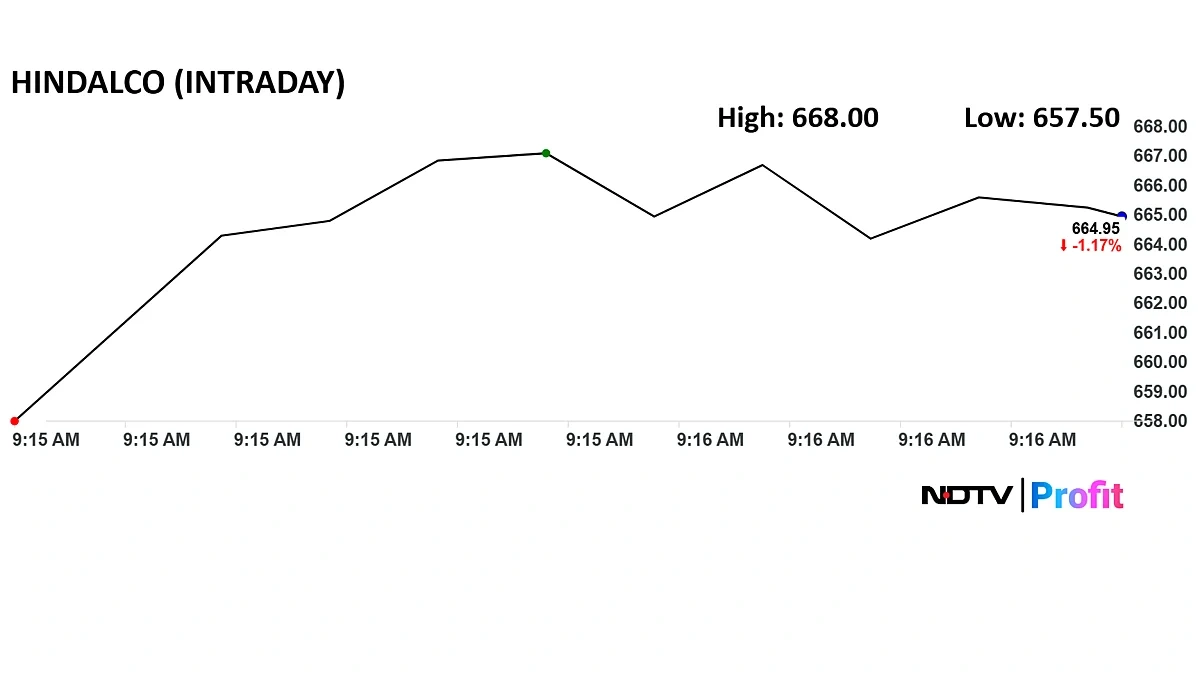

Okay, let’s be real. When you see a headline like “Hindalco Stock Drops 2%,” your first thought probably isn’t, “Wow, I need to drop everything and read about this!” But here’s the thing: even a seemingly small dip in a Hindalco share price can tell us a lot about the market, the company’s resilience, and even global supply chains. And in this case, that 2% drop following a fire at Novelis’ Oswego plant – well, it’s more than just a blip on the radar.

Why This Fire Matters | More Than Just a 2% Dip

So, why should you, sitting in India, care about a fire in an aluminum plant in Oswego, New York? Because aluminum production is a global game. Hindalco, through its subsidiary Novelis, is a major player. What fascinates me is how interconnected everything is – a single incident can ripple through the entire industry, impacting prices, supply, and even investor confidence.

The Novelis plant in Oswego specializes in aluminum rolled products, a crucial component in everything from beverage cans to automotive parts. A disruption there means less aluminum available, potentially leading to higher prices for consumers and manufacturers alike. Initially, I thought this was just a localized issue. Then I realized the extent to which Novelis impacts global supply.

Novelis is not just any company; it’s a global leader in aluminum rolling and recycling. A fire at one of its plants impacts its ability to fulfil contracts and can have a knock-on effect for manufacturers who rely on its output. This can potentially lead to a short-term rise in the price of aluminum. And what does this mean for India? India is a large consumer of aluminum, and disruptions to global supply chains always translate to potential price volatility. If Hindalco’s share price is affected, how will this influence smaller businesses?

Digging Deeper | The Novelis Impact on Hindalco

Let’s rephrase that for clarity. Novelis is a wholly-owned subsidiary of Hindalco Industries. This means that Hindalco’s financial performance is directly tied to Novelis’ success (or, in this case, its setbacks). When Novelis sneezes, Hindalco catches a cold, so to speak. According to market analysts, about 60% of Hindalco’s consolidated profits are driven by Novelis.

But, and this is a big but, fires happen. Manufacturing plants aren’t exactly known for being risk-free environments. A crucial question is, what risk mitigation strategies does Novelis have in place? Does it have business continuity plans to minimize disruption? How long will the Oswego plant be offline? These factors will significantly influence the long-term impact on Hindalco’s financial performance.

Here’s the thing – insurance also plays a big role here. Novelis likely has insurance to cover property damage and business interruption. The key is how quickly the insurance claim can be processed and how much of the loss will be covered. I initially thought this would be straightforward, but then I realized the complexities involved in assessing damages, negotiating with insurers, and getting the plant back up and running.

The Investor Perspective | Overreaction or Valid Concern?

Okay, so the stock dipped 2%. Is that a reason to panic and sell your Hindalco shares? Probably not. Experienced investors know that short-term fluctuations are par for the course. However, it’s crucial to understand the underlying reasons for the drop and assess whether it represents a fundamental shift in the company’s prospects.

A common mistake I see people make is reacting emotionally to market news. A fire is scary, no doubt, but it doesn’t necessarily mean Hindalco is going bankrupt. It’s more about the potential impact on production, sales, and ultimately, profitability. Smart investors will be looking at the company’s response to the crisis, its contingency plans, and its long-term outlook. Don’t fall into the trap of being influenced by short-term fears. Keep your eyes on the long game and consider what will happen to the Hindalco aluminum stock in the future.

And, as per theBSE India website, one must watch trading volumes. Higher than usual trading volumes during a stock drop can indicate increased selling pressure and could be a sign of deeper concerns among investors. So, monitor trading activity closely to get a sense of market sentiment.

Looking Ahead | What’s Next for Hindalco?

So, where does Hindalco go from here? The company’s ability to navigate this crisis will be a key test of its leadership and operational efficiency. A speedy recovery at the Novelis plant, coupled with effective communication and transparency, can help restore investor confidence.

The one thing you absolutely must double-check is the company’s quarterly earnings reports. Pay close attention to the management commentary on the impact of the fire and their strategies for mitigating any financial losses. What’s fascinating to me is the broader trend in the aluminum industry. Are we seeing increased demand, supply chain disruptions, or shifts in global trade patterns? These factors will all influence Hindalco’s long-term prospects.

Moreover,considering recent shifts in the automotive industry(one of aluminum’s biggest consumers) and the growing focus on sustainability and recycled aluminum (Novelis’ specialty), Hindalco might just emerge stronger from this challenge. Here is anotherlink for youto explore. But, let’s be honest, the next few months will be crucial. Hindalco will need to demonstrate its resilience, adaptability, and commitment to delivering value to its shareholders.

FAQ About Hindalco Stock and the Novelis Fire

How will the Novelis fire affect Hindalco’s earnings?

The short-term impact will depend on the extent of the damage and the duration of the plant shutdown. Analysts will be closely watching Hindalco’s next quarterly earnings report for details.

Is this a good time to buy or sell Hindalco stock?

That depends on your investment strategy and risk tolerance. If you’re a long-term investor, a temporary dip might present a buying opportunity. However, do your own research and consult with a financial advisor before making any decisions.

What if I already own Hindalco shares?

Don’t panic. Stay informed about the situation and monitor the company’s progress. Consider talking to a financial advisor if you have specific concerns.

Will aluminum prices in India go up because of this?

Potentially, yes. Disruptions to global aluminum supply can lead to price increases in India, although the extent of the impact will depend on various factors, including inventory levels and alternative supply sources.

How quickly can Novelis repair the Oswego plant?

The timeline for repairs is uncertain. It will depend on the severity of the damage, the availability of equipment and labor, and regulatory approvals. I initially thought this would be straightforward, but then I realized the complexities involved in assessing damages, negotiating with insurers, and getting the plant back up and running.

What are the long-term prospects of Hindalco?

Hindalco’s long-term prospects remain positive, driven by growing demand for aluminum in various sectors, including automotive, construction, and packaging. Novelis’ focus on recycling and sustainable aluminum production also positions Hindalco well for the future.

In conclusion, a 2% dip in the Hindalco share price following a fire is undoubtedly a cause for attention, not necessarily alarm. Remember to look beyond the headlines, understand the underlying dynamics, and make informed decisions based on your own investment goals. It’s not about reacting to the news, but about understanding its implications. And that, my friend, is the key to successful investing.