Here’s the thing about investing – it should feel less like navigating a minefield and more like a leisurely stroll through a well-tended garden. But let’s be honest, understanding where your money actually goes when you invest in mutual funds can sometimes feel like trying to decipher ancient hieroglyphs. That’s where SEBI, the Securities and Exchange Board of India, steps in as our friendly neighborhood financial watchdog. They’ve recently proposed some new rules aimed at boosting cost transparency in mutual funds. But, why should you, the average Indian investor, care? Well, grab a chai, and let’s dive in.

Why Cost Transparency Matters | The Analyst’s View

Think of mutual funds as a bus service for your money. You and other investors pool your cash, and a fund manager drives that bus, investing in various stocks, bonds, or other assets. Now, just like a bus service has operating costs (fuel, driver salary, maintenance), mutual funds have expenses too. These expenses are deducted from your returns, and that’s perfectly normal. The catch? Sometimes these costs aren’t as clear as they could be, which makes it difficult to compare different funds and understand exactly what you’re paying for. This also relates to understanding the mutual fund framework.

The proposed SEBI regulations aim to change that. They want to make it easier for you to see all the costs associated with a mutual fund, presented in a way that’s simple and easy to understand. The idea is to empower you to make more informed decisions. According to recent reports, this includes clearer disclosures about expense ratios and commissions. This is why, having a clear understanding of mutual fund investments is crucial. But why is it so important now?

Well, India’s mutual fund industry is booming. More and more people are entrusting their hard-earned money to mutual funds, seeking better returns than traditional savings accounts. As the industry grows, it’s essential to ensure that investors are protected and that the system remains fair and transparent. Mutual fund investments are more appealing when you understand the costs!

Decoding the New Rules | A Step-by-Step Guide

So, what exactly are these new rules? While the full details are still being finalized, here’s a breakdown of what we know so far and what it could mean for you:

- Enhanced Disclosure: SEBI wants mutual funds to provide more detailed breakdowns of their expenses, including management fees, administrative costs, and transaction charges. This means you’ll get a clearer picture of where your money is going.

- Standardized Reporting: The new rules aim to standardize the way mutual funds report their expenses. This will make it easier to compare different funds side-by-side, without having to wade through confusing jargon.

- Increased Accountability: SEBI is likely to hold fund managers more accountable for ensuring that expenses are reasonable and justifiable. This means they’ll need to provide a stronger rationale for any high fees they charge.

Let me rephrase that for clarity: imagine you’re buying a new phone. You wouldn’t just look at the price tag, right? You’d want to know about the features, the warranty, and any hidden costs. These new rules are like demanding a detailed spec sheet for your mutual fund.

The Emotional Angle | Taking Control of Your Financial Future

Let’s be real: investing can be stressful. There’s the constant worry about market fluctuations, the fear of losing money, and the general feeling of being overwhelmed by financial jargon. But I believe that empowering yourself with knowledge is the best way to combat that anxiety. Increased cost transparency isn’t just about saving a few rupees here and there; it’s about taking control of your financial future.

Think about it: when you understand exactly what you’re paying for, you’re less likely to feel like you’re being taken advantage of. You can confidently compare different funds, choose the ones that align with your goals and risk tolerance, and sleep better at night knowing that you’ve made an informed decision. This is where understanding SEBI guidelines helps in the long run.

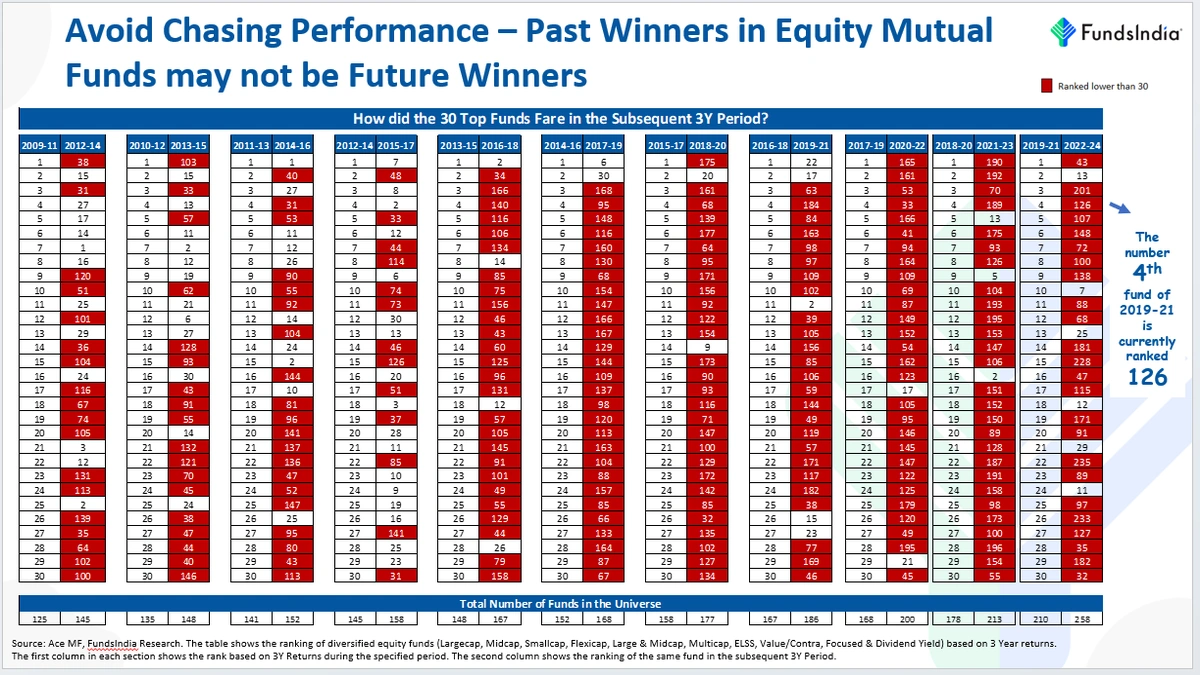

A common mistake I see people make is focusing solely on returns without paying attention to expenses. It’s like celebrating a big salary raise, and then realizing a huge chunk of it goes to taxes! Returns are important, but they’re only half the story. What fascinates me is how this can impact investment decisions.

The one thing you absolutely must remember is that knowledge is power. SEBI’s new rules are a step in the right direction, but it’s up to you to take advantage of them. Do your research, ask questions, and demand transparency. After all, it’s your money, and you deserve to know where it’s going. This contributes to investor protection in the long run.

The Long-Term Impact | A Healthier Investment Ecosystem

Beyond individual investors, these new rules could have a significant impact on the overall health of India’s investment ecosystem. Increased transparency can foster greater competition among mutual funds, encouraging them to offer better value for money. It can also lead to more innovation, as funds look for ways to differentiate themselves beyond just returns.

And, of course, greater transparency can build trust in the financial system, encouraging more people to participate in the market and contribute to India’s economic growth. The ultimate goal here is a more efficient, equitable, and resilient investment landscape. This would greatly contribute to the development of financial markets within the country.

According to SEBI’s official website , these changes are also meant to foster long-term financial planning rather than short-term speculation. And keeping up with market trends will also allow you to make more informed decisions, which, in turn, can help you achieve your financial goals.

FAQ | Your Questions Answered

Frequently Asked Questions

What if I don’t understand the new disclosures?

Don’t worry! SEBI is also working on educational initiatives to help investors understand the new rules. Look out for workshops, webinars, and online resources. And remember, you can always consult a financial advisor.

Will these rules guarantee higher returns?

No. Cost transparency is about understanding your expenses, not guaranteeing returns. But by making informed decisions about costs, you can potentially improve your net returns.

When will these rules come into effect?

The exact timeline is still to be determined, but SEBI is expected to implement the new rules in phases over the next few months. Keep an eye on their official website for updates.

How will this impact my existing mutual fund investments?

The new rules will apply to all mutual funds, including existing ones. You’ll start seeing the enhanced disclosures in your statements and fund reports.

Where can I learn more about the proposed changes?

The best place to stay informed is the official SEBI website. You can also follow reputable financial news outlets for updates and analysis.

So, there you have it. SEBI’s proposed new rules on cost transparency are a welcome step towards a more investor-friendly mutual fund industry. By empowering yourself with knowledge and demanding greater transparency, you can take control of your financial future and invest with confidence. What fascinates me is how the regulatory framework protects individual investors. Remember this: understanding is not just an advantage; it’s your right.