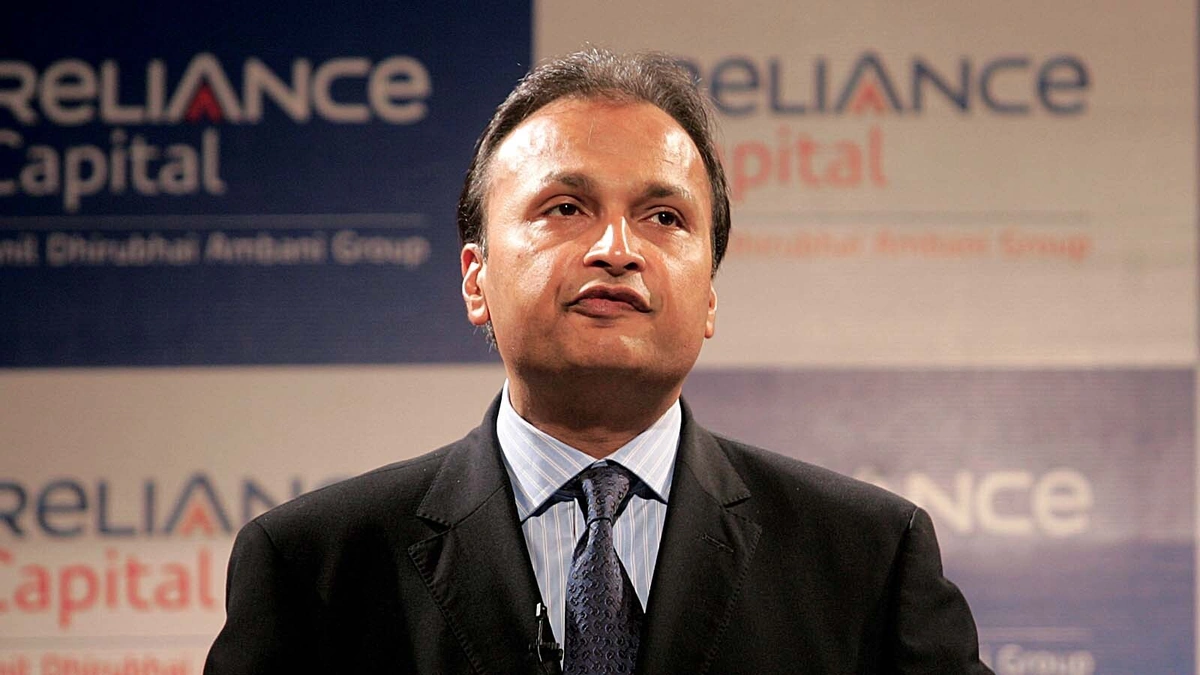

The news hit like a thunderbolt: the Enforcement Directorate (ED) has provisionally attached assets worth a staggering ₹3,000 crore belonging to Anil Ambani . Suddenly, the whispers about his financial troubles have become a deafening roar. But, let’s be honest, this isn’t just about the money; it’s about the dramatic, almost Shakespearean arc of a business empire seemingly on the brink. What fascinates me is not the seizure itself, but what it means for the future of Reliance, for Indian business, and for anyone who’s ever believed in the promise of inherited success. We’ll also delve into related topics, such as the Prevention of Money Laundering Act (PMLA) , under which the assets were seized, and the implications for Anil Ambani’s net worth .

Why This Matters | More Than Just Headlines

So, why should you care about this? Because this isn’t just another financial story; it’s a cautionary tale about ambition, debt, and the ever-shifting sands of fortune. I initially thought this was straightforward – another wealthy businessman facing legal issues – but then I realized it’s far more nuanced. This situation has impacts that reverberate throughout the Indian economy. The seizure, linked to an alleged violation of the Foreign Exchange Management Act (FEMA) , raises serious questions about financial compliance and regulatory oversight.

Let me rephrase that for clarity: it’s a signal that nobody is too big to fail, and regulators are increasingly willing to flex their muscles. And that’s important for market confidence, even if it’s painful to watch. Moreover, understanding the specifics of FEMA violations and the ED’s investigative powers is crucial for anyone involved in international business or finance in India.

How Did We Get Here? A Quick (and Painful) Recap

The story of Anil Ambani is essentially the story of post-liberalization India. Once hailed as a visionary, he inherited a significant chunk of the Reliance empire after a family split. Remember the early 2000s? Reliance Communications (RCom) was the telecom giant. But, somewhere along the line, things started to unravel. Aggressive expansion, coupled with mounting debt, created a perfect storm. A common mistake I see people make is over leveraging, a prime example that comes into view in cases like this.

Then came the disruptive entry of Reliance Jio, led by his brother Mukesh Ambani. The telecom landscape shifted dramatically, leaving RCom struggling to compete. Years of losses, asset sales, and legal battles followed. What fascinates me is the difference in business models between the two brothers; one thrived on disruptive innovation, while the other seemed stuck in an older paradigm. What do you think? Is debt restructuring a possible solution for Anil Ambani?

The ED Action | What We Know (and What We Don’t)

Now, let’s get down to the nitty-gritty. The ED’s action involves the provisional attachment of assets valued at ₹3,000 crore. These assets, according to reports, include properties and investments linked to Anil Ambani companies . But, here’s the thing: a provisional attachment doesn’t mean guilt. It’s a temporary measure to prevent the disposal of assets while the investigation is ongoing. The ED alleges violations of FEMA, specifically related to funds held in foreign accounts. According to sources, these funds were allegedly used for investments abroad without proper authorization.

What’s the one thing you absolutely must know? This is a legal process, and Anil Ambani has the right to defend himself. He can challenge the attachment before the adjudicating authority and, ultimately, in court. It’s a long road ahead, filled with legal complexities and potential appeals.

What Happens Next? The Uncertain Future of Reliance

The big question: what does this mean for the future of Reliance? Frankly, it’s unclear. While Anil Ambani’s personal financial woes are largely separate from the operations of other Reliance entities, the reputational damage can’t be ignored. It’s also worth noting that this legal challenge, alongside already heavy debt obligations, is further straining his finances. The fate of his remaining assets hangs in the balance. It’s a stark reminder of the volatile nature of wealth and the importance of prudent financial management. The legal proceedings relating to Anil Dhirubhai Ambani Group (ADAG) will likely continue for months, if not years. The stock market reaction will be closely watched.

The impact on investors and creditors remains uncertain. This situation might expedite the resolution of pending debt settlements. It’s a complex web of legal and financial issues, and the outcome is far from guaranteed.

FAQ | Your Burning Questions Answered

Frequently Asked Questions

What exactly does ‘provisional attachment’ mean?

It’s a temporary freeze on assets, preventing them from being sold or transferred, while the ED investigates potential wrongdoing.

What is FEMA and why is it relevant here?

FEMA (Foreign Exchange Management Act) regulates foreign exchange transactions in India. Violations can lead to penalties and asset seizures.

What if I forgot my application number?

The ED action is independent of his brother Mukesh. They operate separate business empires, but the reputational impact is impossible to ignore.

Is Anil Ambani going to jail?

Not necessarily. The ED’s action is a civil matter (FEMA violations) at this stage. Criminal charges are possible but not automatic.

How does this affect Reliance shareholders?

While the specific effect on shareholders is unknown, they should pay attention to any announcement regarding the investigation and company position.

Where can I find more about Anil Ambani’s latest news and case developments?

Follow reputable financial news sources and official statements from the involved parties. Be cautious of unverified information on social media.

Here’s the thing: the Anil Ambani story isn’t just about one man’s downfall. It’s a mirror reflecting the complexities of Indian capitalism, the pressures of family legacies, and the ever-present risks of ambition exceeding capability.The story is a modern parable, with the seizure sparking numerous debates and discussions.