SEBI, NCFE, and reputable financial institutions. There are also many investment options offered by many online brokers.

How can I protect myself from financial scams?

Be wary of unrealistic promises, do your research before investing, and never give out your personal information to unknown sources. Consult with a trusted financial advisor before making any major decisions.

So, next time you see that headline about mutual fund assets soaring, remember it’s not just about the numbers. It’s about the people behind them – and whether they have the knowledge to truly benefit from their investments. That’s the real story here.