Okay, let’s talk money specifically, the money you’re paying (or overpaying) in your mutual funds. The Securities and Exchange Board of India (SEBI) is at it again, this time proposing some pretty significant changes to how mutual fund fees are structured. Now, I know what you’re thinking: “Fees? Snooze fest!” But trust me, this impacts your returns directly. And what fascinates me is, these changes are designed to put more money back in your pocket. Let’s dive in, shall we?

Why is SEBI Messing with Mutual Fund Fees Now?

Here’s the thing: mutual funds, while generally a good investment vehicle, can sometimes feel like a black box. You hand over your hard-earned cash, and a chunk of it disappears in the form of various fees. Ever wondered where that money actually goes? Well, SEBI has been paying attention, and the regulatory body wants to ensure that these fees are fair, transparent, and, most importantly, justified. One of the primary reasons for this regulatory push is to align the interests of asset management companies (AMCs) with those of the investors. When fees are structured in a way that encourages AMCs to genuinely perform well and manage costs efficiently, everyone wins. If you’re looking for a more broad picture of the regulatory landscape, this analysis of Tata Sons’ listingmight interest you.

Think of it like this: if the fund manager is getting paid handsomely regardless of how your investment performs, what’s the incentive to really knock it out of the park? These proposed changes are intended to create a more performance-oriented culture within the mutual fund industry, focusing on actually earning those fees.

Decoding the Proposed Changes | What’s Actually Changing?

Alright, let’s get into the nitty-gritty. According to various sources, SEBI is considering a few key adjustments to the current fee structure. Now, while the exact details are still being finalized, here’s a general overview of what’s on the table:

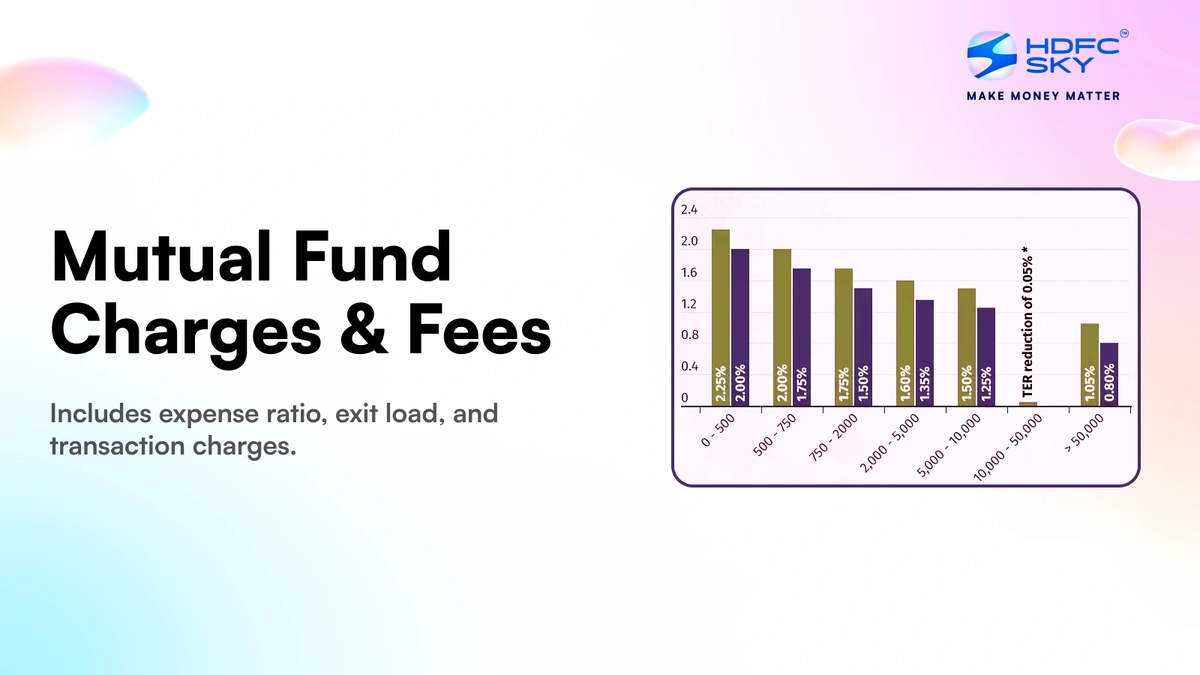

- Capping Expense Ratios: Expense ratios are the total costs of managing a fund, expressed as a percentage of your investment. SEBI is mulling over further reductions to these caps, particularly for actively managed funds. A lower expense ratio means more of your money stays invested and grows.

- Performance-Based Fees: This is a big one. The idea is to link a portion of the fund manager’s compensation to the fund’s performance. If the fund outperforms a benchmark, the manager gets a bonus. If it underperforms, the manager takes a hit. It’s all about accountability.

- Greater Transparency: SEBI also wants AMCs to be more upfront about where your money is going. Expect clearer disclosures about all the fees you’re paying, not just the headline expense ratio.

Let me rephrase that for clarity: It’s about making the whole fee structure less opaque. A common mistake I see people make is focusing solely on the returns, while ignoring the fees eroding those returns over time.

How Will These Changes Impact Your Investments?

This is what you really want to know, right? Here’s the thing: in the short term, you might not see a dramatic difference. But over the long haul, these changes could have a significant impact on your returns, especially if you’re a long-term investor in equity mutual funds . Lower fees mean more of your money is working for you, compounding over time. Performance-based fees could also lead to better fund management, as managers are incentivized to generate higher returns. And increased transparency will empower you to make more informed decisions about where to invest your money. The investment in employee skillis another area of development with potential upside.

I initially thought this was straightforward, but then I realized the psychological impact. Knowing that your fund manager’s pay is tied to performance can give you peace of mind and encourage you to stay invested even during market volatility. Because, let’s be honest, seeing your portfolio dip can be nerve-wracking.

What Should You Do Now? Your Action Plan

So, what should you do with all this information? Here’s a practical action plan:

- Review Your Portfolio: Take a close look at the fees you’re currently paying on your mutual fund investments. Are they competitive? Are you getting good value for your money? Use online tools to benchmark your funds against their peers.

- Stay Informed: Keep an eye on SEBI’s announcements and updates regarding these proposed changes. The official SEBI website (www.sebi.gov.in ) is your best source of information.

- Don’t Panic: These changes are designed to benefit you, the investor. Don’t make any rash decisions based on initial headlines. Take the time to understand the implications fully.

- Consult a Financial Advisor: If you’re unsure about how these changes might affect your portfolio, seek professional advice. A good financial advisor can help you navigate the complexities of the mutual fund market and make informed decisions.

But, above all, remember that investing is a marathon, not a sprint. These changes are a step in the right direction, but they’re just one piece of the puzzle.

The Future of Mutual Fund Investing in India

These proposed changes signal a shift towards a more investor-centric mutual fund industry in India. By reducing fees, increasing transparency, and aligning incentives, SEBI is aiming to create a fairer and more efficient market for everyone. It also is expected that new financial products will become more popular in near future like ELSS mutual funds . While there might be some short-term adjustments for AMCs, the long-term benefits for investors are clear. A more level playing field, lower costs, and potentially higher returns – what’s not to like?

And honestly, it’s about time. The Indian investor deserves a mutual fund industry that prioritizes their interests, not just the bottom line of the AMCs. SEBI’s move is a significant step towards that goal. These changes will also improve mutual fund investments in the long run. I feel a new optimism about the way regulations will continue to safeguard Indian investors.

FAQ

Frequently Asked Questions About SEBI’s Proposed Changes

Will all mutual funds be affected by these changes?

The changes are expected to affect most mutual funds , but the specific impact will vary depending on the fund type and its current fee structure.

When will these changes come into effect?

The timeline for implementation is not yet finalized. Keep an eye on SEBI’s official announcements for updates.

What if my fund’s performance is already good – will these changes still benefit me?

Yes, even if your fund is performing well, lower fees will translate to higher net returns over time.

How do I find out the expense ratio of my mutual fund?

You can find the expense ratio in the fund’s offer document or on the AMC’s website.

Will these changes lead to lower returns in the short term?

It’s unlikely. The primary goal is to reduce costs and improve fund management, which should benefit investors in the long run.

Where can I find more information about these proposed changes?

Refer to SEBI’s official website and reputable financial news sources for accurate and up-to-date information.