Okay, folks, let’s talk about something that might sound dry at first glance – cross-border payments . But trust me, this collaboration between the Reserve Bank of India (RBI) and the European Central Bank (ECB) involving UPI (Unified Payments Interface) and TIPS (TARGET Instant Payment Settlement) is a game-changer, especially if you have family abroad, do business internationally, or even dream of traveling the world someday. Forget the clunky, expensive ways of sending money; this is about to get a whole lot smoother. It’s like the difference between sending a letter by carrier pigeon and sending an email – a massive leap in efficiency and cost-effectiveness. So, why is this such a big deal? Let’s dive in.

The “Why” | Unpacking the Significance of UPI-TIPS Integration

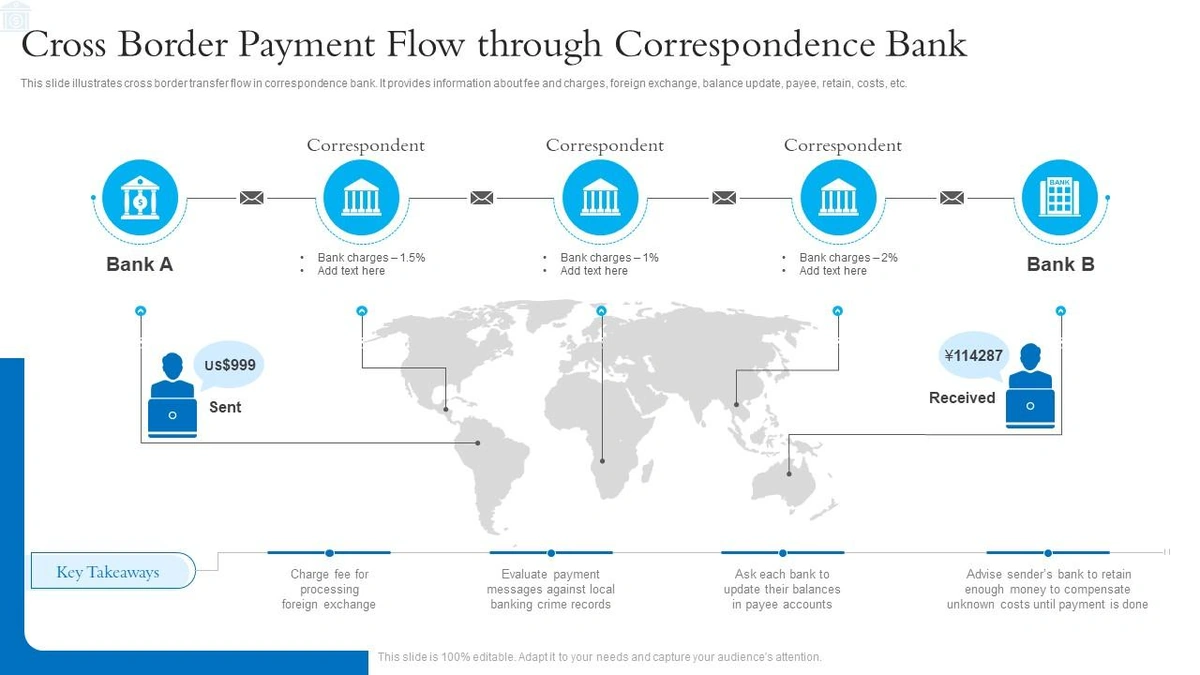

The news is that the RBI and ECB are working together to link UPI and TIPS. That’s the what. But here’s the thing: it’s not just about making payments faster. It’s about fundamentally reshaping how international money transfers work. For years, these transfers have been dominated by a few big players, leading to high fees and slow processing times. What fascinates me is the potential to break that stranglehold. This integration could foster competition, driving down costs and benefiting millions. This initiative promotes cheaper and more transparent cross-border transactions . Think of the small business owner in Mumbai trying to pay a supplier in Italy – no more exorbitant bank charges eating into their profits. The goal is to enable users in India to make payments to Europe and vice-versa using their smartphones.

And here’s another piece of the puzzle: financial inclusion. In India, UPI has been a revolution, bringing digital payments to even the most remote corners of the country. By extending that reach across borders, this collaboration has the potential to empower individuals and businesses that were previously excluded from the global financial system. It aligns with the G20’s financial inclusion priorities. It makes sending remittances back home easier and more affordable for millions of Indians working abroad. As per a report by the World Bank, India is one of the largest recipients of remittances. This is also about creating a more level playing field in the world of international finance .

Navigating the “How” | A Glimpse into the Future of Transactions

Now, let’s talk about how this integration might actually work. While the details are still being ironed out, the basic idea is to create a bridge between UPI and TIPS. Here’s how I envision it: you open your UPI app, enter the recipient’s details (perhaps using a QR code linked to their TIPS account), and the payment is processed seamlessly. No need for SWIFT codes or intermediary banks.

It is easy to see how this system will drastically reduce transaction costs and processing times for international payments . Consider the steps for conventional money transfers. A person living in Chennai wants to send money to his relative in Rome. He would need to visit a bank or money transfer service, fill out forms, pay fees, and wait for days for the money to arrive. With UPI-TIPS integration, the process would be streamlined. The sender could use their UPI app to send money directly to the receiver’s TIPS account in Europe. The money would reach its destination almost instantaneously and at a fraction of the cost.

Of course, there are technical and regulatory hurdles to overcome. Integrating two different payment systems requires careful coordination and standardization. Both the RBI and ECB will need to address issues such as data security, fraud prevention, and compliance with anti-money laundering regulations. What I initially thought was straightforward, then I realized involves complex negotiations and agreements between various stakeholders. But the potential benefits are so significant that it’s worth the effort. This system could facilitate instant payments across countries. This initiative may also encourage innovation in cross-border payments and inspire other countries to follow suit.

The Emotional Angle | Connecting People Across Borders

But beyond the technicalities and economic benefits, there’s a deeply human element to all of this. Imagine the peace of mind knowing that you can instantly send money to your loved ones abroad in times of need. The relief of small businesses that no longer have to worry about hefty transaction fees eating into their profits. This integration makes it easier for families to support each other across borders. It fosters stronger economic ties between India and Europe. The emotional impact of seamless digital payments is significant.

Let’s be honest, sending money abroad can be stressful. The uncertainty, the delays, the hidden fees – it all adds up. This collaboration between the RBI and ECB is about taking that stress away. It’s about creating a more connected world where money can flow freely and easily, regardless of borders. This move is not just about technological advancement; it is about creating a more inclusive and equitable financial system. It acknowledges the importance of remittances in supporting families and driving economic development.

Looking Ahead | The Future of Cross-Border Payments

This is just the beginning. As UPI continues to expand its reach globally, and as other countries develop their own instant payment systems, we can expect to see even more collaborations like this in the future. The vision is a world where cross-border financial transactions are as simple and seamless as sending a text message. It could lead to a more integrated global economy, where businesses and individuals can trade and transact with ease. The possibilities are truly exciting.

And what fascinates me most is the potential for innovation that this creates. As these systems become more interconnected, we can expect to see new and creative solutions emerge, further streamlining and simplifying cross-border payments. Imagine a world where you can use your UPI app to pay for goods and services anywhere in the world, without having to worry about currency conversions or transaction fees. That’s the future that this collaboration between the RBI and ECB is helping to create. It could transform international trade and e-commerce .

FAQ Section

Frequently Asked Questions

Will this integration eliminate all fees associated with cross-border payments?

While the goal is to significantly reduce fees, some charges may still apply. The exact fee structure will depend on the specific banks and payment service providers involved.

How secure will these transactions be?

Both UPI and TIPS have robust security measures in place. The integration will likely involve additional security protocols to ensure the safety of cross-border transactions.

When will this integration be fully implemented?

The timeline for full implementation is still uncertain, but both the RBI and ECB are committed to making it happen as quickly as possible.

Will this integration be available to all UPI users?

While the details are still being worked out, the aim is to make it accessible to a wide range of users. However, some restrictions may apply initially.

How will this impact the existing money transfer services?

The increased competition from UPI-TIPS integration will likely put pressure on existing money transfer services to lower their fees and improve their services.

What if I encounter a problem during a cross-border transaction?

Both UPI and TIPS have customer support channels available to assist with any issues that may arise.

So, there you have it. The RBI and ECB joining forces to make global payments easier and cheaper. It’s not just about the tech; it’s about making life a little less complicated for everyone, one transaction at a time.