Okay, folks, let’s talk mutual funds. And more specifically, let’s talk about something that impacts every single one of us who invests in them: MF rules . Now, you might have seen the headline – Sebi is thinking about tweaking the rules to bring down expenses. Sounds dry, right? But here’s the thing: this could actually put more money back in your pocket. And who doesn’t want that?

But why now? What’s driving this potential change? And more importantly, how will it really affect your investments? Let’s dive in, shall we? This isn’t just about some regulatory body flexing its muscles; it’s about the future of your financial well-being.

The Why | A Race to the Bottom (of Fees)

So, why is Sebi even considering this? Well, the mutual fund industry in India is booming. More and more people are investing, which means more competition among fund houses. And when there’s competition, there’s pressure to attract investors. One way to do that? Lower fees. But here’s the catch: some fund houses might be cutting corners to offer lower expense ratios, potentially impacting the quality of their investments or services. This is where Sebi steps in. They want to ensure a level playing field and protect the interests of us, the investors. What fascinates me is how they balance encouraging healthy competition with safeguarding investor interests.

Sebi’s intervention is crucial because, let’s be honest, understanding the intricacies of mutual fund expenses can feel like deciphering ancient Sanskrit. Many investors focus solely on returns, often overlooking the significant impact of even seemingly small fees. These charges, which include expense ratio and other operational costs, can eat into your profits over time, especially in long-term investments. Sebi’s potential revision aims to bring greater transparency and standardization to these charges, making it easier for investors to make informed decisions. This could be a game-changer, especially for those new to the world of mutual funds.

Decoding the Expense Ratio | What You’re Really Paying

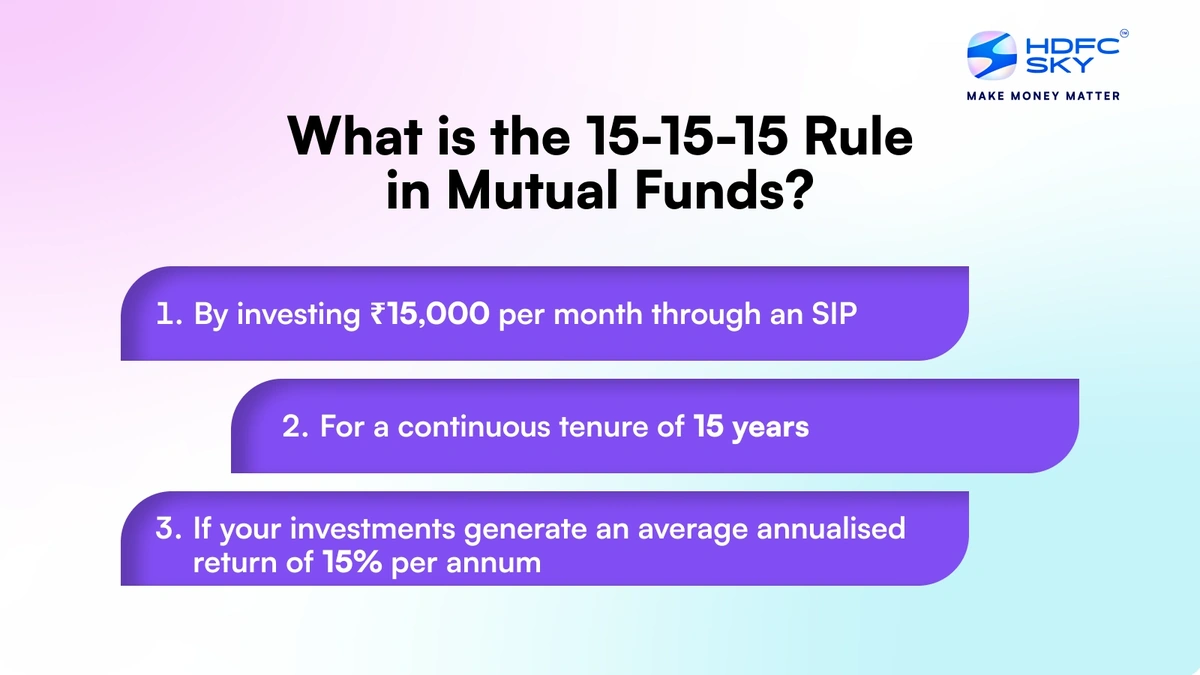

Let’s rephrase that for clarity: what is the expense ratio, really? It’s essentially the annual cost of managing your mutual fund, expressed as a percentage of your investment. It covers everything from the fund manager’s salary to administrative expenses. And while a difference of 0.5% might seem insignificant, it can compound into a substantial amount over the years, especially on larger investments. Here’s the thing – a lower expense ratio doesn’t always guarantee better returns. A fund with a slightly higher expense ratio might outperform one with a lower ratio due to superior fund management or investment strategies. This is where doing your homework comes in.

As stock markets continue to evolve, understanding these nuances becomes even more critical. Many investors are now looking beyond traditional mutual funds to explore alternative investment options that offer potentially higher returns, but often come with different fee structures and risk profiles. Sebi’s move to revise mutual fund regulations is not just about reducing expenses; it’s about fostering a more transparent and investor-friendly environment in the broader financial landscape.

I initially thought this was straightforward, but then I realized the devil is in the details. Sebi needs to walk a tightrope. On one hand, they want to encourage fund houses to be more efficient and pass on the benefits to investors. But on the other hand, they don’t want to create a situation where fund houses are forced to compromise on quality to stay competitive. It’s a delicate balance, and the outcome will have a significant impact on the Indian mutual fund industry .

Potential Impact | More Money in Your Pocket?

So, what could this actually mean for you, the average investor? Well, if Sebi succeeds in bringing down expense ratios, you could see a direct increase in your returns. Even a small reduction in fees can add up significantly over time, especially if you’re investing for the long haul. Think of it as finding a few extra rupees in your pocket every month – it might not seem like much at first, but it adds up! As a serious investor, it is prudent to look at the factors that can impact your returns. But, and this is a big but, don’t make your investment decisions solely on the basis of expense ratios. Look at the fund’s performance, the fund manager’s track record, and your own risk tolerance.

The revision of MF rules could also lead to greater innovation in the mutual fund industry. With pressure on fees, fund houses might be forced to come up with more creative and efficient ways to manage their funds. This could lead to the development of new investment strategies and products that benefit investors. But let’s be honest, it could also lead to some fund houses trying to cut corners in ways that aren’t so beneficial. It’s up to us, as investors, to stay informed and do our due diligence.

And it’s not just about individual investors. Lower expense ratios could also make mutual funds more attractive to institutional investors, such as pension funds and insurance companies. This could lead to a larger pool of capital flowing into the mutual fund sector , which could further boost returns. It’s a virtuous cycle, potentially benefiting everyone involved.

The Fine Print | What to Watch Out For

Now, before you get too excited, there are a few things to keep in mind. First, Sebi’s proposals are just that – proposals. They’re still under consideration, and there’s no guarantee that they’ll be implemented in their current form. Second, even if the rules are revised, it might take some time for the changes to trickle down to investors. Fund houses will need time to adjust their strategies and fee structures. Third, and this is crucial, lower fees are not a substitute for good investment decisions. You still need to do your research, understand your risk tolerance, and choose funds that are appropriate for your goals. According to SEBI Website , these regulations are to protect the interest of the investors.

It’s also important to remember that the mutual fund industry is constantly evolving. New products and strategies are being developed all the time, and it’s up to us, as investors, to stay informed. This means reading the fine print, understanding the fees, and keeping an eye on the performance of our investments. A common mistake I see people make is blindly following the advice of others without doing their own research. Remember, your money is at stake, so take ownership of your investment decisions.

The potential revision of mutual fund expense ratios is a welcome step towards creating a more investor-friendly environment. It has the potential to put more money back in our pockets and encourage greater innovation in the industry. However, it’s important to remember that this is just one piece of the puzzle. We still need to do our homework, understand the risks, and make informed investment decisions. So, stay informed, stay vigilant, and happy investing!

Conclusion | A Win for the Savvy Investor

Ultimately, Sebi considering a revision of mutual fund regulations is a good thing – a potential win for the savvy Indian investor. It forces transparency, encourages efficiency, and could lead to better returns. But it’s not a magic bullet. It’s a prompt to get more informed, to dig deeper into where your money is going. What fascinates me most is the potential ripple effect: a more empowered investor base demanding better value. And that, my friends, is a trend worth watching. Stay curious, stay informed, and remember: your financial future is in your hands.

FAQ

Will lower expense ratios guarantee higher returns?

Not necessarily. While lower fees are beneficial, a fund’s performance depends on various factors like the fund manager’s expertise and investment strategy.

How will I know if my fund’s expense ratio is changing?

Fund houses are required to notify investors of any changes to their expense ratios. Keep an eye on your statements and fund updates.

What if I’m not happy with my fund’s expense ratio?

You have the option to switch to a different fund with a lower expense ratio or explore other investment options that align with your financial goals.

Are all mutual funds affected by these potential changes?

The proposed revisions would likely affect all types of mutual funds, but the extent of the impact may vary depending on the specific fund and its expense structure.

What are some alternative investment options to consider?

Besides mutual funds, you can consider options like direct equity investments, bonds, real estate, and Exchange Traded Funds (ETFs), each with its own risk-reward profile.

How can I stay updated on the latest regulatory changes in the financial market?

Follow reputable financial news sources, subscribe to updates from Sebi and other regulatory bodies, and consult with a qualified financial advisor.